For most federal employees, a high-deductible health plan (HDHP) or consumer-driven health plan (CDHP) will be one of the least expensive plans to join next year. Both offer enrollees pre-funded savings accounts to pay for out-of-pocket healthcare expenses and free preventive care, and most of them have lower premiums than other FEHB plans.

However, HDHPs and CDHPs have high deductibles where enrollees pay the full cost of healthcare expenses before the deductible is met, and a co-insurance percentage for services after the deductible is met.

Adding to their mystery, insurers don’t advertise the allowed charges for medical services. Before the deductible, enrollees will wonder what the full amount will be to see a doctor or visit an urgent care clinic, and after the deductible, they’ll wonder how much of the final bill they must pay for.

For these reasons, many federal employees write these plans off as too scary, too complicated, or both. However, a workaround exists for the cost transparency issue, there are significant total cost savings compared to other popular HMOs and PPOs, and many miss the investment potential of an HDHP with a health savings account (HSA). We encourage you to learn more about how they work and take another look at these plan options this FEHB Open Season.

Cost Transparency

One of the maddening aspects with HDHP/CDHPs is the lack of transparency around what something will cost. Remember, enrollees will pay the full amount of the allowed plan charge before the deductible, and a co-insurance percentage after the deductible, such as 20 or 30% for medical bills, depending on the plan. How much will it cost to see your primary care doctor or go to urgent care? 20% of what? You won’t find that information in the plan brochure, plan website, or other plan marketing materials.

While inconvenient, there is a workaround to this problem. If you call the plan and ask them directly what the allowed charge is for a primary care visit, urgent care visit, emergency room visit, etc., they will give you that information over the phone.

Once you have this, you’ll have a better sense of what to expect for the predictable healthcare services you use and you’ll be able to see how far the plan savings account will take you next year.

How CDHPs Work

Savings Account Type

CDHPs offer enrollees a health reimbursement account (HRA) or a personal care account (PCA). These are just two different names for essentially the same kind of account.

It’s important to note that the health plan owns and manages the savings account and it has no portability. That means if you switch out of a CDHP plan or leave federal service and the FEHB program, you forfeit any unused funds from your HRA.

Contributions

CDHPs will pre-fund the HRA at the beginning of the plan year with the full contribution amount. Plan contributions range from $1,000 to $1,200 per year for self-only enrollments and $1,800 to $2,400 per year for self-plus-one and self-and-family enrollments. You cannot contribute additional funds to an HRA nor can you invest the HRA funds.

Distributions

Qualified medical expenses are automatically deducted by the plan from the HRA. Once the HRA is exhausted, you’ll pay out of pocket for healthcare expenses. You cannot use your HRA for any non-medical expenses.

Rollovers

Unused funds will rollover into the following year. However, there is a rollover ceiling with HRAs. You can only rollover up to $5,000 for self-only enrollment or $10,000 for self-plus-one and self-and-family enrollments.

How HDHPs Work

Savings Account Type

HDHPs offer enrollees an HSA. Unlike an HRA in a CDHP, the plan enrollee owns the account and the HSA is fully portable and will remain with you if you switch plans. A financial services company manages the account and the plan enrollee decides how to invest HSA funds.

Contributions

HDHPs fund the HSA through a pay period premium pass through, which means the entire amount of the plan contribution into the HSA is not available at the beginning of a plan year.

Plan contributions range from $750 to $1,200 per year for self-only enrollments and $1,500 to $2,400 per year for self-plus-one and self-and-family enrollments. You can make additional contributions into your HSA during the year, either as a lump sum or as a pay period pass through. Total annual contributions, from the plan and participant, cannot exceed $3,650 for self-only enrollment and $7,300 for self-plus-one and self-and-family enrollments.

There is also an additional “catchup” contribution of $1,000 a year allowed for enrollees over the age of 55. Any additional contributions are not counted as income for federal and state tax purposes and are free from Social Security and Medicare taxes. For most federal employees this means that taxes are reduced at least 20%, and often 30% or more, of the amount invested.

Distributions

You aren’t forced to use your HSA to pay for healthcare expenses. Of course, you can use the HSA if you so choose, but, unlike HRAs, the plan doesn’t automatically deduct expenses from your HSA.

You can use your HSA for non-medical expenses. However, if you’re under 65, you’ll pay a 20% income tax penalty plus your normal tax obligations. If you’re over 65, you just pay normal tax obligations.

Rollovers

Unused funds will rollover into the following year. There is no rollover ceiling for HSAs, allowing your account to grow year over year.

Retirees on Medicare

Once you retire and are on Medicare, you can no longer make voluntary contributions to an HSA, but you can stay in the HDHP if you so choose. HDHPs that normally would have an HSA instead offer retirees an HRA. You keep your HSA and it can grow from your investment returns, while your new HRA is used for medical expenses.

How to Maximize Your HSA

HDHPs with an HSA have several advantages over CDHPs: full portability of the savings account, no rollover ceilings, the ability to invest your account in stocks and bonds, and the ability to make additional contributions into the account.

