How are the lifecycle funds in the Thrift Savings Plan (TSP) constructed?

For readers who do not like to spend time analyzing and guessing on the future direction of the stock market and interest rates on bonds, the Lifecycle funds (L funds) may be a good option. The purpose of these funds is to provide instant diversification and the funds are rebalanced automatically, without any action necessary by the investor, as the stock and bond markets change.

The intent is that an investor can buy one fund to diversify all of your TSP investment rather than putting money into a variety of the underlying funds or the lifecycle funds. But, for those who want to spread their money around, there is no prohibition in taking this approach.

For those retiring a number of years in the future, a higher percentage of the underlying TSP funds are in the stock funds (C, S and I funds). For those that are closer to retirement or actually retired, the more conservative funds put more of your money into bonds than into stocks.

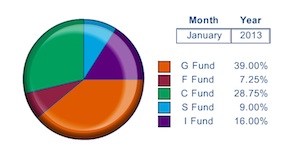

For example, here is how the lifecycle funds were constructed as of January 2014. The source for these graphics is from the Thrift Savings Plan.

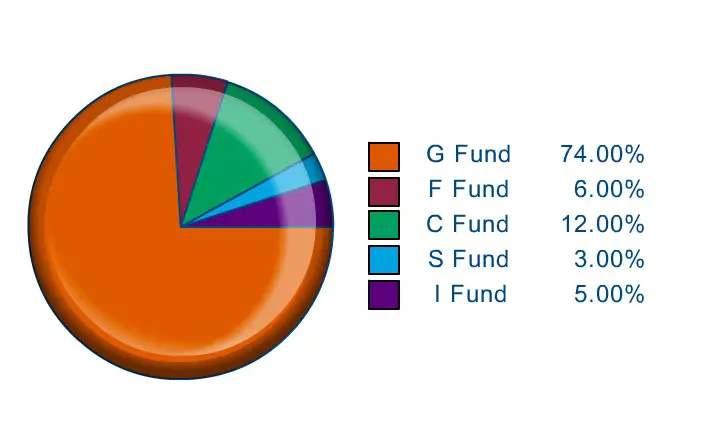

L Income

The theory behind this distribution of funds is that the fund is designed to provide income to the investor in this fund. The 80% concentration in bond funds will accomplish this although for current retirees the income it generates may be disappointing as the bond funds are paying relatively low interest rates.

At the same time, there is the potential for increased value in your investment portfolio with a 20% investment in the underlying stock funds. The C fund is less volatile so it has the largest percentage of the stocks in this configuration.The asset allocation of the L income fund does not change. It is the most conservative investment (more bonds) among the lifecycle funds.

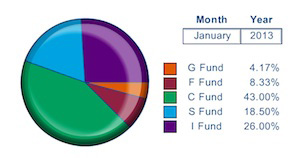

L 2050

At the other end of the configuration is the L2050 fund. This, as the name implies, this fund is designed for those who plan on retiring in a few decades (2050 or so). A federal employee who is more than 30 years from retirement can afford to be aggressive in investing. Any dip (or “correction”) in the market will likely be overcome by subsequent bull markets which the stock markets go up.Notice also the configuration of the stock funds.

The C fund is the “safer” stock fund but potential in some foreign stocks is potentially greater than the larger companies in the C fund and the 2050 fund reflects this but putting a greater concentration of the investors’ money into the I fund.

Overall, more than 87% of the investment is in stocks which, hopefully, will result in a much larger portfolio value by the time 2050 rolls around.

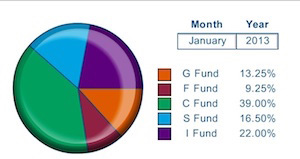

L 2040

For federal employees with a time line for retirement of about 2040, the L2040 fund differs from the 2050 fund in that it puts more of the investors’ money into bond funds (about 22.5% in the current allocation) but still leaves the bulk of the investments in stocks to enhance (hopefully), the total value of the TSP investment over a multi-decade investment.

The TSP puts a smaller percentage in each of the stock funds and increasing the allocation to bonds as the time line is shorter to the projected retirement date.

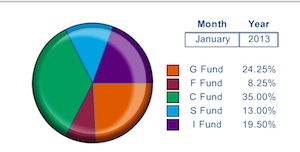

L 2030

The L 2030 fund still has most of the investor’s money in stocks but the percentage is declining as retirement becomes a closer event. The percentage in bonds has now gone up to 32.5% with significant diversity in the stock fund investments. As with the other lifecycle funds. the majority of the stock investments are still in the C fund.

L 2020

The L 2020 fund has a relatively even balance between stocks and bonds. 46.25% of the investor’s money is in bonds and the remainder in stocks. The C fund is still the major investment for stocks and the S fund is down to 9%.

The reason for this differential is that someone retiring in about six years will not have as much time to recover from a drop in the stock market.

Or, if interest rates rise as many are predicting, the value of the F fund will drop.The G fund, as always, will protect your actual investment but is unlikely to provide much growth beyond the rate of inflation. In fact, the actual purchasing power of money in the G fund is likely to go down. But, as a near-term retiree, protecting the principle of your investment becomes much more important than for a person who will be receiving an income for many more years.

Additional Details

Each quarter, the L Funds’ asset allocations may change. As the target date of retirement gets closer, the allocation will move to a less risky mix of investments (i.e. more invested in bonds and less in stocks). So if you are invested in one of the L Funds, you will notice that as you get closer to your target date, your allocation to the TSP stock funds will get smaller while your allocation to the more conservative G Fund becomes larger.

The rate of change in the target asset allocation is small when the L Fund target dates are distant. The rate increases as the funds approach their target dates.

When an L Fund has reached its target date (for example, the L2020 fund), it will be rolled into the L Income Fund.