Most federal employees know that their federal annuity is a primary component of their eventual retirement. For FERS employees, though, their Social Security benefit can be equally important. This would also include CSRS Offset workers and those CSRS employees with enough outside quarters to be eligible for a Social Security benefit. What many people do not know, though, is the sheer number of options you have when considering how to file for your benefits. Those options will depend on your age, marital status, and other factors, but should all be considered before deciding on a filing strategy.

Background Information

Why It’s Important

There are many reasons why Social Security is so important. The first is the actual size of the benefit relative to your other income sources. A typical benefit of $2,000 per month could be considered the approximate equivalent of an investment account worth $600,000. That alone makes it something worth paying attention to. Maximizing your filing strategy can possibly increase your lifetime benefits by hundreds of thousands of dollars.

The next issue is that people are living much longer than they used to, meaning that any attempt that can be made to maximize benefits will be useful for a much longer timeframe.

Common Terms

Before beginning any discussion of Social Security, it is important to clarify the two terms that are referenced most often. The first is the “Primary Insurance Amount”, or PIA. This is the full benefit amount that is calculated by the benefit formula, and will be the first number you see on a benefit statement. You are eligible to receive the PIA at your “Full Retirement Age”, or FRA. Your own FRA will be listed on your benefit statement, but is somewhere between age 65 and 67, depending on the year you were born. These two acronyms will be prevalent, and are important to remember.

Benefit Formula

In order to calculate the Social Security benefit, the “Averaged Index Monthly Earnings” (AIME) must first be calculated. To do that, the earned income in each year is converted to today’s dollars through a wage inflation factor, and then the highest 35 income years are averaged. This average is divided by 12 months to get the monthly amount. As a quick example, an AIME of $6,000 means that the income for the highest 35 years averaged out to be $72,000 in today’s dollars. Because Social Security is only taxed up to an income of $113,700 (2013 amount), the highest AIME possible is $9,475.

The PIA is then calculated by adding the following:

- 90% of the first $791

- 32% of the next $3,977

- 15% of the amount over $4,768

For the example with a $6,000 AIME, that calculation works out to be $712 + $1,273 + $185 for a total monthly PIA of $2,170 per month. The maximum PIA possible is $2,691. Keep in mind that these are based on the current rules and limits.

Other Rules

There are a few other rules that are important to consider as well. They include:

- Workers are eligible for a Social Security benefit after accumulating earnings in 40 different quarters of work. This can be important for CSRS retirees, who may be close to earning a benefit even though most of their work was in federal service not covered by Social Security.

- Benefit eligibility begins at age 62, but the benefits are reduced from the PIA by about 6% per year. The benefit at age 62 will be about 25% lower than the PIA available at FRA. Benefits also continue to increase past the FRA at about 7% per year up until age 70. At 70, the benefit is about 43% higher than the PIA. Benefit amounts do not increase past age 70.

- If benefits are filed for prior to the FRA, there is an “earnings” test applied. For $2.00 of earned income over $15,120 (2013 amount), the Social Security benefit is reduced by $1.00. This test applies even if the earned income formula reduces the benefit to zero.

- Spouses (and sometimes ex-spouses) are eligible for a spousal benefit, which is equal to half of the other person’s PIA. The same reduction applies if taken earlier than the FRA, but the benefit is not increased by waiting longer than the FRA.

- Surviving spouses are eligible to receive the higher of the two individual benefits, but not both.

- Children are also able to receive benefits if they are under the age of 18 or disabled (and were disabled before the age of 22).

Benefit Taxation

It was originally planned that most Social Security recipients would not be taxed on those benefits because they fell under an income threshold, but that threshold has not been indexed with inflation and now many people find that their benefits are taxed. This is especially true with federal employees who receive an annuity.

