There are many factors to consider when constructing a retirement income strategy, including timing, investment allocations, Social Security, future employment, spousal retirement, children’s expenses, etc. There are also many different decisions that will need to be made along the way, and each could have a significant impact on the bigger picture. In order to make those decisions in an informed manner, it is important to have a framework to work with as you contemplate the options.

Once an initial plan is developed, choices can then be evaluated to see their effect on that plan. Choosing a retirement date is often the biggest decision to make, and one that is permanent. Therefore, becoming comfortable with how everything interacts together is critical before sending in your retirement paperwork. It is crucial that all factors be included in the analysis for accuracy and confidence.

Putting a plan together

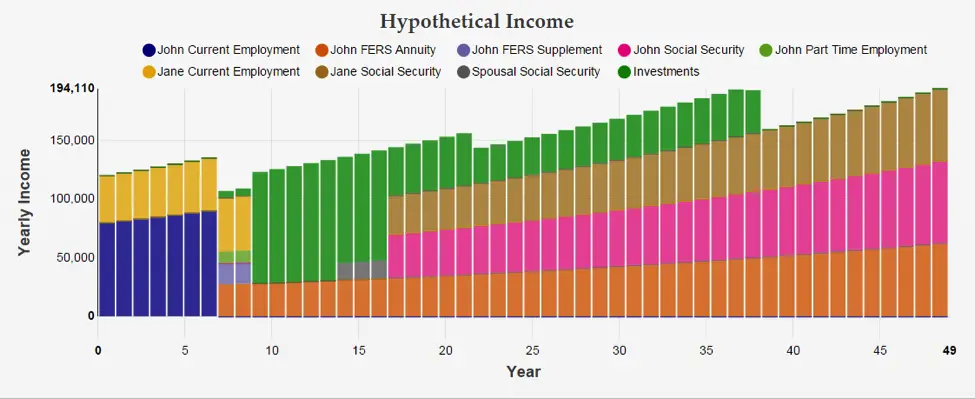

This article will serve as an introduction to one method of putting together a retirement income plan. Keep in mind that it is based primarily on income sources, and as such is not an investment plan. In fact, an investment plan can only properly be crafted after the income plan is complete, so you have a good idea when you expect to need to tap into your retirement assets.

The example plan I will review here is a sample only, and does not reflect any particular person. Your own plan should be based on your particular situation and circumstances. The graph itself can also seem rather simple, but significant planning and calculations go into each component. In addition, any references to investments utilize general assumptions only and are not guaranteed. The final note is that the effect of income tax is ignored in this example, and the assumption is made that everything is pre-tax. If you have Roth or standard taxable assets, appropriate adjustments would need to be made.

