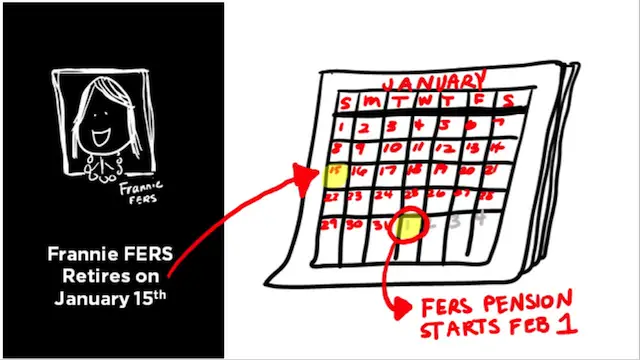

Before you pick your retirement date, you need to know the answer to this question: When does your FERS pension start?

The technical answer is the first day of the following month after you retire.

It gets easier if we use a picture. Let’s pretend that Frannie FERS retires on January 15th. Her pension doesn’t start until February 1st. This could leave Frannie in a bit of a “pickle” because she won’t be getting any pension until the next month.

ime lump sum payment. Pretty cool benefit, right!

But if you’re in a “use or lose” scenario with Annual Leave and want leave paid out at retirement, then you’ll NEED to retire BY that Leave Ending Date that year. Otherwise, you’ll miss out on that “use or lose” leave!

But isn’t it the same every year?

Here’s the challenge: The Leave Ending Date changes every year, so this can be tricky. Check OPM’s Leave Ending Dates so that you can avoid this potentially costly mistake.

Mistake No 2: Paying More Income Taxes Unexpectedly

If you have a lot of Annual Leave saved up when you retire, you’re likely to get a pretty big check—BUT IT’S TAXABLE! This income is going to be added to all your other earnings that year.

Let’s just pretend that Sam Sample retired on October 31st, and he’s earned most of his regular income having worked for most of the year. Now, Sam gets this big Annual Leave payment and it puts him into a higher tax bracket. He could have to unexpectedly pay more income taxes the following April.

“What happened last year? Why didn’t you call me?”

Talk with your tax professional. Ask if it might be better to pick a retirement date on the last day of the year or within the first few months of the year when your work earnings will be less so that your Annual Leave payment may be taxed at a lower rate.

Tax planning and retirement go hand-in-hand! (Unless you like tax surprises, which most of us prefer to avoid like the plague.)

Mistake No 3: Losing TSP Monies to Penalties

A lot of people plan to use money from their TSP when they retire. But they aren’t too clear about age restrictions before they pick their retirement date.

Normally, you must be at least 59 ½ year old to take monies out of your retirement savings account (like TSP or IRA). If you’re younger than that, you could have to pay something called an early age withdrawal penalty, plus normal income taxes. This can get expensive.

BUT there’s an exception for your TSP. If you retire or separate from service in the year in which you turn 55 years or older, you can take withdrawals from TSP without any early age penalty! It’s called a waiver.

Don’t be in such a hurry

But here’s a mistake that some people make. Let’s say Frannie Fers retires at 57. She’s decided to transfer her TSP to an IRA right away, but she doesn’t know about the early-age withdrawal waiver inside of TSP. BOOM! Once she transfers her TSP to an IRA, she’s lost the waiver, and any withdrawals under age 59 ½ may be subject to early age withdrawal penalties (until she reaches 59 ½).

The Moral of the Story: If you’re retiring under age 59 ½, you should strongly consider leaving your funds at TSP because of the early age withdrawal wavier.

Mistake No 4: Thinking that FERS starts Right Away

It’s true that your FERS pension begins the first day of the month after you retire, BUT that doesn’t mean you’ll immediately start receiving payments that fast!

Be prepared to wait because OPM’s retirement application processing time can vary quite a bit.

It can be a big mistake to retire without enough savings to take care of expenses—and money can get very tight fast. Even TSP can take 4 – 6 weeks after you retire before you can request payments. It makes good financial sense to start retirement with at least 4 – 6 months of expenses in a savings account.

Before you get dressed for the party

Make sure that you know how to pick your retirement date like a pro—before you get ready for your retirement party!

- If you’ll have “use or lose” leave, check the leave end calendar so that you don’t risk losing that extra leave.

- Talk with your tax professional about how the extra income from the Annual Leave payment may impact your tax planning.

- Map out how you’ll access your TSP monies.

- And finally, have enough saved to wait while your retirement application is “in line” at OPM.

Be sure to get your free companion checklist, Pick Your Retirement Date Like a Pro, to help plan your retirement.