The basis for determining taxability of benefits is called “Provisional Income”. Provisional income is calculated by taking 50% of the Social Security benefit and adding it to the Modified Adjusted Gross Income (MAGI). MAGI includes such things as IRA or TSP withdrawals, Roth conversions, and your federal annuity. For many federal employees, the annuity income alone is enough to make your Social Security partially taxable. Refer to the chart below for tax rates:

| Single or Head of Household | Married, Filing Jointly | ||

|---|---|---|---|

| Provisional Income | Social Security Taxation | Provisional Income | Social Security Taxation |

| Up to $25,000 | Not Taxed | Up to $32,000 | Not Taxed |

| $25,000 – $34,000 | Up to 50% Taxable | $32,000 – $44,000 | Up to 50% Taxable |

| Over $34,000 | Up to 85% Taxable | Over $44,000 | Up to 85% Taxable |

As with the benefit calculations, please keep in mind that these figures are all based on current tax law, but are subject to potential change in the future through legislative action.

Common Filing Strategies

Delay Filing

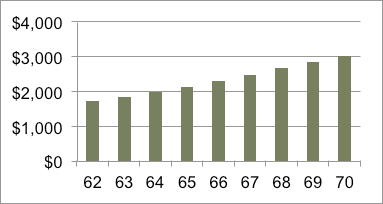

This is the most widely known concept and also the only one applicable to a single person. While benefits are available beginning at age 62, that is often not the best time to take them. Every year you wait, your monthly benefit amount increases up to age 70. That will result in a nearly doubled benefit after waiting the 8 years. Here is an example:

| Age | Benefit Amount | % of PIA |

|---|---|---|

| 62 | $1,725 | 75% |

| 63 | $1,840 | 80% |

| 64 | $2,001 | 87% |

| 65 | $2,139 | 93% |

| 66 | $2,300 | 100% |

| 67 | $2,484 | 108% |

| 68 | $2,668 | 116% |

| 69 | $2,852 | 124% |

| 70 | $3,036 | 132% |

There are a few particular considerations with this strategy:

- The delayed benefit credits are set up so that the actual dollar benefits received is the same regardless of the time you file if you live to an average age, about 79-80. If you don’t expect to live that long, filing earlier would make more sense. If you are more concerned about living a long time, waiting to file would be better.

- Even if waiting until age 70 gives you the best long-term income picture, it still may not be appropriate. Depending on when you actually retire, you would also need other sources of funds to provide income in the meantime while you wait to file for Social Security. That interim cash flow is an important consideration in the overall strategy.

- Delaying benefits at least until the FRA eliminates the earnings test if you are still working.

Maximizing Survivor Benefits

The survivor in a married couple receives the higher benefit between the two spouses. Statistically, there is a good chance one spouse will outlive the other by quite a few years. To help with that situation, it is usually a good idea for the spouse with the higher benefit to wait as long as possible to file and maximize that survivor benefit. In the example above, the difference between the age 62 and 70 amounts was $1,311/month. If a survivor was to outlive their spouse by 15 years (i.e. husband dies at 77, wife at 92), the difference in lifetime income just for the survivor after their spouse’s death would be over $236,000.

Spousal Benefit Coordination

While the strategies available for a single person include primarily deciding how long to delay benefits, married couples (including divorced people that were married for at least 10 years) can utilize the option of spousal benefits in many different strategies. In the simplest scenario, taking full advantage of the spousal benefit keeping everything else the same can be a difference of over $50,000. If you file for spousal benefits prior to your FRA, though, you will automatically be deemed to have filed on your own record. That means your own benefit would not be able to continue to increase. More complex strategies utilizing the spousal option are covered below

File and Suspend

This is a common strategy for married couples, particularly those of similar age and income histories, and can be used to take advantage of the spousal benefit option while maximizing each of the individual benefits. The primary rule involved here is the ability to “suspend” benefits after filing for them. This is only possible after reaching FRA and the eventual benefit still continues to increase while suspended. As a demonstration of this, imagine a couple that are of the same age and both with a PIA of $2,000. When the first spouse reaches FRA, they can file and suspend. The second spouse would then be eligible to file for spousal benefits even if the first spouse isn’t actually receiving them. That benefit would be equal to 50% of the PIA, or $1,000 per month. If the spouse was 66 and had 4 years before filing on their own benefits at age 70, $48,000 of spousal benefits would be received before either person received their own actual benefits.