Salary and FERS Annuity

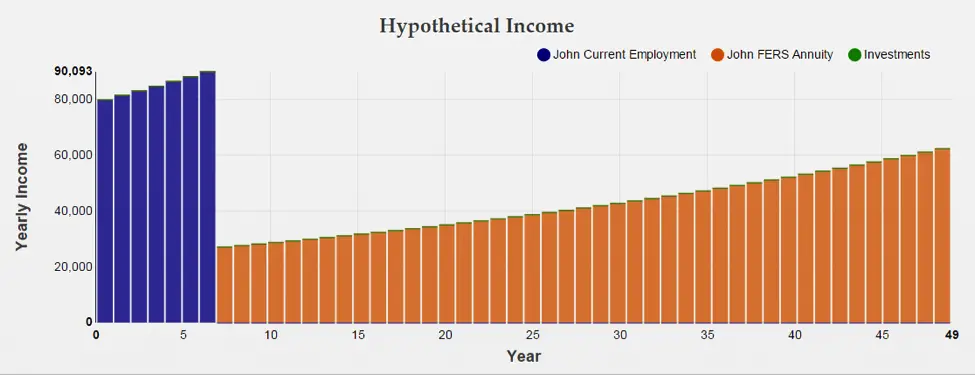

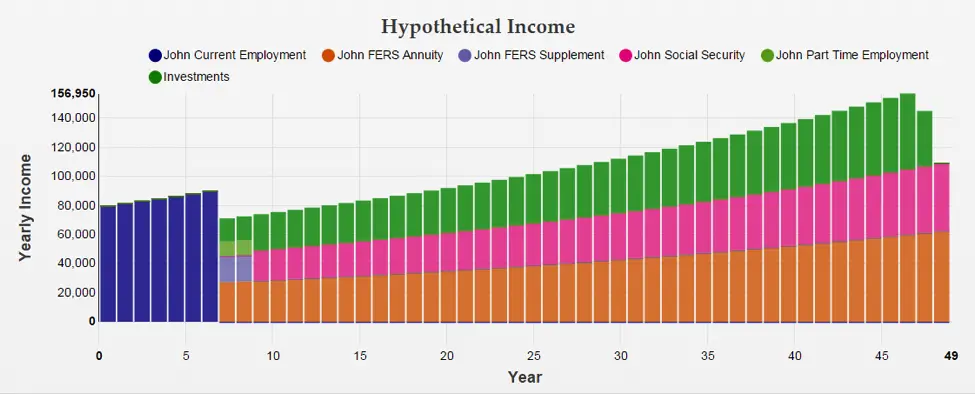

The retirement income plan should be put together piece by piece, including all income sources. The first item to consider is a retirement date. A salary will be included up to that time, and the calculated FERS annuity afterwards. You will also notice that annual increases are factored in for raises, step increases, and COLA for the annuity. In this example, will consider a sample federal employee with the following details:

- John Fed

- Age 53 with 27 years of service

- Current salary of $80,000

- 15% contribution to TSP, with a current balance of $350,000

- Planned retirement at age 60 with 34 years of service

- Calculated FERS annuity at retirement is $2,267 per month

You can see the salary and retirement annuity reflected on the plan as follows:

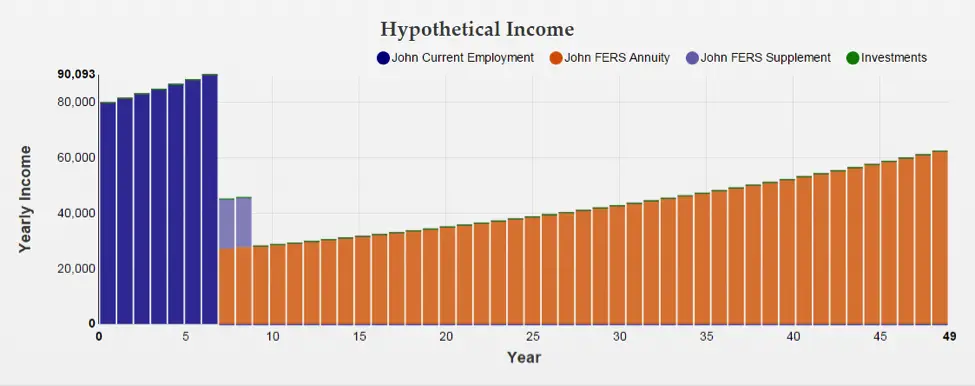

FERS Supplement

Because John Fed has met his service requirements and will be retiring before age 62, he is also eligible for the FERS supplement. The supplement is calculated to be $1,505 per month, based on years of service and the assumed age 62 Social Security benefit (reviewed later). Note that there is no COLA factor applied to the supplement.

You can see the addition to the plan below:

