Whether you are watching television, reading the paper, surfing the internet or standing by the water cooler, chances are you are hearing that taxes are likely to increase in order to pay down our federal deficit, as well as fund our various commitments and entitlement programs. All levels of government are experiencing the same crisis – lower tax receipts and higher levels of claims for service (unemployment, Medicaid, etc.).

These problems are expected to get worse, indeed much worse, over the next two years. This means that we should be bracing for continued low consumer spending, which means that sales tax will continue to disappoint. When you kick in shrinking property values and their effect on property taxes, you get the picture of government entities in a world of hurt.

So if the deficit could be closed by increasing taxes, how much of an increase would be necessary? A couple of weeks ago, the Tax Foundation (

www.taxfoundation.org) came out with a great article on where income tax rates would need to be in order to eliminate the federal deficit. This article clearly illustrates the degree to which our government is spending money compared to what it is bringing in.

Based on their analysis along with that of the IRS, here is what your new tax rate would be in order to pay off the Federal Deficit:

Current Tax Rate New Rate Required

10% 24.3%

15% 36.4%

25% 60.6%

28% 67.9%

33% 80.0%

35% 84.9%

Could you imagine the impact it would have on your life if you had to pay tax based on the rates required to pay off the deficit. Even worse, could you imagine if you were in retirement and you were trying to fund your retirement income with your pension, social security and TSP, all of which are taxable, and had to pay taxes based on these assumed rates? Ouch!

It is no surprise the government needs tax revenue to remain operational. During a strong economy they can keep tax rates low due to the revenue that’s coming in. However, the reverse has also held true during lagging economies where the government has needed to increase taxes to increase their revenue.

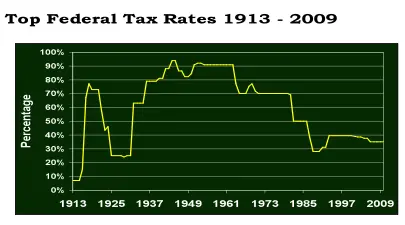

The chart below was designed by the H.S. Dent Foundation, which illustrates what our nation’s top tax rates have been from 1913 through 2009.

If you are familiar with our nation’s economic history, you will see that during difficult economic times, maximum tax rates have been very high, such as during the early 40’s through the early 60’s, when they regularly exceeded 90%. Today we are at historical low tax rates and yet are experiencing difficult economic times and an astounding federal deficit.

Now it is doubtful that our elected officials are going to increase taxes to the levels that would be required to pay off the deficit. They would lose the next election so fast that their heads would spin. But it is very likely that they will raise tax rates to some degree. In fact, unless Congress acts to extend the Bush tax cuts, we will revert back to the rates we had prior to these cuts. Here is the breakdown of what the tax rates will be if the Bush tax cuts expire:

Current 2010 Tax Rate: 2011 Tax Rate if Bush Tax Cuts Expire:

10% 15%

15% 28%

25% 31%

28% 36%

33% & 35% 39.6%

There are strategies that can be put into place to protect some of your assets from future taxes. One is the Roth IRA, which in my opinion is one of the best tax breaks ever. Beginning in 2010, a new era for Roth IRAs began, allowing anyone with a traditional IRA to have a Roth IRA, by way of Roth conversions. In addition, there are special tax treatments if you convert in 2010, which allow you to spread the tax over 2011 and 2012.

The Roth IRA is just one of the many strategies you should become aware of. We have included this and other tax protection options in our recently released white paper: "Tax Reduction Strategies for 2010 and Beyond". If you would like to have a copy of this white paper, email

nmeglino@franklinplanning.com .

© 2024 Carol Schmidlin. All rights reserved. This article

may not be reproduced without express written consent from Carol Schmidlin.