It’s a question many federal employees are asking right now: Should I invest in gold—and why has it gone up so much lately?

With gold making headlines and prices moving sharply higher, it’s natural to wonder whether it belongs in your retirement strategy—especially when most long-term savings are concentrated inside the Thrift Savings Plan (TSP).

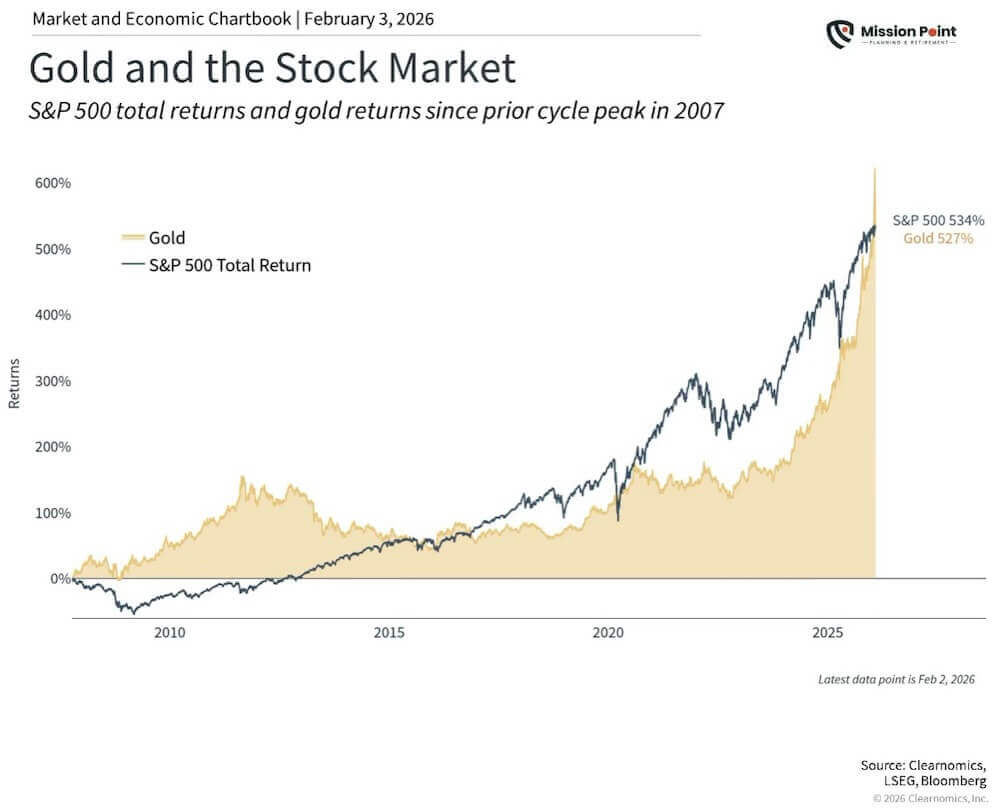

Let’s walk through what’s driving gold, what the chart above is really telling us, and how this ties back to diversification for federal employees.

Why Gold Has Been in the Headlines

Gold’s recent run isn’t random. Several forces have converged at the same time:

- Large and growing government deficits

- Heavy government spending

- Ongoing uncertainty around inflation and long-term dollar value

When confidence in fiscal discipline or currency stability weakens, gold often attracts attention as a potential hedge. Earlier this year, prices surged above $4,300 per ounce before pulling back—an important reminder that gold can be volatile, even when the long-term story feels compelling.

What Central Banks and Policy Uncertainty Have to Do With It

Another major driver has been global central bank demand. Many countries have been increasing their gold reserves amid geopolitical uncertainty and concerns about currency stability. That institutional buying has helped support prices.

At the same time, uncertainty around future monetary policy—particularly as leadership changes approach at the Federal Reserve—has added to market unease. When policy direction feels less predictable, gold often moves back into focus.