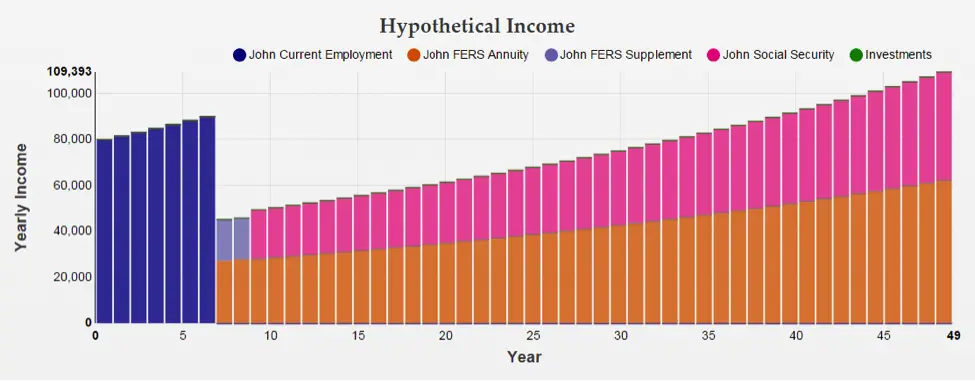

Social Security – Age 62

The FERS supplement stops at age 62, which is when John is first eligible for Social Security. This is not necessarily the best time to file for benefits, but I will start there in building the plan. The final decision on Social Security will come later once everything is put together, and is one of the most important decisions a retiree will make.

We are assuming here that John’s Social Security benefit calculation at his full retirement age is $2,400 per month, so the age 62 benefit is $1,770 per month. You can see the Social Security benefit added below, along with annual COLA increases:

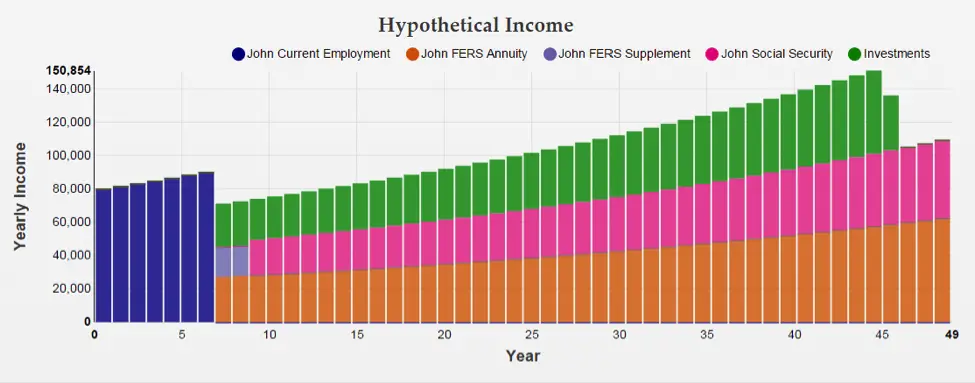

Retirement Accounts (including TSP)

It is at this point that actual retirement savings enter the picture. Rather than use an annuity payout or set withdrawal rate, an income-based plan will use those assets to make up the shortfall between other income sources and the budget each year.

The first step in that process is to establish the budget. The easiest way is to take a look at all of the current income (salary, etc.), and attempt to replicate the same amount in retirement. Put simply, if the budget works now, it will work then. To be comparable, though, you would need to remove items from the gross salary such as TSP contributions, Social Security taxes, Medicare taxes, and other deductions that won’t be there in retirement. You can also try to reconstruct a retirement budget based on assumptions about your spending needs, but that can be a bit more difficult.

Inflation also needs to be factored in once the budget is established, as it can be one of the biggest drivers of the success or failure of a retirement plan. You will notice the “investment” portion of the income plan below filling up to meet the budget that is increasing every year. It is also less than the initial salary, due to the lack of deductions mentioned previously. The result is that retirement investments run out after 46 years, and only the guaranteed income sources remain. At that point, John Fed would be 99 years old.

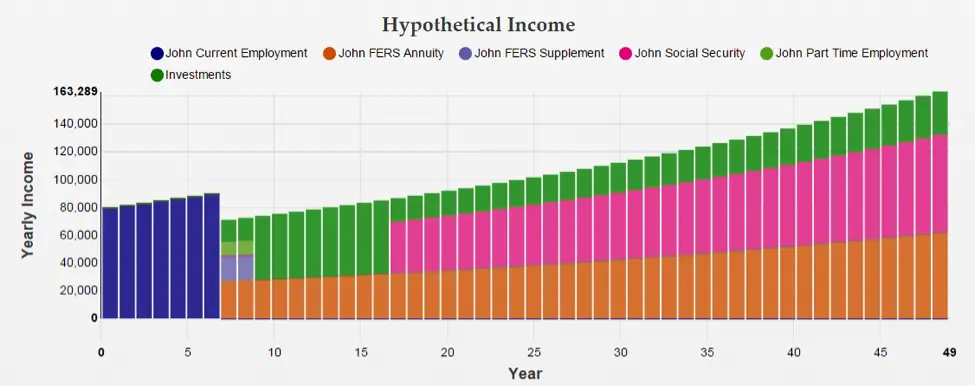

Part Time Work

Once the initial framework of the plan is put together, it is possible to look at modifications and other decisions that can come up. One common scenario is that a person retires from federal service, but continues to work part time at a job he hopefully enjoys. This can have psychological as well as financial benefits.