Voluntary contributions into the HSA are triple tax advantaged; they go into the account tax-free, grow tax-free, and, if used for qualified medical expenses, exit tax-free.

To maximize the full potential of the HSA, you’ll want to try to preserve the plan contribution in the account, add plan contributions in future plan years, and have your account grow tax-free year over year.

Here are two important ways to help you preserve the plan HSA contribution:

Premium Difference Contribution

If you switch from a more expensive PPO plan to an HDHP, it’s tempting to pocket the premium difference. Instead, since you’ve already budgeted for a higher premium, contribute the premium difference into the HSA. Total contributions into an HSA for 2022 cannot exceed $3,650 for self-only enrollment or $7,300 for self-plus one or self-and-family enrollments. By contributing extra funds to your HSA, you’ll be able to use the voluntary contributions for out-of-pocket expenses without touching either the automatic contribution paid from your plan’s premium, or your existing HSA balance.

Limited Expense Health Care FSA (LEXHCFSA)

If you’re enrolled in an HDHP, you cannot have a general purpose flexible spending account (FSA), a limitation on the total amount you can exempt from taxes. However, you can sign up for an LEXHCFSA for qualified dental and vision expenses, which will allow you to pay for those services without touching your HSA.

Total Cost Savings

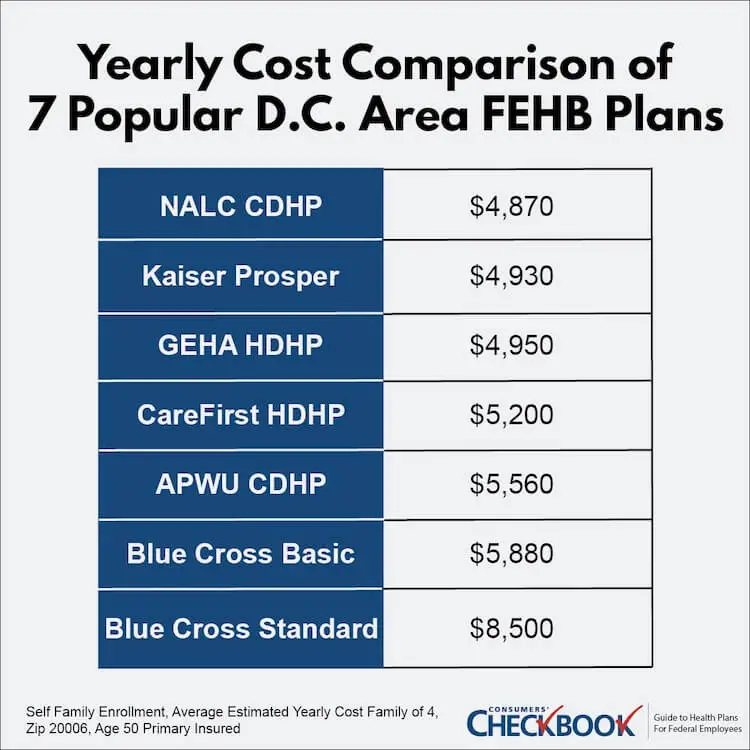

Checkbook’s Guide to Health Plans for Federal Employees takes each plan’s for-sure expense (premium) plus the enrollee’s expected out-of-pocket costs and adds factors that influence healthcare spending (age, family size, expected health care usage) to produce a yearly cost estimate for every FEHB plan.

HDHPs and CDHPs have some of the lowest estimated total costs. A family of four in the Washington, D.C. area could save around $3,500 next year (and most likely in future years) by switching from Blue Cross Standard to either GEHA HDHP or NALC CDHP.

Who Shouldn’t Be in a CDHP/HDHP?

If a $1,000 to $2,000 health bill would cause you financial distress, a CDHP/HDHP might not be the best plan for you.

There will always be a gap between the plan contribution into the savings account and the plan’s deductible. In the most extreme case, that gap is $2,000. If you had an unexpected accident at the beginning of the plan year before you met the deductible, you’ll be paying the full charge for that expense.

While there’s always a risk with any FEHB plan of having a worst-case year and paying the out-of-pocket maximum, not having traditional insurance kick in right away at the start of the year with a CDHP/HDHP heightens that risk somewhat.

These two types of plans work best for enrollees whose usual expenses are low (no high-cost maintenance drugs, for example), with most of the fund balances kept in reserve and fund levels growing each year.

The Final Word

Viewed strictly as a health insurance decision, CDHPs are one of the lowest cost plan choices available to federal employees. However, HDHPs with an HSA are more than just health insurance; they are a tax advantaged investment vehicle. The power of compounding investment returns and time can provide you with a significant nest egg for any unexpected healthcare expenses you might face down the road or simply as income for any expense once you retire. Some enrollees in HDHPs have amassed HSA balances of $50,000 or more by making extra tax-advantaged contributions over several years.