There are a number of factors that need to be taken into consideration when identifying your savings options for retirement. Cost is not the only consideration, but an important one since fees can seriously erode your earnings.

Fees can have a clear impact on investment return.

Consider this example:

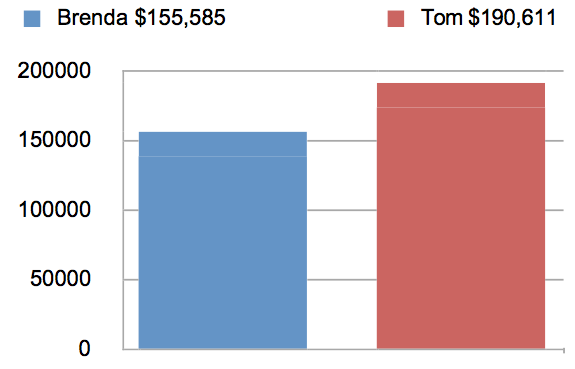

Tom and Brenda are retirement plan participants of two different plans. They each have $50,000 invested in the same type of fund delivering the same 8% return per year. Let’s assume they hold on to these funds for 20 years until reaching retirement age. The only difference is that Tom’s fees and expenses total one percent a year, while Brenda pays a total of two percent annually.

After 20 years, Brenda with a 2% expense, has $155,585 in her savings plan. Tom’s account on the other hand with a 1% expense totals $190,611. A difference of $35,026!

Can you think of anything you could do with an extra $35,026?

There are many kinds of retirement plans, but this article focuses on the three common plans that you and your family may participate in: TSP, 401(k)’s, and IRA’s.

Thrift Savings Plan (TSP)

Good news for TSP participants, not only is TSP the largest defined contribution plan in the country, it also has some of the lowest fees available. The last reported net expense ratio for 2012, was 0.027%. This means that for every $1,000 in your account the fee is 27¢. These fees are extremely rare in defined contribution plans, which on average range between 1 to 2 percent.

You may want to consider consolidating other retirement accounts into your TSP account as long as the money you want to transfer is an eligible rollover distribution, for federal income tax purposes. Tax-deferred transfers are allowed from eligible employer plans like 401(k)’s, 403(b)’s and 457(b)’s, as well as Traditional IRA’s and Simple IRA’s. Roth transfers are allowed from Roth 401(k)s, Roth 403(b)s, and Roth 457(b)s. You can find additional information at www.tsp.gov.

401(k) Plan

Many of the fees associated with 401(k) plans are not easily identifiable and you may have to do a little digging. Even with the Department of Labor regulations that went into effect last year, requiring full disclosure of plan fees, turns out not to have reached many investors.

Are there too many hands in the cookie jar? There can be as many as 17 different fees charged on a plan’s assets, including custodial fees, third party administrator (TPA) fees, investment advisor fees, insurance wrap fees, and mutual fund expenses. The average investment expense for 2012, according to the 401k Averages Book, was 1.46%. Teachers and other employees of nonprofit organizations who save for retirement through 403(b) plans may pay additional mortality charges and expenses to insurance companies, which typically provide annuities as investment vehicles.

Investigate undisclosed or hidden costs. This is usually referred to as “Revenue Share Offset”, which happens when a plan’s service provider and individual mutual fund companies engage in revenue sharing arrangements. Examples of this would be a plan provider getting commissions from mutual fund companies by pointing participants into funds with higher costs, or a mutual fund offering a rebate to the service provider. If you have a 401(k) from a previous employer or you know someone that currently has a 401(k), a good educational resource I have found is www.xraymy401k.com.

Individual Retirement Accounts (IRA’s)

Many people mistakenly think an IRA is an investment – but it is simply a type of tax-deferred retirement account which may be funded with the purchase of many types of securities such as but not limited to: stocks, bonds, mutual funds, annuity’s and Real Estate Investment Trusts (REIT’s). There are several types of IRA’s, including Traditional IRA’s, Roth IRA’s, SEP IRA’s and Simple IRA’s. So let’s now focus on the cost of some of these plans, specifically the Traditional IRA and Roth IRA.

An IRA must have a custodian, which is usually a bank or brokerage firm that has the responsibility of safeguarding the assets in the account. The custodian executes transactions on behalf of the plan participants, does record keeping, files reports such as statements and tax notices that are required by the custodial agreement or the law. The custodian may charge a set up fee, annual maintenance fee, and termination fee if you decide to move your account. The initial set up fee is typically between $10.00 to $50.00, and the annual maintenance fee is usually in the same range.

The other fees associated with your IRA really depend on what type of security(s) you hold in your account. If you have a brokerage account, you may pay commission’s, transaction fees, mutual fund fees, and or management fees. Having the IRA directly held at a mutual fund company may cut out the brokerage fees, but may limit your investment choices to those at one specific company.

Total expenses can vary widely but here is an example of what the the cost could be for an IRA invested in a mutual fund. This is based on a $50,000 asset. Annual maintenance fee of $50.00, fund operating expenses of 1.25% and annual trading costs of 0.50% (incurred each time a mutual fund manager buys and sells securities). The total annual fees in this example are 1.9%, or in dollars $950.00. Keep in mind this does not include any commissions, or sales loads which may or may not be associated with the cost of the chosen investments.

IRA’s can allow you many more investment choices than what is provided through your employer’s plan, but you really need to investigate the fees associated with your investment choices. I am frequently asked, “What should I do with my TSP after I retire?” That really depends on several factors that do not fall into the scope of this article, but I will comment on the advantages and disadvantages of rolling some or all of your TSP to an IRA.

First the advantages: (1) More choices, not limited to five funds, (2) Flexibility on how you take withdrawals, (3) You can manage the IRA yourself or have a professional manage it.

Now the disadvantages: (1) Will most likely be paying higher fees, which may be acceptable if the additional cost is providing you value, (2) More responsibility on You, the individual investor, which necessarily means you should be willing to do your own due diligence on managing the IRA yourself or have a professional that manages it.

Securities offered through GF Investment Services, LLC. Member FINRA/SIPC. 2080 Ringling Blvd., Third Floor, Sarasota, FL, 34237. (941) 441.1902. Investment Advisory Services offered through Global Financial Private Capital, LLC, an SEC Registered Investment Adviser.