In the chart below, a part time income of $10,000 per year is added for the first two years after federal retirement. As you can see, the net effect is to stretch out the retirement assets an additional two years since the initial withdrawals will be a bit lower.

Change Social Security to Age 70

Strategizing Social Security benefits is the subject of its own article entirely, but in this case I will show the effect of simply delaying filing for benefits. Instead of taking the age 62 benefit of $1,770, John will now take the delayed benefit of $3,104 at age 70.

The effect of this change is to cause the investments to not run out for at least 50 years, and the guaranteed income is higher even if they did. The downside of the strategy is the increased withdrawal rates for the 8 years in between, which can be seen in the chart. The specific strategy that may make sense for you will be dependent on many factors. Once in the plan framework, however, the effects are much easier to understand and evaluate.

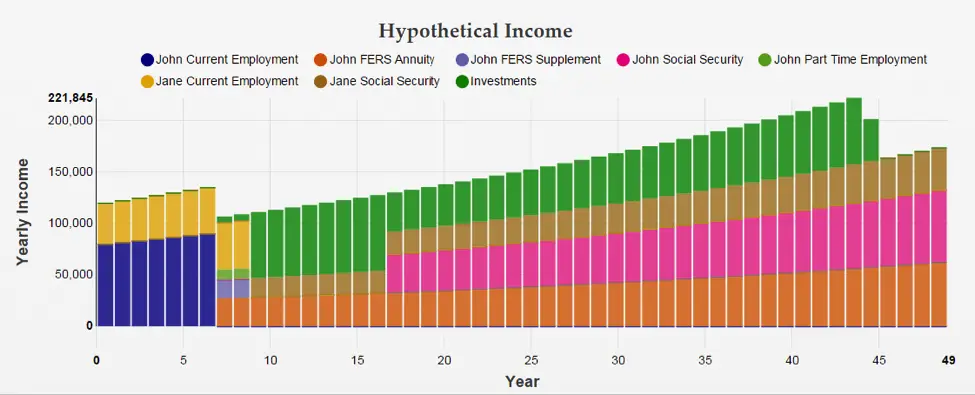

Planning With a Spouse

Up until this point, we have considered only our example of John Fed. We are now going to look at both John and Jane Fed, to see the effect a spouse can have on the income plan. To do that, we are adding Jane’s information as follows:

- Jane Fed

- Not a federal employee

- Age 53

- Current salary of $40,000

- 15% contribution to a 401(k), with a current balance of $200,000

- Planned retirement at age 62

- Age 62 Social Security benefit of $1,549 per month

In order to accurately reflect the new data, Jane’s salary (minus the deductions) is added to the required budget. Her salary, Social Security benefits, and retirement savings are also added. You can see the effects of these changes in the chart, with the investments now back to running out in 44 years at age 97.

