Holman Rule Part of New Rules Package for the House

The Holman Rule is back. House Republicans passed a rules package for the House on January 9th. The rules outline terms of operation in the next session of Congress.

The rules package passed 220 to 213. All Democrats and one Republican, Tony Gonzales of Texas, voted against the rules package. As noted by the Wall Street Journal, “It is customary for the minority party to oppose the rules.”

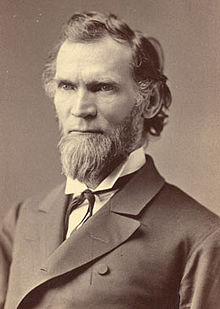

The Holman Rule is the brainchild of William S. Holman of Indiana. He served in 16 Congresses when a career in Congress was still relatively uncommon.

Perhaps his impact has been much greater than other Congressmen who served in that era because of this Rule. It modified a House rule prohibiting appropriations “for any expenditure not previously authorized by law.”

The Holman Rule “empowers any member of Congress to propose amending an appropriations bill to single out a government employee or cut a specific program.” With the vote of a majority of the House and the Senate, the pay of an individual federal government employee could be reduced or a specific federal program could be eliminated.

The rule is an exception to the prohibition against provisions in appropriations legislation that change existing law. Prior to the rule’s reinstatement this year, cuts could be made to agencies but not to specific programs or employees.

Rule Routinely Attacked

The purpose of the Holman Rule now, as it was in past years, is to cut government spending.

The Holman Rule was first introduced and adopted in January 1876—147 years ago. That is when the U.S. House of Representatives adopted it for the first time.

While mentioning the Rule seems to result in an explosion of negative reactions from those who like the idea of an expanding federal government and bigger budgets, the reality is that it may not make much difference in the final analysis and has not been used in recent decades.

One federal employee union wrote this about the Holman Rule:

This rule is the choice vehicle for ethically corrupt members of congress who seek to purge the operational funding of agencies and programs that run counter to their outside political interests (such as law or regulatory enforcement agencies that keep industry captains and the most powerful people in check).

AFGE’s president said in 2017:

“It takes the power and authority away from the President’s Cabinet secretaries and administrators to determine how to run agencies, and gives it solely to a member of Congress. It’s a dangerous rule, it’s a reckless rule, and obviously that’s the reason it hasn’t been in existence for 30 plus years. But now it’s been resurfaced I think really to go after federal employees.

Congressman Gerald Connolly (D-VA) previously made this comment in 2018 about the Holman Rule:

House Republicans snuck into legislation the Holman Rule – a cynical and dangerous attack on federal workers that allows Members of Congress to reduce the salaries of federal employees. This archaic tool, also known as the Armageddon Rule, is nothing more than a backdoor way for Republicans to dismantle the federal workforce and carry out political vendettas at the expense of career civil servants.

How Holman Rule Has Been Used in the Past

The Holman Rule is one way that Congress could cut government spending by eliminating spending on specific programs or even for specific employees. The reason it probably has not been as effective in the past as some have feared it would be is that it still requires agreement between the House and the Senate but it does eliminate other obstacles.

The Holman Rule can work. The Holman Rule has been used in the past but not in recent decades. In 1932, it was used to eliminate 29 Customs positions. It was used to eliminate eight more Customs positions in 1939. It also allowed a 1952 amendment that did not allow filling of vacancies in independent agencies until the agency’s workforce was reduced by 10%.

The government survived and thrived in the 147 years since the Holman Rule was originally introduced. It is likely to do so again with little real impact on the $1.7 trillion dollar budget just passed for the federal government.

That budget, which is more than 4,000 pages long, was passed without any amendments or debate. Those voting on it, including those who voted but were not in attendance, did not have a chance to read the entire bill before it was passed as it was cobbled together and passed quickly in order to avoid another government shutdown. This background is part of the reason the Holman Rule has resurfaced in 2023.

Effort to Cut Government Spending

The Holman Rule is one part of a Rules package that includes a “Cut-As-You-Go” policy. This means that legislation cannot be considered if it increases mandatory spending over a 5 or 10 year period. The “CUTGO” policy requires bills that would authorize new spending to find offsetting spending.

America’s national debt now exceeds $31 trillion. It is larger than our Gross Domestic Product (GDP). GDP serves as a measure of an economy’s overall size and health, measuring the total market value of all of a country’s goods and services produced in a given year. In addition to the rapid inflation the country is now experiencing, the size of the debt can also be a signal that a recession is underway.

As the national debt increases as it has in recent years, pressure to reduce government spending will build. Total interest payments on the government’s debt could reach $580 billion this fiscal year, up from $399 billion in fiscal year 2022.

Whether the Holman Rule will play any significant role in the budget process remains to be seen. The rate of inflation, the strength of the economy, and rising or declining tax revenues could all play major roles as well.