Here are six money-saving tips for federal employees to consider during the FEHB Open Season.

You could save money by switching plans

Most federal employees will not switch their health plan this Open Season. In fact, only an average of 5% will make a change during any Open Season. We know from Office of Personnel Management (OPM) data on plan enrollments and from counseling thousands of federal employees over the years that many stay in expensive plans when better, less expensive options are available.

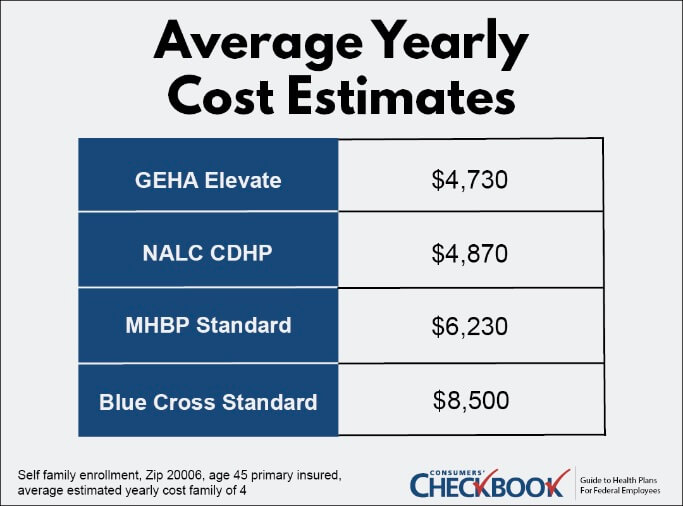

The Consumers’ Checkbook Guide ranks all FEHB plans on estimated yearly cost, which is the combination of known expenses (premium) plus expected out-of-pocket costs based on the user profile—age, family size, and expected healthcare usage. Our benchmark ranking of all plans shows how much you can save by switching plans. For example, a family of four in D.C. could switch from Blue Cross Standard to GEHA Elevate and save about $3,770 in annual costs.

Make sure you’re enrolled in the right plan within the plan family

Many insurance carriers have multiple plan options. GEHA offers five FEHB plan options—four PPO plans and one HDHP plan. If you’re satisfied with the customer service and responsiveness of a particular insurance carrier, make sure you consider all their plan options to see if there is a plan that might save you money.

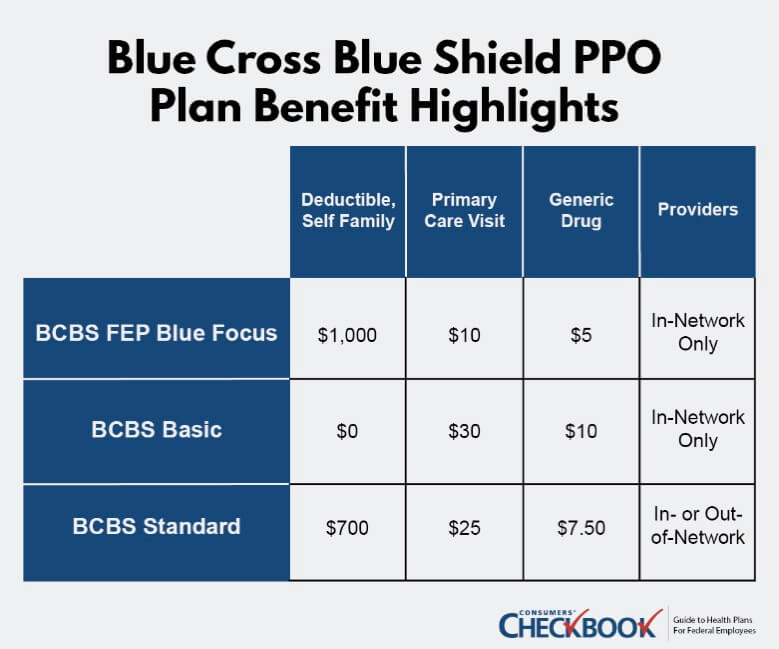

Consider Blue Cross Blue Shield and their three PPO plans—FEP Blue Focus, Basic, and Standard. The big advantage of the Standard plan is that you have coverage to go out-of-network, which you can’t do in Basic or FEP Blue Focus, but if you’re enrolled in Standard and don’t use out-of-network providers, Standard might not be the best BCBS plan for you. You could switch to Basic, not have a deductible, pay a bit more out-of-pocket when you receive care, and save about $2,600 in premiums for a self and family enrollment.

Check if self plus one or self and family enrollment is cheaper for a couple or two-person family

Most of the time, self plus one is less expensive than self and family enrollment for couples and two-person families. However, in 2022, there are 98 FEHB plan options where self and family enrollment is less expensive.

For example, the NALC High plan has a $507.76 self plus one monthly premium and a $437.71 self and family monthly premium for 2022. In this case, choosing the right enrollment option could save you $840 next year.

Look into your FEHB plan’s wellness benefits

We’re seeing plans continue to expand their wellness benefit offerings. While you shouldn’t choose a plan solely because of a wellness benefit, we do think they can be tiebreakers between two closely ranked plans.

To find a plan’s wellness benefit, look at both section 5(h) in the official plan brochure and for most plans the non-FEHB benefits section that follows. The online Checkbook Guide will also include the most important wellness benefits for every plan.

Kaiser Prosper in the Washington, D.C. area offers $425 to a plan member and spouse for completing a total health assessment with current biometric screenings and a COVID-19 vaccination.

