TSP investments made by federal employees rise and fall in popularity over time.

The Thrift Savings Plan (TSP) returns through October were very good. The C fund, for example, was up 9.84% for the year through the end of October. (See It’s Good to be a Federal Employee: Investing Advantages as Stocks Rise)

Bailing Out of the C Fund and Into the G Fund

Perhaps many TSP investors thought that these returns were too good to last. Maybe they thought the election of Donald Trump as the next president would be bad for the stock market. They could have been skittish about the returns of the stock market for the rest of the year with the Dow Jones Industrial Average crossing the 19,000 mark for the first time. Some investors were retiring and wanted to put their money into the G fund instead of stock funds seeking the safety of a special bond fund. That fund does not make much for investors but it is a very safe investment.

But, for a number of possible reasons, some TSP investors decided to bail on stocks in November.

Almost $2.2 billion was moved into the G fund in November. More than $1 billion was transferred out of the C fund. $551 million left the F fund; $370 million was transferred from the I fund and $293 million was transferred from the life cycle funds. $84 million was moved into the S fund.

The F fund was down more than 2% in October. The S fund was up almost 8% and this fund is up more than 14% for the year.

As of the end of October, the S fund was the best performing fund so far in 2016. While chasing returns by timing the market is often a losing investment philosophy, short term TSP results could be part of the reason some TSP investors are putting a little more money into the S fund and moving out of the F fund.

Note that the transfers are a very small percentage of total TSP assets. Most TSP assets remained in existing investments.

Total TSP assets were more than $490 billion at the end of November, and there are over 5 million TSP participants.

Stock Returns in November

The final returns for all of the TSP funds for the year will be available early in January.

The Dow Jones Industrial Average is very close to crossing the 20,000 threshold for the firs time. The S&P 500 (the index on which the C fund is based), is up more than 3% over the last month. It will likely return more than 10% in 2016.

The S fund is up more than 9% for the month. The G fund is up for the year, as always, and will probably provide a yearly return of about 1.7%.

How TSP Investments Changed

The percentage of assets invested in individual TSP funds has changed. Investors tend to get more conservative as they get closer to retirement. Investors invest more in TSP stock funds and less in the G fund if they are more optimistic about how the stock market will perform.

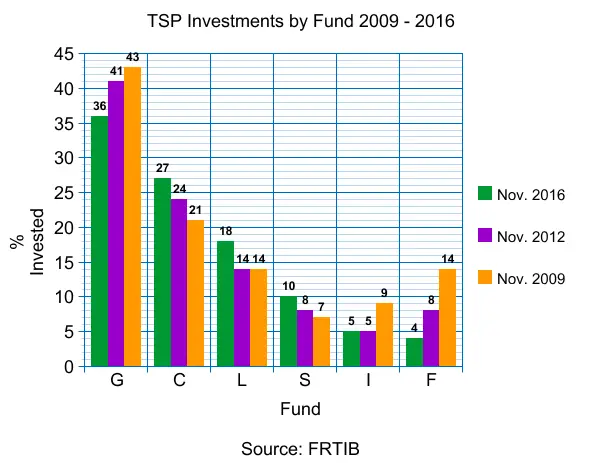

Here is how TSP investors have elected to invest their money as of the end of November in 2009, 2012 and 2016.

The G Fund has been the most popular fund in each of these three years. The stock market declined dramatically in 2008. Near the end of 2009, investors had the 2008 results in mind and 43% of their funds were in the G fund. In 2009, 21% of assets were in the C Fund which went up almost 27%.

As investors gained confidence, C fund investments went up and G fund investments went down. This chart compares each of the funds as of November 2009, November 2012 and November 2016.

Average FERS TSP Balance Up $31,748 in Five Years

The average balance in TSP investment accounts has gone up over the last several years. Below is a comparison of the average TSP balance by retirement plan. The average TSP balance for FERS employees jumped by $31,748 over a five year period. The average TSP balance for CSRS employees jumped up by $35,808 during this same time period.

Here is a comparison of the average balances as of November 2016, November 2015 and November 2012.

| Retirement Plan | Avg. 2016 TSP Balance | Avg. 2015 TSP Balance | Avg. 2012 TSP Balance |

|---|---|---|---|

| FERS | $121,059 | $116,921 | $89,311 |

| CSRS | $125,647 | $118,935 | $89,839 |

Congratulations to those TSP investors who are continuing to invest and to make their retirement assets continue to grow over time