May 2022 has been a wild month for stocks. On Friday, May 20, it looked like stocks would officially enter a bear market but then went back up on Monday. Anyone who watches the stock market’s ups and downs probably won’t sleep at night wondering what is coming next.

Investors wonder if the bottom has been reached and if the downward trend will continue. No one knows, of course, until after the fact. The chances are a stock market bottom is still in the future and the volatility will continue. As summer approaches, the best approach for readers may be to enjoy a summer vacation.

As the Federal Reserve hikes rates to try and control inflation, there is also the possibility of a recession and a continuing drop in stock prices. While there has been success in earlier decades at controlling inflation with rate increases, keeping the economy out of recession at the same time is a challenge for policymakers.

When inflation hit new peaks 40 years ago (similar to today’s rate of inflation), “stagflation” set in. This happens when economic growth slows, demand for goods and services drops, unemployment rises and inflation keeps climbing. The economic situation today is roughly similar to supply chain issues and an oil shortage that occurred more than 40 years ago.

Obviously, these factors can have a negative impact on stock prices. As one can see from the results in your TSP investments so far in 2022, this has not been a good year for stocks.

How Are TSP Investors Reacting to the Stock Market Volatility?

Have the volatility and dropping stock prices caused TSP investors to panic and sell their TSP stock funds? By and large, this has not been the trend so far.

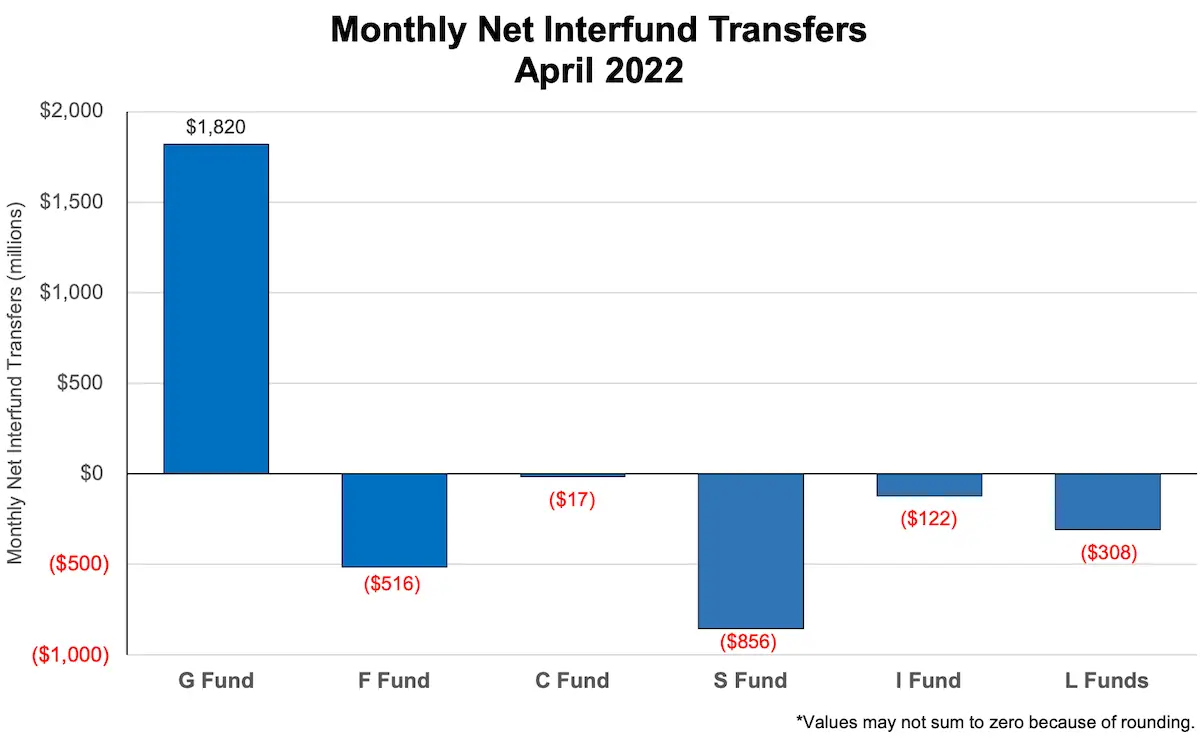

TSP Interfund Transfers in April 2022

In April, it is not surprising that transfers largely involved moving money from the TSP stock funds into the G Fund.

Here are the results:

- $1.8 billion into G Fund

- -$516 million from F Fund

- -$17 million from C Fund

- -$856 million from S Fund

- -$122 million from I Fund

- -$208 million from L Funds

At the monthly meeting on the TSP, Board members emphasized that 1.41% of TSP assets were transferred into the G Fund in April. In other words, the vast majority of TSP participants have not moved money as some may have expected during a time of stock market volatility.