One Early, One Late

Another common strategy for couples with either an age or income disparity is to have one person file as early as possible at 62, while the higher earning spouse waits to file as long as possible. The spouse who files early may then switch to spousal benefits later if they are higher

Federal Employees

There are several additional rules that affect Social Security benefits for federal employees, particularly those under the Civil Service Retirement System (CSRS). The first is the Windfall Elimination Provision (WEP, http://www.ssa.gov/pubs/EN-05-10045.pdf). WEP applies to employees who did not pay into the Social Security system (CSRS) but who are eligible for benefits. Because the formula is geared to provide greater proportional benefits to those with lower incomes, the WEP calculation is an attempt to avoid skewing the benefit ratio in favor of someone who only has a lower Social Security income average due to much of their income being outside Social Security.

The second rule for federal employees is the Government Pension Offset (GPO, http://www.ssa.gov/pubs/EN-05-10007.pdf). GPO applies primarily to CSRS employees who didn’t pay into Social Security but are eligible for survivor benefits. Since typical survivors within Social Security are only eligible for one benefit (theirs or their spouse’s), the GPO is an attempt to place the same restriction on those people who are receiving a CSRS annuity instead.

Both rules for CSRS employees have specific calculations that will vary based on the income history and benefit amounts. You should work with an expert knowledgeable in these intricacies to get confirmation on the various effects before finalizing a complete income plan.

What Is The Best Strategy For You?

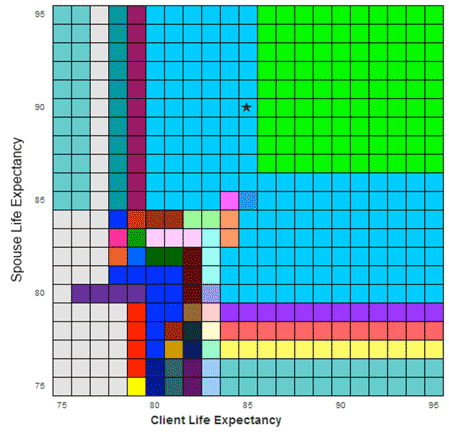

Once all of the various rules and options are known, the next step is to look at your own situation. Given your ages and income histories, the life expectancies are the only variables left in evaluating the Social Security options. A sample comparison chart is shown below where each different color block represents a different combination of benefit timing that produces the highest lifetime income.

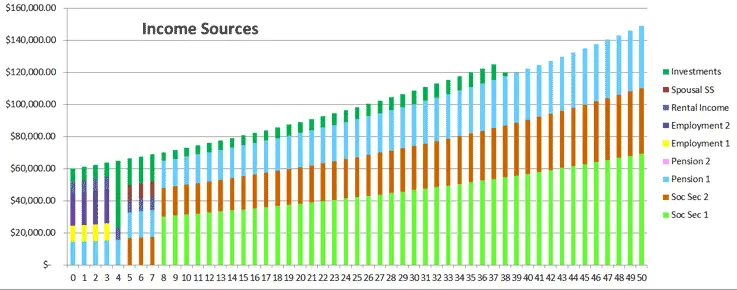

In addition to evaluating the Social Security benefit by itself, another major component is working it into the overall retirement income plan. Income sources for each year need to be evaluated to see which combination allows for the most consistent income. It is also necessary to factor in other savings and investments, such as the TSP, to possibly provide income while delaying Social Security. That type of basic plan can be seen below.

The final decision on timing for Social Security benefit filing is a very personal one incorporating many factors. It is important to be well-informed on all of your options so that you don’t miss an opportunity to positively impact your income and lifestyle going forward.