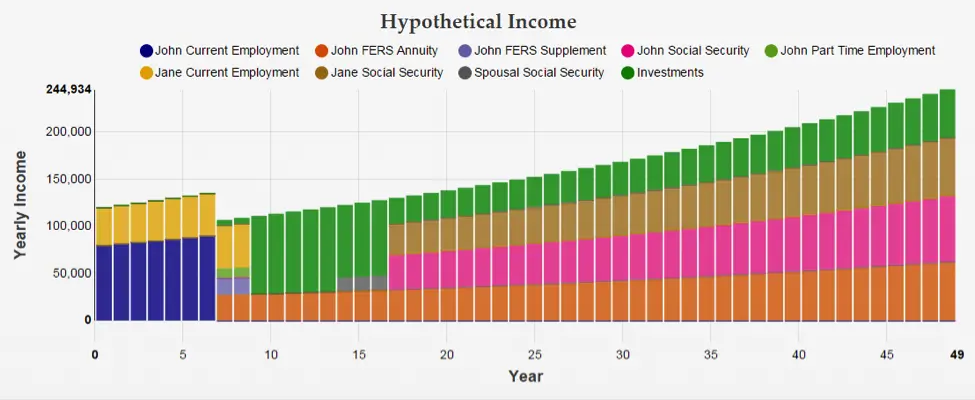

File and Suspend Social Security Strategy

The addition of a spouse also opens up the options for more advanced Social Security strategies. In this instance, I will show a “file and suspend” strategy where John files on his own benefits at his full retirement age of 67 and then immediately suspends. This allows Jane to take spousal benefits between ages 67 and 70, while her own benefit is delayed until age 70. John also begins receiving his own benefits at age 70. The net effect is similar to John delaying his own benefits, where more assets are used earlier, but the guaranteed income is higher later and the investments do not run out through 50 years.

Frontloaded Expenses

One assumption used so far is that expenses will be consistent (factoring in inflation) throughout the rest of their lives. In reality, though, it may make sense to spend a little more earlier in retirement. This is especially true if the overall plan is very comfortable, and there aren’t other desires for leaving a larger estate.

There are many things the additional budget could be put towards, but the most common that I see is for travel. With two spouses not working, there is much more time to travel if the funds are there. It can also be beneficial to travel earlier while you are younger and healthier, rather than waiting until it becomes more difficult with age. Travel is not the only thing that could be planned for separately (weddings, college, etc.), but is one that hits home with most people.

In this instance, we will add a $10,000 travel budget starting at age 62 when Jane retires. That will keep up until they are age 75. You can see the increase in year 9 and decrease in year 21. While the result of this plan shows the assets being used up, it is important to note that there is still the majority of the income left from sources that do not run out.

Investment Assumptions

A key component of the discussion with regard to the retirement investments is the assumed return. In this model, we used a moderate return for a moderate investment allocation. In your particular situation, this may need to be adjusted depending on your risk tolerance. For example, it would be irresponsible to plan on a large investment returns each year if you are only comfortable investing in the G fund.

The returns being applied uniformly is also another challenge, since it rarely works that way in the real world. There are strategies to mitigate the market variation, however, especially as it relates to what portions of a portfolio are used to generate the income. There are also more sophisticated planning tools that can be used if necessary. This plan is reviewed constantly throughout the years, and adjustments made as needed to stay on track. As long as you are looking far enough ahead, the adjustments should be able to be smaller.

The investment usage throughout the plan is not equal throughout the years. This is important to recognize, as it is one of the biggest reasons why utilizing an annuity (through TSP or outside) should usually be avoided. Flexibility to deal with the changes over time is important, and locking yourself into a withdrawal pattern can be very limiting.

Other Considerations

We have shown quite a few budget and income factors in the analysis so far, but there are also many other things that could be applied. Some of those are:

- Paying off mortgage

- Expenses that will end (children moving out, etc.)

- Purchase of a second home, RV, etc.

- Change in cost of living if moving

- Rental properties, including income, equity and sales and improvement decisions

- Divorce

- Inheritance

- One-time expenses (wedding, etc.)

- Education expenses for children or grandchildren

- Desired estate or legacy

Contingency Planning

Survivor benefits and life insurance are common issues to be decided upon, and using an income plan can be very helpful. For each person, you only need to look at the effect of them dying in any given year. That would include stopping any income, changing to selected survivor benefits, and going down to one Social Security benefit. From there a new budget would be established and the plan reviewed to see if it was feasible. If not, it is simply a matter of adding an insurance benefit until the plan is workable. At that point, you have systematically determined an insurance need (if any) for both people to be comfortable moving forward.

What’s Next?

After a comprehensive income plan has been put together, it can be used as the basis for other decisions. Investment allocations can be planned around expecting withdrawal timing, Social Security filing strategies can be evaluated, and gifting and estate planning methods implemented. In order to be successful, the big picture plan should be reviewed and adjusted on a regular basis to attempt to avoid surprises.