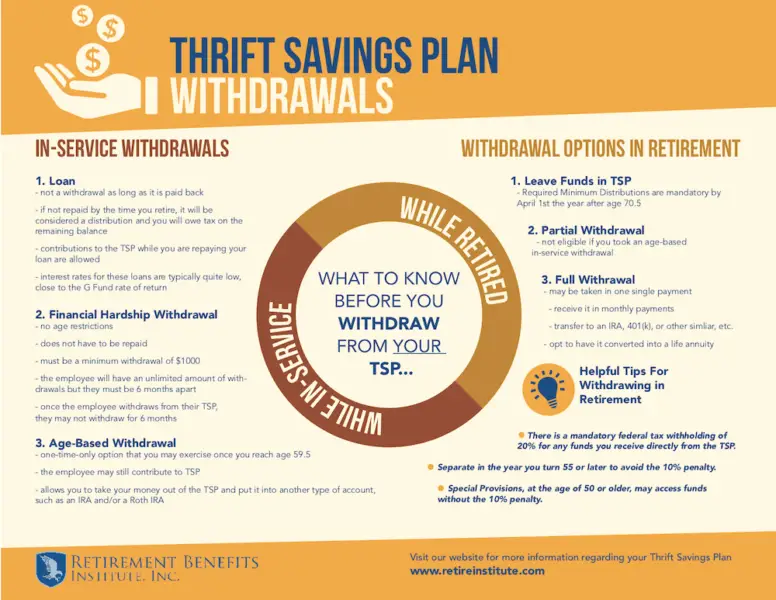

Federal employees spend their entire working careers contributing to personal savings in what we call the accumulation phase. In this article, we will evaluate the ways you can access your TSP while working. We will discuss the rules associated with each type of withdrawal and how they could affect future withdrawals.

Each of the TSP loan options below are available on on showing the purpose of this loan is not required.

How TSP Loans are repaid

Payments (including interest) are deposited back into the traditional and Roth portions of the account, in the same manner the loan was disbursed. Your TSP loan payments will be invested back into the TSP account, according to your most recent contribution allocation.

TSP withholds $50 from the proceeds to cover administrative costs. This amount is deducted proportionately from your traditional and Roth accounts, if you have both. The fee is deducted from the total loan amount. For example, if you request to borrow $1,000, TSP will deduct a $50 fee, and the amount that you must repay will be $950 plus interest.

Financial Hardship (TSP-76)

A financial hardship may be taken at any age, must be applied for, and must be at least $1,000. You can have unlimited amounts of withdrawals, but each must be six months apart.

If a hardship is taken, you will not be allowed to contribute to TSP while working for at least six months. Plus, you will pay a 10% early withdrawal penalty if you are younger than 59.5. This penalty tax is in addition to the income tax you would ordinarily pay.

Age – Based (TSP-75)

If you are working for the federal government and over the age of 59.5, you can make a one-time in-service age-based withdrawal. Your withdrawal must be at least $1,000 or your entire vested account balance (even if it’s less than $1,000). You can still contribute to TSP and receive your match. This allows you to roll over your TSP into an Individual Retirement Account (IRA) or purchase a boat! Taxation will depend on what you do with your money.

Disclosure: The information contained in these blogs should not be used in any actual transaction without the advice and guidance of a tax or financial professional who is familiar with all the relevant facts. The information contained here is general in nature and is not intended as legal, tax or investment advice. Furthermore, the information contained herein may not be applicable to or suitable for the individuals’ specific circumstances or needs and may require consideration of other matters. RBI is not a broker-dealer, investment advisory firm, insurance company, or agency and does not provide investment or insurance-related advice or recommendations. Brandon Christy, President of RBI, is also president of Christy Capital Management, Inc. (CCM), a registered investment advisor.