UnitedHealthcare plans in 2022 will offer the Peloton app for free to plan members. You’ll also find plans that offer gym reimbursements, tobacco cessation programs, and discounts on dental, vision, hearing aids, and LASIK surgery.

Consider enrolling in a high-deductible health plan (HDHP)

For many federal employees, an HDHP will be the least expensive choice for them this Open Season. HDHPs tend to have lower premiums than popular PPO plans, free preventive care, good catastrophic coverage, and a health savings account (HSA) funded by the health plans to use for out-of-pocket expenses before you reach the deductible.

Funding amounts vary by plan and are between $750 and $1,200 for self only enrollment and between $1,500 and $2,400 for self plus one and self and family enrollments. These funds are contributed tax free, will grow over time tax free, and can be used for health care tax free. Over time, HSAs are a major vehicle for tax-free savings and can grow to tens of thousands of dollars.

But, as the name suggests, HDHPs have a high-deductible. That means before you meet the deductible, you’ll pay the full amount of the plan’s allowed charge for healthcare services other than preventative care. After you meet the deductible, you’ll typically pay a coinsurance percentage for each healthcare service, but you’ll still be left wondering, “X% of what?”

The plan’s allowed charge is not something made publicly available through the plan brochure or plan marketing materials, and this lack of cost transparency leads many federal employees to write off HDHPs, but they are worth a second look and serious consideration.

First, there is a way to find out the plan allowed charge. You can call the plan and ask about any benefits, including how much it will be to see your doctor or go to an urgent care if you’re in-network. By doing so, the out-of-pocket costs before and after the deductible will become more predictable. Remember, you’ll have your HSA to help pay for any out-of-pocket expenses before or after you meet the deductible.

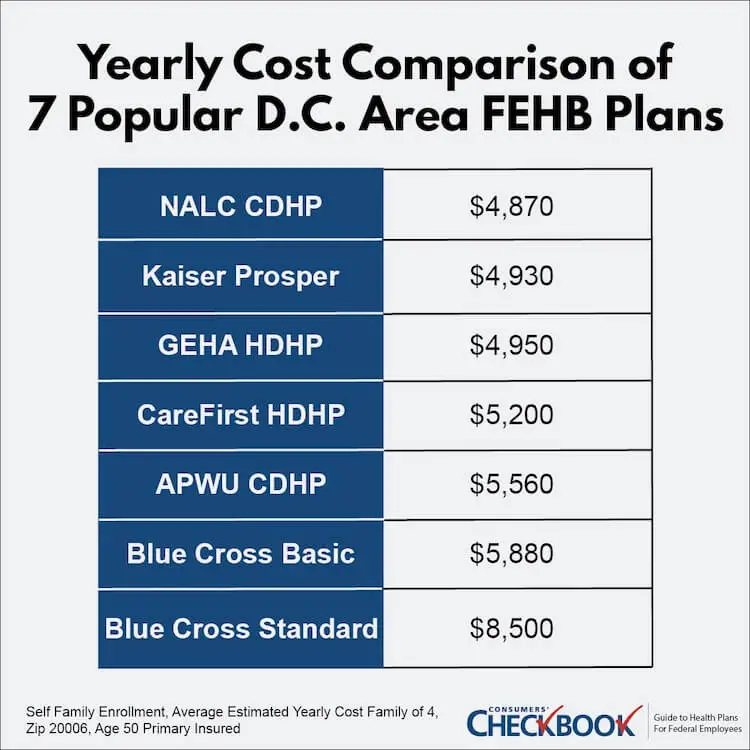

And finally, HDHPs have some of the lowest estimated yearly costs in low, average, or high healthcare expense years. Our 2022 Guide shows that a family of four in D.C. could save about $3,300 in annual expenses switching from Blue Cross Standard to CareFirst HDHP.

To maximize an HDHP’s full potential, you’ll want to try to preserve the plan HSA contribution so that it can grow year over year along with future plan contributions. There are two things that will help you preserve the plan contribution:

- Premium Difference Contribution – If you switch from a more expensive PPO plan to an HDHP, it’s tempting to pocket the premium difference. Instead, since you’ve already budgeted for a higher premium, contribute the premium difference into the HSA. Voluntary contributions go into the HSA tax-free, grow tax-free, and, if used for qualified medical expenses, exit tax-free. Total contributions into an HSA for 2022 cannot exceed $3,650 for self only enrollment or $7,300 for self plus one or self and family enrollments. By contributing extra funds to your HSA, you’ll be able to use the voluntary contributions for out-of-pocket expenses without touching the plan contribution.

- Limited Expense Health Care FSA (LEXHCFSA) – If you’re enrolled in an HDHP plan, you cannot have a general purpose flexible spending account (FSA). However, you can sign up for an LEXHCFSA for qualified dental and vision expenses, which will allow you to pay for those services without using your HSA.

Fund a Flexible Spending Account

While almost every federal employee will have some predictable out-of-pocket health care expenses, only about 25% have an FSA. Establishing an FSA is an easy way to save about 30% on those expenses, depending on your tax bracket.

In 2022, employees can contribute up to $2,750 pre-tax to an FSA. You don’t have to be perfect in predicting your out-of-pocket costs either as you can rollover up to $550 in unused funds into the next plan year.

The only good reason to not have an FSA is if you’re enrolled in an HDHP plan and have an HSA. However, keep in mind you can still set up a limited expense FSA for dental and vision expenses with an HSA.