What This Chart Is Telling Us

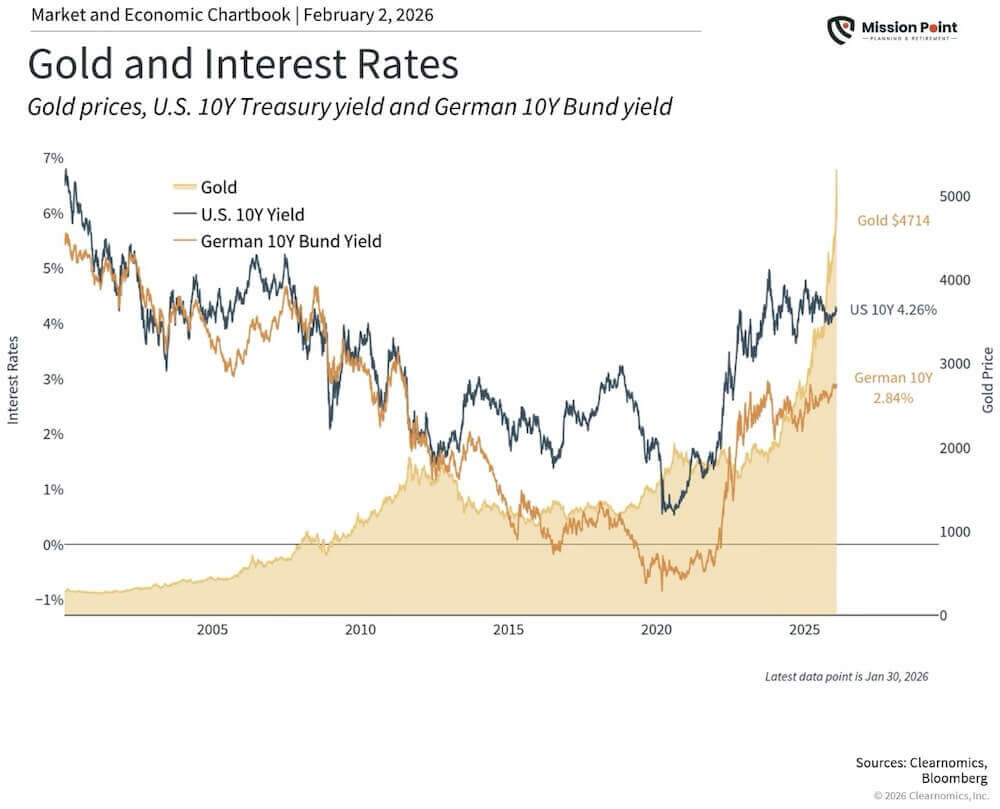

The chart below shows gold prices alongside interest rates—specifically the U.S. 10-year Treasury and the German 10-year bond—over time.

Historically, gold and interest rates tend to move in opposite directions. When rates rise, gold often struggles. When rates fall—or when there’s uncertainty about where rates are headed—gold can benefit.

What’s unusual today is that gold has risen sharply even while interest rates remain relatively high. That tells us this move isn’t just about rates. It reflects broader concerns about fiscal policy, global stability, and long-term confidence in currencies.

In other words, investors aren’t buying gold because they expect rates to collapse tomorrow. They’re buying it because they’re looking for diversification during a period of heightened uncertainty. That dynamic helps explain both gold’s strength and its volatility.

Where the TSP Fits In (and Where It Doesn’t)

The TSP is an excellent retirement vehicle—low cost, efficient, and simple. But it’s also limited by design.

The core TSP funds (G, F, C, S, and I) do not include direct exposure to real assets like gold. That means federal employees who rely exclusively on the TSP may be heavily concentrated in traditional stocks and bonds.

For some investors, that raises a reasonable diversification question—especially during periods of policy uncertainty like the one we’re in now.

Using the Mutual Fund Window or Outside Accounts for Diversification

For federal employees looking to expand diversification beyond the core TSP funds, there are a couple of common paths.

The TSP Mutual Fund Window provides access to a much broader range of investments, including funds that offer exposure to gold and other real assets.

It’s true that when compared to the near-zero cost of the TSP’s core holdings, the fees associated with the Mutual Fund Window can make even cost-conscious Feds cringe. That reaction is understandable.

However, for larger TSP balances—often north of $500,000—the ability to add meaningful diversification through the Mutual Fund Window may provide value that outweighs the additional costs. At that level, diversification benefits can matter more than shaving every last penny point off fees.

Another option, when eligible, is using an outside IRA to access asset classes not available inside the TSP.

In either case, the goal isn’t to replace the TSP. It’s to thoughtfully complement it.

Closing Thoughts

Gold can be a tool—but only when it’s used in context.

For federal employees, the real question isn’t whether gold is “hot.” It’s whether your overall retirement structure—your pension, TSP, and any outside accounts—is properly balanced and diversified.

Successful retirement planning isn’t about reacting to the news cycle. It’s about building a strategy designed to work across many different market conditions—because that’s what leads to long-term confidence and sustainable income.

Securities and advisory services offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.

The opinions and forecasts expressed are those of the author and may not actually come to pass. This information is subject to change at any time, based on market and other conditions and should not be construed as a recommendation for any specific security or investment plan. Past performance does not guarantee future results.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Asset allocation does not ensure a profit or protect against a loss. All indices are unmanaged and may not be invested in directly.