Enrolling (or not enrolling) in Medicare Part B is one of the most important decisions you’ll face when you turn 65 and are no longer working, or when you eventually stop working if you plan on working past age 65. Because there’s an additional premium you must pay, this decision is about more than just health insurance coverage; it’s a financial decision, and one that we receive the most questions about from federal employees and retirees each year.

We’ll walk you through reasons to enroll in Part B and provide examples of when it might be the wrong choice for you.

What is Medicare Part B?

Part B is the medical insurance part of Original Medicare that covers both preventive and medically necessary physician care. In addition, Part B covers mental health services, durable medical equipment, clinical research, lab tests, imaging, some home health services, and ambulance services.

The premium you’ll pay for Part B is determined by your adjusted gross income (AGI). The AGI used will be from your tax return and has a two-year lookback. For example, if you turn 65 in 2022 and decide to enroll in Part B, the premium you’ll pay will be based on your AGI as reported on your 2020 tax return. However, if your AGI was higher two years ago before you or your spouse stopped working, and is now lower, you can apply to the Social Security Administration to use your current AGI instead.

If your income falls below $91,000 as an individual or $182,000 as a couple, you’ll pay the base Part B premium which is $170.10 per month in 2022. If your income is above those levels, you’ll pay the base Part B premium and an extra charge called Income Related Monthly Adjustment Amount (IRMAA). Part B premiums rise quickly if you’re subject to IRMAA and can be as much as $578.30/month if you fall into the highest IRMAA tier.

The initial Medicare enrollment period lasts seven months: It starts three months before you turn 65, includes the month you turn 65, and ends three months after you turn 65. If you plan on working past the age of 65, you can (and almost certainly should) delay Medicare enrollment because you’ll avoid wasted spending on Part B premiums as well as qualify for a special enrollment period that lasts eight months once you do retire.

It’s important to decide whether enrolling in Part B is in your best interest when you turn 65 or when you stop working if you work past age 65. If you don’t enroll in Part B when you’re first eligible and decide to enroll later, you’ll pay a 10 percent penalty for every year you could have had Part B, and that penalty stacks. For example, if you miss five years of Part B and decide to enroll late, you’ll have to pay a 50 percent penalty on top of the Part B premium you would regularly pay.

Reasons to Not Enroll in Medicare Part B

About 70 percent of federal retirees decide to enroll in Part B and the case to take Part B has been made even stronger recently with new low-cost plan options (see below), but there are situations where it may not be the best choice for you.

You’re Subject to IRMAA

If you’re subject to higher Part B premiums because of IRMAA, and you expect your income to remain consistent in retirement, enrolling in Part B will be of limited financial value. For retirees that fall into the first tier of IRMAA—above $91,000 and below $114,000 for an individual and above $182,000 and below $228,000 for a couple, you should still consider joining Part B and enrolling in a Medicare Advantage plan, discussed below. Retirees that fall into the second or an even higher tier of IRMAA should in most cases bypass Part B enrollment. You’ll be paying double or more the standard Part B premium and you’re far better off financially keeping your existing FEHB coverage and declining Part B.

Your Existing FEHB Plan Has Poor Medicare Coordination and You Don’t Want to Change Plans

When you have Medicare and an FEHB plan, Medicare serves as the primary payor and your FEHB plan will be secondary. Many FEHB plans will waive their deductibles and doctor and hospital co-pays to zero if you have both parts of Medicare. In this scenario, you won’t have to pay out-of-pocket to see your doctor or for a hospitalization because your FEHB plan provides “wraparound” coverage of Medicare.

But not all FEHB plans coordinate well with Medicare. Some FEHB plans state, “We do not waive any costs if Original Medicare is your primary payor.” In this scenario, you’ll still be on the hook for out-of-pocket charges when you see your doctor and having Part B would not reduce your costs. In fact, your healthcare costs would be higher because you’re paying a second premium and losing the ability as a retiree to pay your FEHB premium with pre-tax dollars.

If you’re happy with your FEHB plan and it doesn’t coordinate well with Medicare, enrolling in Part B will be of limited financial value for you. But a better decision will almost always be to change your FEHB plan to one that does coordinate better with Parts A & B.

To see how well your existing FEHB plan coordinates with Medicare, you can go to Section 9 of the official FEHB plan brochure where Medicare coordination benefits are discussed. Also, Checkbook’s Guide to Health Plans has a special Medicare area where each FEHB plan receives a cost reduction score on how well the plan reduces costs if you have Part B.

