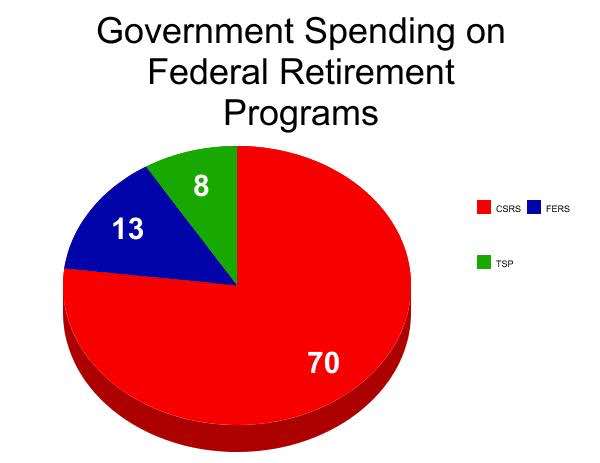

In 2016, Uncle Sam spent $91 billion on retirement benefits for civilian employees. Here is the breakdown:

- $70 billion for CSRS pensions for civilian retirees and their survivors;

- $13 billion for FERS pensions for civilian retirees and their survivors;

- $8 billion for contributions to TSP.

Those expenditures were partially offset by $3 billion in revenues from employees’ contributions to the CSRS and FERS pension plans.

The $91 billion expense is a big target with potential for reducing federal spending. With a national debt now standing at about $20 trillion and continuing to rise, the House Oversight and Government Reform Committee requested the Congressional Budget Office (CBO) to consider potential savings to the government by changing the federal retirement system.

Under the way the retirement systems are currently structured, the government’s net cash expenses for federal civilian retirement systems are projected to grow by an average of about 2.8 percent annually between 2018 and 2027.

Retirement System Options for FERS

The Civil Service Retirement System (CSRS) is phasing out. It has been closed to new participants since 1983. The Federal Employees Retirement System (FERS) is the newer system and the one in which current federal workers participate.

As no new employees are entering the CSRS system and it has been closed since 1983, the expense of the FERS system and changes made to it will have an impact on future federal expenses. Expenses for the CSRS system will gradually be phased out as those receiving CSRS pensions will die and no new pensioners under this system are entering the system. Most of the CSRS expenses will be gone by 2050 and completely phased out around 2060 according to projections by the Congressional Budget Office.

This new report from the CBO concerns the FERS system. To examine how changing FERS would affect federal government spending in the long term, CBO assessed options for changes to the FERS system.

Options for Changing FERS System

Option 1

Option 1 would modify the FERS pension plan by changing employees’ contributions to the plan. This option would increase the FERS contribution rate to 4.4 percent for current employees (from 0.8 percent for employees hired before 2013 and from 3.1 percent for employees hired in 2013).

Option 2

Option 2 would decrease the pension contributions for some employees with larger contributions from the government to employees’ TSP accounts.

The CBO describes this option as a change that would be similar to shifts over recent decades from defined benefit to defined contribution retirement plans in many private-sector companies and some state governments. This option would decrease the FERS contribution rate to 0.8 percent for all employees (from 4.4 percent for employees hired after 2013 and from 3.1 percent for employees hired in 2013).

While this option may help in recruiting new federal employees or retaining current employees, it would increase the federal government’s net retirement costs by 10 percent on a cash basis over the next 10 years.

Option 3

Option 3 would change the current pension formula from calculations based on an employees “high 3” years of highest income to a “high 5” years of highest income. In effect, Option 3 would decrease FERS pensions by basing the retirement benefit on the five years of highest salary (instead of three years of highest salary).

This option would decrease the government’s cost by 1 percent over the next ten years on a cash basis but actual savings closer to 4 percent in accrual cost calculating the cost for workers with no prior federal service who are projected to join the federal workforce in 2018.

Options for Eliminating FERS Pension for New Employees

The following two options would eliminate the FERS pension for new employees. Instead, the pension would be replaced with larger TSP contributions.

On a cash basis, these options would impose costs to the federal government in the near term because they would require larger outlays at the time the benefit is earned. The cost to the government would be lower in the future when employees retire and rely on their their Thrift Savings Plan for their retirement income.

Option 4

Option 4 would eliminate the FERS pension, increase the government’s automatic TSP contribution to 8 percent of salary, and require the government to match employees’ contributions up to an additional 7 percent.

Option 5

Option 5 would eliminate the FERS pension, increase the government’s automatic TSP contribution to 10 percent of salary, and eliminate the government’s matching contribution. This option would potentially have the biggest long term savings for the federal government. The percentage change in accrual cost would be about 29 percent according to the CBO.

Summary

Many readers will read the options outlined in the CBO report and will ask themselves if they should retire now.

Probably not, unless retiring in the near future is in your best interest for reasons other than speculation about what action Congress may take on federal retirement benefits. Most of the proposals would have a greater impact new employees rather than those already employed.

There is no guarantee that any of these changes will be adopted in Congress. It is not clear that Congress is interested in cutting the federal deficit. That could change, but changes to the federal retirement program are always speculative. Federal employees have considerable influence on legislation that is passed and various groups will be working with Congress to adopt changes that are less drastic than proposals that would have the biggest impact on federal expenses.

Employees who are just starting a federal career or who are roughly in the middle of a federal career will want to pay close attention to proposed changes to the federal retirement system. For some readers, a proposal to eliminate the defined benefit pension but receive a significantly higher contribution to the Thrift Savings Plan could be beneficial and enable them to receive a higher future retirement income. When FERS went into effect, employees under the CSRS system were given an option of moving to FERS. That could happen with changes to the current FERS system as well.

In short, don’t panic at new proposals or options for changes to federal retirement. Any changes will not happen quickly, if they happen at all. There is likely to be time to make decisions about your future retirement when the legislative forecast becomes clearer.