Our nation’s deficit is finally becoming a concern to the powers that be and the taxpayer gets to bear the costs.

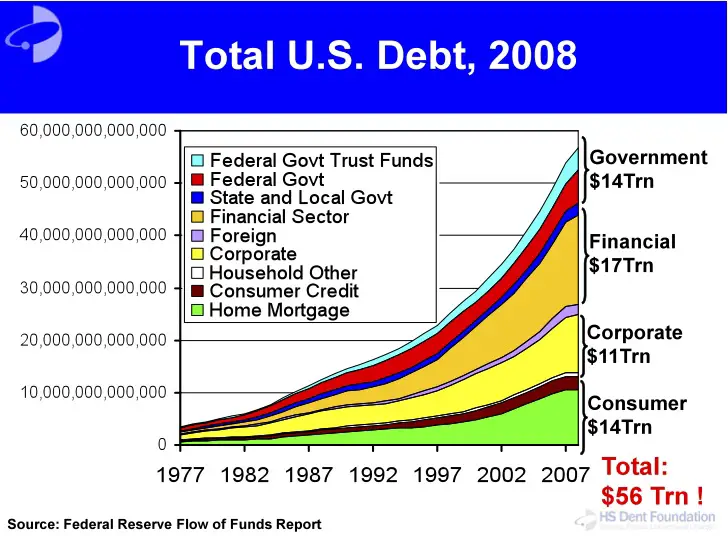

First, let’s visit how much of a debt crisis we actually have. Over the past ten years the federal debt has mushroomed from $5 trillion to well over $13 trillion, and is forecasted to reach $20 trillion in this decade. But wait, it gets worse…private debt (consumer, financial, corporate) has swelled to $42 trillion!

Combining government and private debt brings the grand total to $56 trillion as can be seen in the chart below, compiled from the HS Dent Foundation.

Add our unfunded liabilities for Social Security and healthcare and our total debt balloons to $102 trillion, or seven times the value of everything we make in the US in a year (715% of GDP)!

Let’s look at the provisions in the National Health Care Reform Bill that could increase your tax bill.

- Additional Medicare Payroll Tax on High-Income Taxpayers. Currently, an employee pays 1.45% of wages for Part A, Medicare hospital insurance. Beginning 2013 individuals with incomes above certain thresholds will pay an additional tax of .9% for Medicare Part A. This tax of 2.35% will be imposed on wages that exceed $250,000 for married individuals filing jointly and $200,000 for single filers. Alone, the average federal employee will probably not have to pay this tax, however, keep in mind that the income determining these thresholds for the additional Medicare tax for married federal employees with both spouses working may very well exceed the $250,000 threshold.

- Reduced Benefits from Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA). Beginning 2011 employees will no longer get reimbursed for over-the-counter (OTC) drugs. These plans will only reimburse employees for prescription drugs and insulin. Currently, individuals can contribute $5,000 a year of pre-tax dollars into a FSA. Effective January 1, 2013, these contributions will be limited to $2,500 per year. Also, effective in 2011, an additional 20% tax (currently 10%) will be imposed on employees under the age of 65 that take a distribution from their HSA, that is considered nonqualified. Beginning 2011 OTC drugs will fall into this nonqualified category!

- Medicare Tax on “Unearned Income” on High-Income Taxpayers. Beginning 2013, an additional 3.8% tax will be imposed on investment income, for individuals that exceed the thresholds: $250,000 for married individuals filing jointly and $200,000 for any other taxpayer. The 3.8% tax on unearned income will be imposed on the lesser of net investment income or the excess of modified adjusted income (MAGI) over the threshold amounts. Unearned income includes income from interest and dividends outside a qualified retirement plan, rental income, gains from the sale of certain properties, and income from a business. There is a real need to shelter non-qualified assets, if you are near the income thresholds. Not only could you be forced to pay an additional tax on your nonqualified investment income but should the Bush tax cuts expire, like they are scheduled to in 2011, you could be paying tax on dividends of 43% (39.6% top tax rate plus 3.8%).

- Itemized Deductions for Medical Expenses increasing to 10 Percent of AGI. Beginning in 2013 the threshold for unreimbursed medical expenses will go to 10% (currently 7.5%). This means that you cannot deduct unreimbursed medical expense unless they exceed 10% of your AGI. For individuals that have high health care costs, this will put an additional strain on their income.

Now, let’s take a look at the consequences of the sunset provision of the Bush tax cuts, which are scheduled to expire December 31, 2010.