You Don’t Want Double Coverage

Your FEHB plan doesn’t get worse the day you retire. If you don’t want to pay two premiums—one for your FEHB plan and one for Part B—it’s perfectly reasonable to not enroll in Part B. Out-of-pocket costs for doctor visits and labs are already low under most FEHB plans. Additionally, Part A enrollment together with an FEHB plan covers all hospital charges regardless of whether you have Part B in almost all FEHB plans. That means lower costs in almost all cases for FEHB plans without Part B.

Also, in 2022, Part B premiums increased by an astonishing 14.5% compared to just a 2.4% average increase in FEHB plan premiums, the second lowest premium increase in the last 24 years. While no one can predict the future, the rapid increase in Part B premiums compared to FEHB premiums should be considered when deciding on Part B enrollment.

Reasons to Enroll in Medicare Part B

In 2020, a handful of FEHB carriers started offering new Medicare Advantage options to federal retirees. These plans require you to be enrolled in both an FEHB plan and Medicare Part B, offering the most compelling case to enroll in Part B we’ve ever seen.

Medicare Advantage Options

Medicare Advantage plans, or Part C, are offered by private insurers and are an alternative way to obtain Medicare. Medicare Advantage plans offered by certain FEHB carriers now have even better benefits and lower costs than any existing traditional FEHB and Medicare pairing.

Medicare Advantage plans offered by APWU, UnitedHealthcare, Humana, MHBP, Compass Rose, Rural Carrier, and Aetna charge $0 for any inpatient or outpatient benefit and have no out-of-pocket maximum for healthcare expenses other than prescription drugs. They promise you’ll pay nothing, subject, of course, to the usual restrictions on paying only for medically necessary care, besides prescription drugs.

Additionally, you’ll be able to see any doctor or provider, in- or out-of-network, if they accept Medicare. Most of the Medicare Advantage plans have some form of Part B premium reimbursement, including some Kaiser plan options that offer full reimbursement.

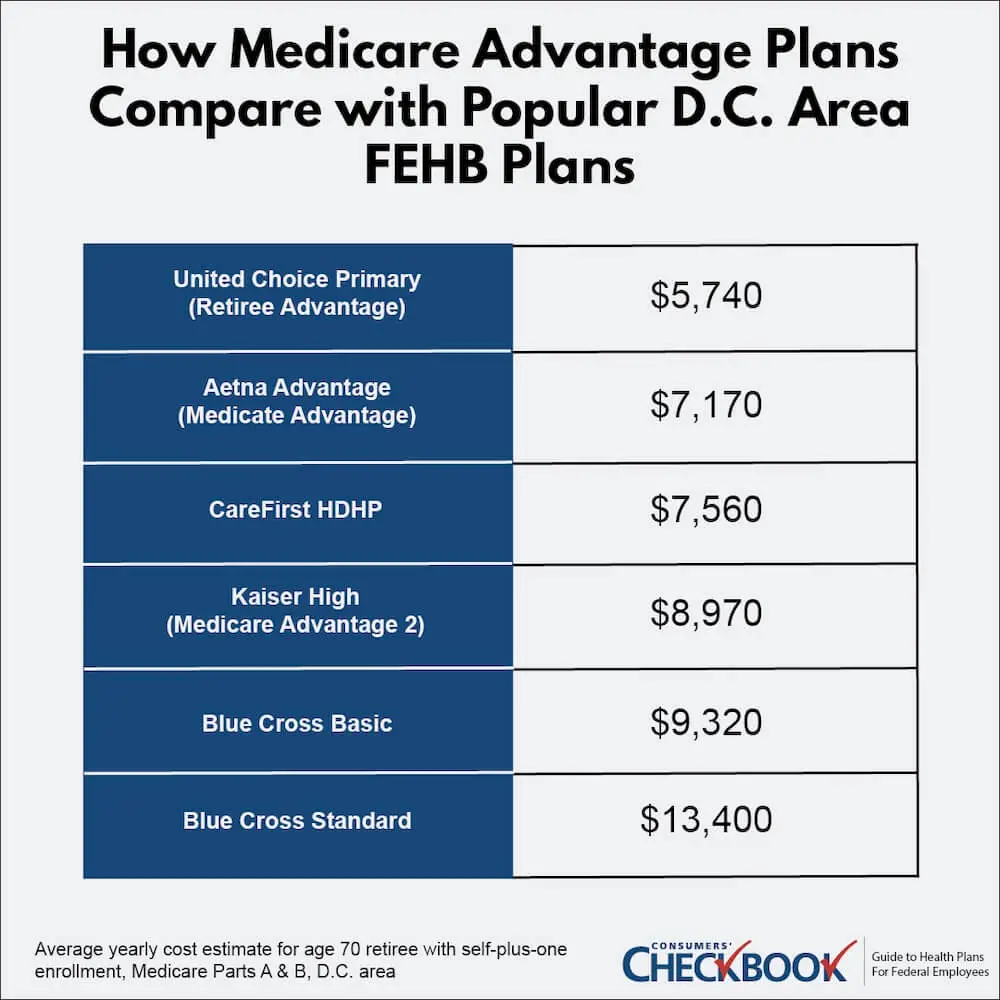

When we rank all plan options in Checkbook’s Guide to Health Plans for retirees on estimated yearly cost—the combination of premium plus expected out-of-pocket costs based on the profile of the user—we see dramatic cost savings from these Medicare Advantage plan offerings.

