A new report from the Congressional Budget Office outlines the consequences of the country hitting the much talked about “fiscal cliff.” The report also offered numerous deficit reduction strategies to help avert the potential crisis, a couple of which would apply to the federal workforce.

Just how bad is the debt?

The current federal debt held by the public currently exceeds 70% of GDP, a percentage not seen since 1950. The CBO said that if lawmakers maintain current policies, annual deficits would average nearly 5% of GDP annually and debt held by the public would increase to 90% of GDP.

One of the biggest strains of the federal budget is spending on mandatory spending programs, namely Social Security, Medicare, and Medicaid. These programs, coupled with an aging baby boomer generation that is demanding more and more of the services provided from these programs, are creating an alarming financial strain on federal spending.

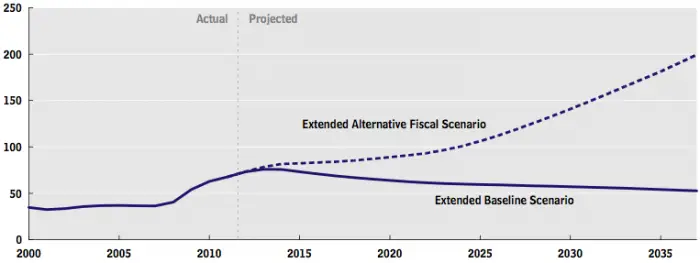

One of the more telling charts in the report shows two potential fiscal paths the country can take. The rosier of the two, the extended baseline scenario, adheres closely to current law, following CBO’s ten year baseline budget projections through 2022.

The more ominous path (the extended alternative fiscal scenario) incorporates the assumptions that all expiring tax provisions (other than the payroll tax reduction), including those that expired at the end of December 2011, are extended, that the alternative minimum tax is indexed for inflation after 2011 (starting at the 2011 exemption amount), that Medicare’s payment rates for physicians’ services are held constant at their current level, and that the automatic enforcement procedures specified by the Budget Control Act of 2011 do not take effect. The chart speaks for itself as to what the two scenarios do to the projected level of debt.

What are the consequence of rising federal debt?

The CBO names four key problems:

- Higher federal spending on interest payments

- A reduction in national saving

- Limits on policymakers’ ability to use tax and spending policies to respond to unexpected challenges, such as economic downturns, natural disasters, or financial crises

- An increase in the likelihood of a fiscal crisis, in which investors would lose confidence in the government’s ability to manage its budget, and the government would thus lose the ability to borrow at affordable interest rates

All of this leads up to CBO’s recommendations for how to tame the spending problem. The report states:

The United States cannot sustain the federal spending programs that are now in place with the federal taxes (as a share of GDP) that it has been accustomed to paying. To put the budget on a path that is more likely to be sustainable than if current policies were continued, lawmakers will need to adopt a combination of policies that require people to pay more for their government, accept less in government benefits and services, or both. However, making policy changes that are large enough to shrink the debt relative to the size of the economy—or even to keep the debt from growing—will be a formidable task.

The report makes many recommendations in a number of areas. Some of them include:

- Raising the ages at which people qualify for Social Security benefits

- Repeal provisions of ObamaCare that expand health insurance coverage while leaving other provisions of the law unchanged

- Allow the automatic cuts in the Budget Control Act to take effect

- Reduce funding for National Institutes of Health

- Increase payments by tenants in federally assisted housing

- Increase fees for aviation security

Federal employees should take note of two of the CBO’s recommendations in particular which would directly affect the federal workforce. Specifically, the CBO suggests the following:

- Reduce the across-the-board adjustment for defense and non-defense federal civilian employees’ pay

- Adopt a voucher plan and slow the growth of federal contributions for the Federal Employees Health Benefits program

Taken together, these two items represent approximately $15 billion in potential deficit reduction savings in 2020.

Neither of these ideas are new and have been pitched before. Ralph Smith noted in his article earlier this week that the change to the FEHBP has been proposed before and what it might look like for federal workers.

President Obama has arguably already adopted the across-the-board pay reduction proposed by the CBO since he proposed the pay freeze in 2010 (which was enacted by Congress and put in place for the last two years), and he has proposed only a 0.5% pay raise for federal workers in 2013.

Something has got to give eventually; the spending and the rate at which the federal deficit is expanding is simply not mathematically sustainable as the CBO report helps to illustrate. It’s likely we will eventually see some form of spending cuts at the federal level, but what remains unknown is what those will ultimately be.