While there has been talk of extending these cuts, in my opinion, this seems to be a long shot based on the state of our economy. No one likes paying taxes, but if these cuts do expire as scheduled, there will no longer be a 10% tax bracket. The lowest bracket for personal income tax will be increased by 50% to 15% (from 10%). For many people that are in the 15% bracket, they will face the largest percentage increase and will be looking at a 28% tax rate. The highest tax bracket will be 39.6%, but for many individuals they could face an additional 3.8% Medicare tax on unearned income beginning in 2013.

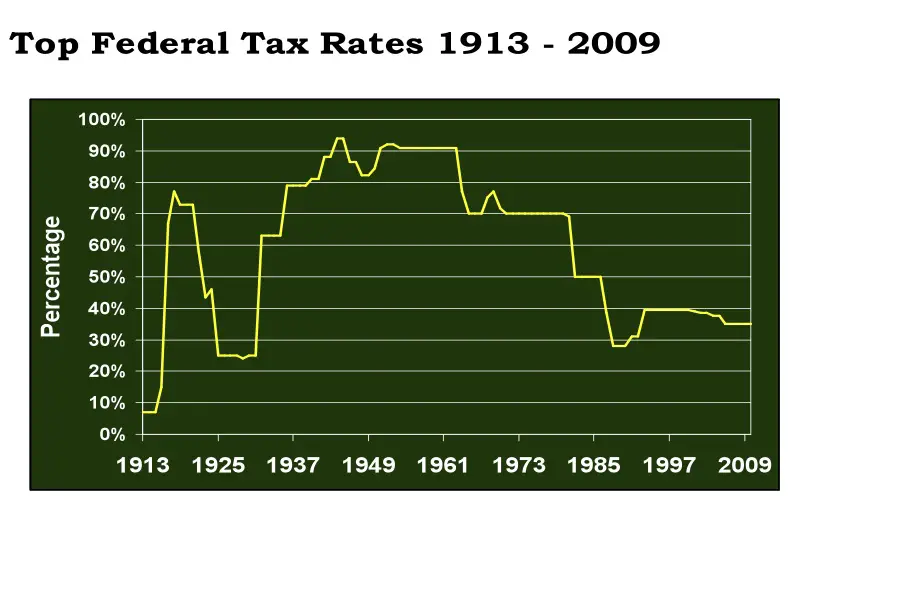

The chart below, courtesy of the H.S. Dent Foundation, illustrates what our nation’s top tax rates have been from 1913 through 2009. Notice that during difficult economic times, tax rates have been very high, in the 60’s as high as 91%. Where do you think tax rates need to go to reduce the deficits mentioned earlier?

Many investors have fared well from their dividend paying stocks and mutual funds. But is this really a wise investment in the future where one may be paying taxes on these dividends at a rate of 43%? Currently, qualified dividends and long term capital gains are taxed at a maximum of 15%. However, if the Bush tax cuts expire, dividends will go back to being taxed at a much higher ordinary income tax.

How may this affect the average federal employee? Let’s use an example: Joe Smith is an engineer for the Environmental Protection Agency. His wife, Mary is a high school English teacher. Joe’s salary is $125,000 and Mary’s salary is $75,000. Joe contributes $16,500 per year to his TSP, and at present Mary is contributing $5,000 per year to her Roth IRA. There taxable income is roughly $164,000. In 2010 their marginal tax rate is 28%. In just a few more months, this could dramatically increase to a 36% rate.

In addition, Joe and Mary will be losing some benefits of Joe’s FSA. Beginning in 2011 they will no longer be able to utilize this account to purchase Mary’s OTC allergy medicine on a pre-tax basis. Also, beginning January 1, 2013, Joe will only be able to contribute $2,500 to his FSA, (he currently funds this account with $5,000 a year).

Where will taxes be when Joe and Mary retire?

Keep in mind that the distribution of Joe’s retirement funds: FERS annuity, TSP distributions, and Social Security, will be subject to income taxes. The only retirement asset that is sheltered from taxes is Mary’s Roth IRA.

There is a lot of uncertainty on whether or not the Bush tax cuts will fully or partially expire.

The one side of the coin is that the economy is on uncertain footing as we try to recover and not go into a double dip recession. What would be the impact on United States citizens if tax rates rise next year during the housing and unemployment crisis? Flip the coin, and we are looking at the largest amount of debt our nation has ever seen. While I’m sure we all agree that we have a fiscal responsibility to make our country better for our children and our grandchildren, we can only hope the outcome will set us on the course to renewed prosperity.