A few days ago, we ran an article entitled Day Traders Taking Bite from TSP Returns. Articles on the Thrift Savings Plan are always popular and we knew this one would generate some interest from readers.

Based on comments from readers and survey results from previous articles on our site, I knew that some people liked to try and maximize their returns by frequently trading in their TSP accounts and I assumed that this was a small number of readers. Also, we ran a survey a couple of months ago on the reaction of readers to the possibility of imposing a fee on TSP trades and most readers were against it.

While we had reported and run a survey on the possibility of the TSP starting to place restrictions or fees on frequent traders, many readers apparently did not take it as a serious possibility or see it as an action that would have an impact on them. And, in reality, the decision to start imposing trading restrictions probably will not have a significant impact on most readers who do not engage in frequent trading of their accounts.

The surprise in the mix was the reaction to the most recent articles on our site about the trading restrictions. The article on Market Timing and Your TSP generated 95 comments that were approved and the initial article on the trading restrictions generated about 165 comments. While we normally have articles being read by thousands of people, it is unusual for that many people to want to submit comments. We can apparently assume that when it comes to retirement and money, people are going to take a personal interest in the subject.

With this many comments, several commonalities began to emerge. Some readers are incensed at the thought of restrictions being placed on their ability to frequently trade TSP funds. Among this group of readers, the comments often focus on their belief that balancing the lifecycle funds in the TSP costs more money than the administrative costs generated by about 3000 frequent traders. For some reason, this line of thought was particularly attractive to some in the fields of engineering and information technology. For example:

A statistician from DoD wrote:

"What a stupit (sic) closing !…While a more restrictive policy will not benefit some participants, it is likely to produce better returns for the majority of TSP participants who do not trade on a regular basis. " Do you realize the half million participants on all the five L – Funds are the ones causing the increase on the fund management cost ?"

A NASA engineer stated:

"Others are correct in stating that the Lifecycle funds rebalance each day. Should everyone who is invested in these funds also be charged a separate fee, as they no doubt cost the TSP program more than just buy-and-hold investing in the individual funds? If fees are to be charged for individuals choosing to move their money around between the funds, then so should those participating in the Lifecycle funds."

A systems analyst from DoD weighed in with this:

"…There ARE DAILY rebalancing actions that take place within the L funds. THIS IS THE SAME AS DAILY TRADING or FUND MOVEMENT! That daily trading is more expensive than those 3000 in which TSP, a lot of ignorant/jealous people blogging here, and Mr. Smith are attacking.

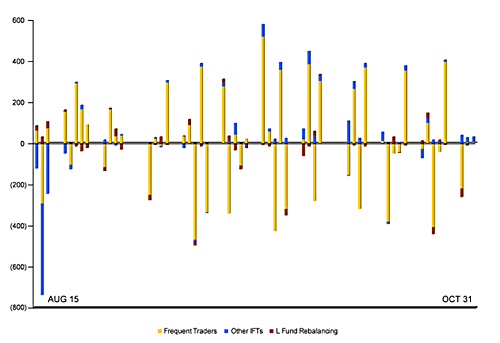

So, to either quell the emotional storm or perhaps to stock the fires of indignation, we thought the TSP folks could throw out a few facts to shed some light on the subject. Here is a chart provided by the Thrift Savings Plan that shows the impact of daily trading on the I fund. The lines in red indicate the impact of L fund rebalancing on the daily trading activity; the yellow indicates the amount of trades from the market timers.

Again, according to the figures from the TSP, the average daily trading activity in the I fund in September and October 2007 was $224 million. Rebalancing the Lifecycle funds amounted to $16 million. Frequent traders accounted for $142 million.

The biggest impact of the frequent trades in the I fund is the market impact. And, while some of these frequent traders fervently insist they are making more money that those who are not smart enough to realize the benefits of predicting the future of the stock market, the rest of the 3.8 million TSP investors are footing the bill for the trades.

To meet the requirements of the several thousand people who are frequently buying and selling their shares in the I fund, the TSP has to keep money available. In plain English, this means that the millions of dollars required on a given day with a rapidly changing market are kept in reserve. That means that, because of the frequent trading activity, the vast majority of TSP investors are getting a smaller return because less money is invested on their behalf.

Moreover, the costs to the TSP do not stop there. If there is a lot of selling of the I fund on a given day (as there was in September and October) the TSP does not always get the money from the sale of the funds right away. It may take as much as three days for the funds to be received. This costs all investors money as the interest on this money is lost to meet the requirements of the frequent traders.

The reality is that charging a fee for these various expenses would require a fee much larger than most would be willing to pay–even if it were possible to design a program that could capture the true cost of the trading. The market impact of the trading varies from day to day and the time it takes to recapture the money of the sold shares also varies.

The reality is this: Frequent trading in the TSP funds is costing significant amounts of money and the cost is being paid by all TSP investors by reducing the overall return of the TSP funds. From reading numerous comments on the articles we have recently published, those who like to spend the time and effort to trade daily, weekly or at least frequently are unlikely to be satisfied with the decision to implement trading restrictions. The vast majority of TSP investors may not have a strong opinion as the cost to them are largely hidden in the form of lower returns and not as a direct cost that shows up on a financial statement.

Some readers have, along with their lively comments about the decision on trading restrictions, stated or implied that the articles I have written on this topic reflect a hidden agenda or a conspiracy out of which various people may realize a financial gain. For the record, I do not own any shares in any TSP fund and the information provided by the TSP for these articles is information that is publicly available. Here is the TSP report on the impact of frequent trading. To my knowledge, the only people likely to benefit from the trading restrictions are the TSP investors who may realize a slightly higher return on their retirement investments through the benefit of lower administrative and trading costs. Those that will lose are those convinced they have made and would continue to make large profits from implementing their financial expertise by timing the stock market with their TSP funds.

The arguments in the article are mine. Feel free to ignore them, comment on them or use them as you see fit. It is your retirement and each individual is the one who who will benefit or suffer from your personal investment decisions.