For example, a retiree who is 70 years old and living in the D.C. area with self-plus-one enrollment and Medicare Parts A & B with income below $182,000 can enroll in United Choice Primary Retiree Advantage and save about $1,800 in estimated yearly costs compared to the least expensive FEHB plan with Parts A & B, CareFirst HDHP.

Even greater savings are achieved if you switch to the United Medicare Advantage plan from one of the popular BCBS plans. If you enroll in the United Medicare Advantage plan, you’ll save about $3,500 compared to BCBS Basic, and you’ll save about $7,600 compared to BCBS Standard in estimated yearly costs.

To join one of these Medicare Advantage plans you must be enrolled in Part B. Even if you don’t want to enroll in one of these plans now, having Part B preserves your future right to receive these large savings, without a late enrollment penalty. Under these plans you’ll enroll in both the FEHB plan and Part B. As a result, if you have a spouse who is not age 65 and eligible for Medicare, or a child, that spouse or child will be covered by your self plus one or family enrollment in the FEHB plan, while you are covered by the Medicare Advantage plan.

If you’re subject to IRMAA, but only fall into the first tier—income above $91,000 and below $114,000 for an individual and above $182,000 and below $228,000 for a couple—the Medicare Advantage plans will not be the least costly plan choice available to you. You’ll find a handful of FEHB plans paired with Medicare Part A as the lowest yearly cost options available. However, you’ll find the United Choice options still rank well and should be considered along with your decision about whether to enroll in Part B.

The availability of the Medicare Advantage plan options varies based on where you live. Some of the plans are national—Aetna Advantage, APWU High, MHBP Standard with open enrollment and Rural Carrier and Compass Rose with restricted enrollment. The other Medicare Advantage plan options are regional—Humana Value, Kaiser, and United Choice.

You will not find these Medicare Advantage plans in the main sections of the FEHB plan brochure. Instead, if available, they are all described in Section 9 of the FEHB brochure and usually have names like “Senior Advantage” or “Retiree Advantage”.

To enroll, you must complete three steps:

- Be enrolled in Medicare Part B.

- Enroll in the FEHB plan that corresponds to the Medicare Advantage plan you want to join.

- Call the Medicare Advantage insurance carrier to enroll in the Medicare Advantage plan.

Your Existing FEHB Plan Has Good Medicare Coordination

Many FEHB plans will wraparound Medicare and pay your deductible and doctor and hospital co-pays if you have Medicare Parts A & B. As a result, you’ll have close to 100% coverage of almost all medical expenses, with the big exception of prescription drugs and a few other services such as acupuncture or chiropractor visits.

A few FEHB plans now offer partial Part B premium reimbursement, including two national plans—BCBS Basic and GEHA High. Of course, if you’re enrolled in a consumer-driven health plan (CDHP) or high-deductible health plan (HDHP) you can use the health reimbursement account (HRA) or the health savings account (HSA) to pay for Part B premiums.

If you decide to enroll in Part B, make sure you enroll in a plan that has wraparound benefits, which will greatly reduce your out-of-pocket expenses and helps offset the expense of paying a second premium.

You Want Greater Access to Providers

If you join Part B, you can use the Part B benefit to go outside the doctor network of your FEHB plan. You’ll have to pay the $233 Part B deductible and 20 percent of the Medicare-approved amount for the service, but when the doctor participates in Medicare the 20% is based on the Medicare payment rate, which is lower than most in-network FEHB rates.

If you’re in an FEHB plan that doesn’t have out-of-network provider benefits, such as BCBS Basic, joining Part B gives you access to more providers.

The Final Word

Most federal retirees will benefit by enrolling in Part B, but there are scenarios where joining Part B will not be the best choice. If you must pay IRMAA premiums and your income will remain the same throughout retirement or if you’re in an FEHB plan with no Medicare coordination, your best choice might be not enrolling in Part B.

For those that enroll in Part B, you should without fail consider the new Medicare Advantage plans. Most of them offer the lowest estimated yearly costs of any plan options available to you.