If you’ve never compared your existing FEHB plan with a high-deductible plan, now is a good time to explore your options to see if you can save some money in 2021 by switching plans.

High deductible plans (HDHP) have been available in the FEHB system for many years, but we’re still amazed about how many questions we get from federal employees about how they work.

Let’s spend some time demystifying how HDHP plans operate, what you need to plan for, and review the reasons federal employees might consider joining one.

As you might gather from the name, with high-deductible plans, you pay healthcare costs out-of-pocket until you reach the plan deductible. After the plan deductible has been met, the health plan starts to provide cost sharing for your health care expenses.

It might sound scary to pay for all your health care expenses out-of-pocket before you hit the deductible, but keep a few things in mind. These plans provide preventative care services for free, premiums tend to be lower with these plans, and the plans set-up a savings account that you can use to help pay for some of the out-of-pocket expenses you’ll face before you meet the deductible.

Types of HDHP Plans

There are two types of HDHP plans, and the difference has to do with the type of savings account they offer.

Plans that offer a Health Savings Account (HSA) are HDHP plans, and plans that offer a Health Reimbursement Arrangement (HRA) or a Personal Care Account are Consumer Driven plans (CDHP).

Using the Plan Savings Account

In both savings account types, the health plan deposits a portion of your pre-tax premium into the account. The amount is about $1,000 for self-only enrollment and twice as much for self-plus-one or family enrollments.

During the year, you can use this account to pay for any of your qualified healthcare expenses. If you use up your account (or decide to save it rather than use it), you face a high deductible, often almost twice as much as the savings account.

The focus of the plans is to encourage you to be a smart consumer of healthcare. If you are relatively healthy and spend wisely, you may avoid any out-of-pocket expenses. Furthermore, your unused account balances roll over to subsequent years and you can build up a substantial cushion for future healthcare expenses.

Differences in Savings Account Set-Ups

The two savings account set-ups do have differences. The HDHP plans with an HSA not only let you accumulate funds tax free, invest them tax free, and spend them on health care tax free, but also let you retain the savings account when you change FEHB plans.

Your HSA will be managed by a financial services company and you can choose how you want to invest your funds. You can earn interest or capital gains, tax-free, for decades to come. The HSA is your property.

Besides the portion of your premium that the health plan funds your account with, you can also decide to make additional contributions into your account during the year. This feature comes into play if your health care expenses are much higher than you expected, but you can make contributions regardless of your expected expenses. This is a better arrangement than Flexible Spending Accounts (FSA) because there is no use-or-lose penalty.

Speaking of FSAs, you cannot have an HSA account and a general-purpose FSA. However, you can set-up a Limited Expense Health Care Flexible Spending Account (LEX HCFSA) for any out-of-pocket dental or vision expenses.

CDHP plans with HRA accounts do not let you grow the account through interest, and you cannot make additional contributions to the account. Also, if you switch plans, you lose the account and any unspent balance remains with the plan. However, you can use an HRA, but not an HSA, if you are covered by other health insurance such as TRICARE, a spouse’s plan, or Medicare.

Benefits of HDHP/CDHP Plans

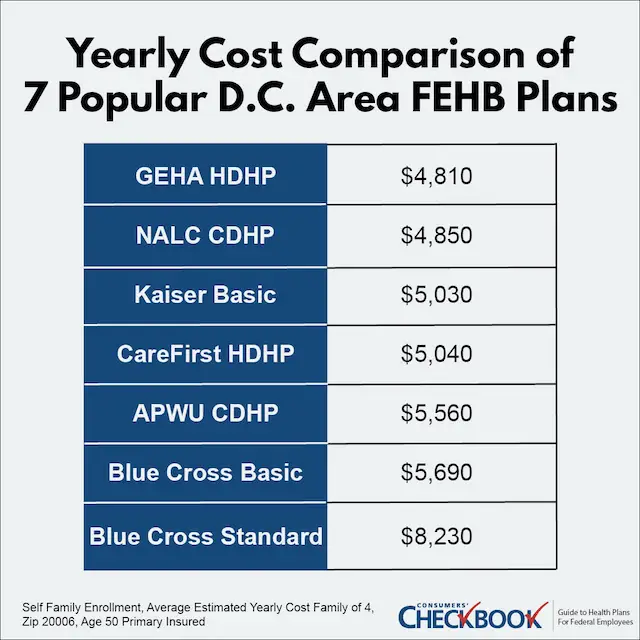

Overall, most of the HDHP/CDHP plans tend to have lower premiums with good catastrophic coverage, and those features plus the plan contribution into your savings account leads to some of the lowest yearly cost estimates available to federal employees.

In Checkbook’s Guide to Health Plans for Federal Employees, we provide total cost estimates and the combination of premium plus expected out-of-pocket costs for someone like you for all FEHB plans. We consistently find many HDHP/CDHP plans at the top of our rankings every year.

Here’s a snapshot of results for some popular D.C. area plans for enrollees age 50 in a family of four paying GS full-time premiums:

While many federal employees would save money by switching to a HDHP/CDHP plan, there are some cases where an employee might be better served in a more traditional HMO or PPO plan. Employees with significant prescription drug expenses or employees who expect high healthcare usage in the upcoming year should explore other options available to them.

Conclusion

Open Season only comes around once a year. Take some time to compare your existing plan with a HDHP/CDHP plan to see how much money you might save. Just download the brochure for one of these plans and read the explanation of how the plan works to make sure you understand its benefits.