With record inflation causing the highest FEHB premium increase in the last decade, many federal employees are looking for ways to save money on their 2023 FEHB premiums. Here’s how to do just that.

Find a New Health Plan

During the 2021 Open Season, OPM reported only 2.5% of federal employees opted to switch health plans. This is a big mistake; the best health plan for you and your family may not be same as the one you chose the year before. Those who stick with a health plan ignore new plans, shifts in their life that could make another option a better choice, and the impact of premium and benefit changes that happen every year.

2023 FEHB Premiums Increase

Let’s start with premium. The average enrollee share of premium is going up an average of 8.7% in 2023, but keep in mind that the increase is not uniform across all FEHB plans. Of the 262 FEHB plans available in both 2022 and 2023, premiums decreased in 56 plans, stayed the same in 9 plans, increased less than the average in 119 plans, and increased at or above the 8.7% average in 78 plans.

How is your plan’s premium changing in 2023? While we don’t recommend choosing a plan based on premium alone, it’s a for-sure expense that can impact your budget. Consider the case of Humana Health Plan High (9F) available in Illinois. The plan premium is increasing 34.2%, which means self-only enrollees will pay an extra $6,510 next year in premium alone.

Comparing FEHB Plans by Total Cost

Total cost is a better way to choose an FEHB plan. It’s the combination of for-sure expense (premium) and the likely out-of-pocket costs you’ll face next year based on the composition of your family considering age, family size, and expected healthcare usage.

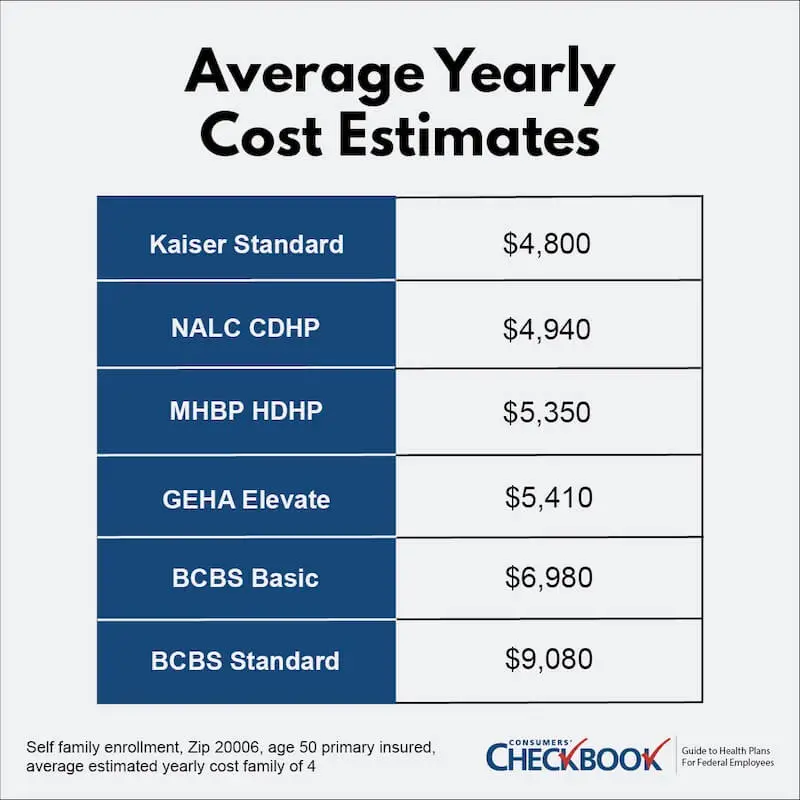

Checkbook’s Guide to Health Plans ranks your options based on total cost, and in 2023, there are big price differences among FEHB plans. For example, a family of four in the Washington, D.C. area could save $4,280 next year in estimated total costs by switching from BCBS Standard to Kaiser Standard. If the same family didn’t want to switch to an HMO, they could keep PPO coverage and save $3,670 in estimated total costs by switching from BCBS Standard to GEHA Elevate.

High-Deductible Health Plans

For most federal employees, a High Deductible Health Plan (HDHP) will be the least expensive in 2023. HDHPs generally have lower premiums than other plan types, and enrollees receive a plan-funded Health Savings Account (HSA) that totals between $800-$1,200 for self-only enrollment and $1,600-$2,400 for self-plus-one or self & family enrollments.