Transfers will be higher in May as transfers have already exceeded transfers in April. So far, despite the volatility, there is no expectation of an unusual number of TSP participants moving money into the G Fund from other stock funds.

The Board is urging TSP participants not to try and time the stock market. There is concern about participants deviating from their long-term strategy because of the current volatility.

TSP management watches these transfers closely, perhaps because of how TSP participants have reacted in previous bear markets. While we are not in a bear market, the market is close to reaching a downturn of 20% or more from a recent high. The longer the downturn drags on, the more stock market investors are likely to react to the emotional impact of losing money as they see their investment cache dwindle.

Preparing for TSP Mutual Fund Window Changes

The TSP has been preparing for the transition to the TSP mutual fund window for a long time to make sure the transition goes smoothly.

There will be a black-out period for TSP transactions. All transactions and services, including the My Account and the ThriftLine will be temporarily unavailable after Thursday, May 26, and until the first week of June, when the transition period ends. TSP investments will remain invested in the TSP funds during the transition period.

The TSP says that TSP participants will not need to take any actions to prepare for the new TSP features and changes. These are steps that TSP participants may want to take:

- Update profile information and complete transactions. After the transition, most transactions can be done online.

- Download historical documents in My Account. Documents and messages will not transfer to the new system but they can be requested later. Statements that post after the transition will be available in My Account going forward.

- Beginning May 26, there will not be any investment changes that can be made until the end of the transition period.

TSP Performance in May 2022

The G Fund is up 0.83% for the year. That is not a great return, but it is the only TSP fund with a positive return in 2022. The G Fund serves as a source of relative calm in a volatile market.

All of the other TSP Funds are down so far this year. Note that the I Fund (International stocks) does have a positive return so far in May.

Here is how the TSP performance looked as of the close of business on Monday, May 24th, after a significant one-day rise in the midst of market volatility:

| FUND | Month-to-Date | Year-to-Date |

|---|---|---|

| G Fund | 0.18% | 0.83% |

| F Fund | -0.01% | -9.33% |

| C Fund | -3.69% | -16.13% |

| S Fund | -5.71% | -23.46% |

| I Fund | 0.33% | -12.44% |

| L Income | -0.45% | -3.75% |

| L 2025 | -0.94% | -6.92% |

| L 2030 | -1.44% | -9.90% |

| L 2035 | -1.61% | -10.94% |

| L 2040 | -1.77% | -11.93% |

| L 2045 | -1.92% | -12.81% |

| L 2050 | -2.07% | -13.62% |

| L 2055 | -2.55% | -15.76% |

| L 2060 | -2.55% | -15.77% |

| L 2065 | -2.55% | -15.77% |

Impact of Rising Gasoline Prices on Inflation

Inflation in 2022 is raging at 40-year highs. Gasoline is one reason for the fast increase in prices and all Americans feel the difference. President Biden promised to “end” the use of oil and natural gas in the United States during his campaign and also talked about mounting a “whole of government” approach to achieving that goal.

He is fulfilling that promise. President Biden said that the country is going through an “incredible transition” away from fossil fuels as we pay more for the high gas prices. The administration has restricted financing of oil drilling projects and taken other steps to restrict the supply of oil while blaming much of inflation on “Putin’s price hike.”

According to President Biden, “Here’s the situation. And when it comes to the gas prices, we’re going through an incredible transition that is taking place that, God willing, when it’s over, we’ll be stronger and the world will be stronger and less reliant on fossil fuels when this is over.”

This week, gas reached an average of $6.07 in California and the national average is now $4.60. The president takes credit for prices not going higher than they already have. He said, “And what I’ve been able to do to keep it from getting even worse — and it’s bad. The price of gas at the pump is something that I told you — you heard me say before — it would be a matter of great discussion at my kitchen table when I was a kid growing up. It’s affecting a lot of families.” He notes his administration has taken steps including releasing 1 million barrels of oil a month from the U.S. Strategic Petroleum reserve.

Summary

International events, the policies of the federal government, national elections coming up in a few months, concerns about the state of the economy and continuing inflation are all contributing to a very volatile stock market. All stock market downturns come to an end.

While we are close to a bear market at the time of this writing, and may be into such a market by the time this is published and read, bear markets do not usually last a long time. The average length of a bear market is 289 days or about 9.6 months. That’s significantly shorter than the average length of a bull market, which is 991 days or 2.7 years. We do not know if we will go into a bear market this year or how long it will last or if there will be a recession.

Most TSP participants appear to be staying put with their investment strategy. As events impact the markets and how TSP investors react, FedSmith will strive to keep readers informed.

Best of luck in making good investment decisions in 2022!