What often separates the success stories from the tragic failures in financial planning is, as the term implies, sound planning. This may seem obvious, but many federal employees fail to start thinking about retirement until it is just around the corner.

Earlier is better, but whatever your age, career stage, or retirement goals, the time to start planning is always now. The earlier you start saving, the sooner you can begin growing your Thrift Savings Plan (TSP) and other retirement accounts. These tax-advantaged accounts have yearly contribution limits, which means the sooner you start saving, the more assets you can shelter and the longer your assets may be able to grow.

In addition to growing your TSP, you need to think about how you will use this money later in life.

Tax Brackets

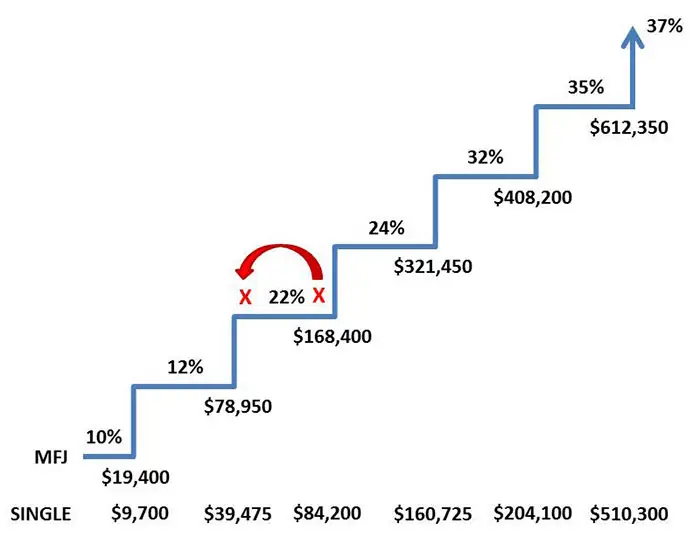

Let’s examine what we commonly see as the tax bracket system in America today. These numbers are for 2019 as it relates to tax brackets, specifically taxable income.

For many federal employees, we find they hover around the top of the 22% tax bracket or higher, maybe $140,000 married or $80,000 single.

When you look at those robust pensions and take into account Social Security, spousal earnings, and other sources of retirement income, your taxable income in federal retirement may drop all the way down to about the bottom of the 22% tax bracket. Instead of dropping to the 12% range, you may simply drop to the other end of the same tax bracket.

This is a unique problem to have here in America because not many people have a pension. A lot of advice that you may listen to on the radio or read about discusses tax deferral. Maybe you have heard someone say, “Save your money in the TSP and pay taxes after you retire because your tax rate will be lower!”

If you examine the numbers carefully, many of you may find that your tax rate will not be lower. Thus you could be pulling out at the same rate that you are putting in. Is that good or bad? What if taxes go up? If taxes go up in the future, would you rather pay taxes now or in the future when they’re higher? No one knows the future of our tax code but it is an interesting thought to ponder.

Let’s examine two case studies for growing your TSP. The hypothetical figures below are for illustrative purposes only.

CASE STUDY 1:

Consider Joe, a federal employee, who continues to only contribute to the traditional TSP, (10% of his pay while receiving the 5% match from TSP.)

Assumptions:

- Salary in 2019: $75,000

- Pay Increases: 2%

- Rate of Return: 4%

- Federal Tax Rate: 22%

- 2019 Beginning Traditional TSP Balance: $150,000

If we assume a retirement year in the future, (i.e., 2028) then his TSP at the 4% growth rate and 10% contribution rate will be worth roughly $371,928. However, because the money is in a tax-deferred state, that $371,928 is not all Joe’s federal retirement savings. It is Joe’s and the federal government’s money.

When we take out the 22% that the government might get, Joe’s spendable money ends up being $290,104. Be careful when you look at your TSP and say, “I have X number of dollars.” If it’s tax-deferred, your TSP savings is not all yours.

| Year | Traditional TSP |

|---|---|

| 2019 | $167,475 |

| 2020 | $185,878 |

| 2021 | $205,252 |

| 2022 | $225,639 |

| 2023 | $247,086 |

| 2024 | $269,638 |

| 2025 | $293,347 |

| 2026 | $318,262 |

| 2027 | $344,437 |

| 2028 | $371,928 |

| Total after tax: | $290,104 |

Question — What portion of that money will go to the government, and who gets to make that decision?

Answer — The government determines what our tax rates are, which is then used to calculate the amount we owe in taxes.

CASE STUDY 2:

Joe stops contributing to Traditional TSP, and begins contributing 7.8% of his pay to Roth TSP with the 5% match going to the Traditional account.

Assumptions: (same as above)

- Salary in 2019: $75,000

- Pay Increases: 2%

- Rate of Return: 4%

- Federal Tax Rate: 22%

- 2019 Beginning Traditional TSP Balance: $150,000

- 2019 Beginning Roth TSP Balance: $0.00

| Year | Traditional TSP | Roth TSP |

|---|---|---|

| 2019 | $159,825 | $5,967 |

| 2020 | $170,119 | $12,292 |

| 2021 | $180,903 | $18,991 |

| 2022 | $192,199 | $26,083 |

| 2023 | $204,027 | $33,585 |

| 2024 | $216,411 | $41,517 |

| 2025 | $229,375 | $49,897 |

| 2026 | $242,944 | $58,748 |

| 2027 | $257,143 | $68,086 |

| 2028 | $272,000 | $77,943 |

| Total after tax | $290,104 |

Tax planning strategies may help as you’re chartering the course to your federal retirement days. Analysts at Retirement Benefits Institute are happy to assist you with any federal benefit questions.

Disclosure: The information contained in these blogs should not be used in any actual transaction without the advice and guidance of a tax or financial professional who is familiar with all the relevant facts. The information contained here is general in nature and is not intended as legal, tax or investment advice. Furthermore, the information contained herein may not be applicable to or suitable for the individuals’ specific circumstances or needs and may require consideration of other matters. RBI is not a broker-dealer, investment advisory firm, insurance company, or agency and does not provide investment or insurance-related advice or recommendations. Brandon Christy, President of RBI, is also president of Christy Capital Management, Inc. (CCM), a registered investment advisor.