The HSA is funded through premium pass throughs, and enrollees can choose to make additional tax-preferred voluntary contributions either as a lump sum or a payroll deduction. Total contributions by the plan and enrollee are capped at $3,850 for self-only coverage and $7,750 for self-plus-one or self & family enrollment. You can invest your HSA funds as you would with an IRA. HSAs are triple tax-advantaged—money goes in tax-free, grows tax-free, and leaves tax-free for qualified medical expenses. For any employees expecting high out-of-pocket healthcare costs next year, HDHPs with an HSA can save you about 30% on those expenses.

HDHPs are also a great plan choice for federal employees nearing retirement. Once you turn 55, you can contribute an additional $1,000 per year as a catch-up contribution. Additionally, penalty-free non-medical distributions are allowed once you turn 65, and you’ll only have to pay your normal tax obligations. Both before and after retirement, your HSA can be invested in stocks, bonds, or index funds and can grow to tens of thousands of dollars.

Thus, the HDHP with an HSA can supplement your Thrift Savings Plan (TSP) by paying for out-of-pocket medical costs, including Medicare Part B premiums. You’ll have the added flexibility of non-medical distributions which can be used as an additional stream of post-retirement income, preserving your TSP investments.

Self-Plus-One vs Self & Family

For two-person families, either a married couple or parent and child, self-plus-one is often the least expensive enrollment option.

However, in 2023 there are 86 FEHB plans where self & family is less expensive than self-plus-one. The differences in some cases are substantial: For the Kaiser High (E3) plan in the D.C. area, the bi-weekly self & family premium is $50.90 less expensive than the self-plus-one premium. That difference totals $1,323 annually.

Keep in mind that the plan benefits you receive are the same under both enrollment options. The best way to check cost is to go to the last page of the official FEHB brochure, look for enrollee share of premium, and choose the cheaper option.

Flexible Savings Accounts

OPM reports less than 20% of active federal employees have a Flexible Savings Account (FSA). Keep in mind that annuitants are not allowed to have an FSA. That means most active federal employees are missing out on for-sure savings on some or all their out-of-pocket healthcare expenses.

You’ll fund your FSA with pre-tax payroll deductions. Contributed funds are not subject to payroll taxes, which saves you about 30% on out-of-pocket healthcare expenses paid through the FSA. In 2023, you can start an FSA with as little as $100, and the annual maximum contribution limit is $3,050, a $200 increase from last year. For households with two active federal employees, both can have an FSA, doubling the annual maximum to $6,100.

You’ll want to budget somewhat carefully as FSAs have a use-it-or-lose-it provision. You can only roll over $610 of unused funds into the next plan year, a $40 increase from last year. Any additional funds above the rollover limit are forfeited if not used.

For budgeting, consider your known out-of-pocket healthcare expenses, some of which could be for dental or vision care, prescription drug or doctor co-pays, etc. Realize that you don’t have to be perfect with your budgeting. In fact, there would be no risk for any first-time FSA participant to start with contributing $500 dollars, knowing that in the unlikely event of having no out-of-pocket healthcare expenses next year, you could roll over the entire $500 into the next plan year.

While you’re budgeting, keep in mind that even more out-of-pocket healthcare expenses qualify for FSA reimbursement. Over-the-counter (OTC) items such as allergy medicine, pain relief medications, and hundreds of other items are once again FSA eligible as a result of the CARES Act passed during the COVID-19 pandemic.

Paperless reimbursement is now available from most FEHB carriers, making it even easier to use an FSA. During FSA enrollment, you can opt-in to paperless reimbursement. When your provider files a claim with your FEHB or FEDVIP plan, FSAFeds will reimburse you automatically for eligible out-of-pocket expenses from the claim.

If you’re part of the 80% of federal employees without an FSA, you’re guaranteed to save some money next year by taking advantage of this tax-preferred benefit.

The Final Word

Federal employees will face higher 2023 FEHB premiums, and this Open Season is a great opportunity to consider whether your existing plan is still the best fit. Perhaps your plan is one where the premium increased more than 8.7%. There are likely comparable plans that offer as good or perhaps even better benefits for less.

If you’re part of the 80% of federal employees without an FSA, we strongly encourage you to take advantage of this way to save on for-sure out-of-pocket expenses. If you haven’t done so before, there is no risk in starting with a few hundred dollars as you’ll be able to roll over any unused funds into the next plan year.

FEHB, FEDVIP, and FSA Open Season starts November 14th and ends December 12th.