Health insurance is regarded as an important benefit to most workers. According to the Kaiser Family Foundation (KFF)/Health Research & Educational Trust (HRET) 2017 Employer Health Benefits Survey, about 53% of firms offer health insurance to their workers with that rising to 96% for firms that employ 100 or more workers. Of the large firms offering health benefits to workers in 2017, 25% also offer health benefits to retirees.

Comparing cost increases in the Federal Employees Health Benefits (FEHB) Program to employer-provided health benefits provides a perspective on current and future costs.

OPM’s announcement that premiums for the 2018 FEHB Program will rise by an average of 4% brings the increases slightly above average increases for employer-provided health insurance plans.

The disparity is even larger when compared to the most popular FEHB plans and when compared to current inflation levels for medical care.

KFF found that average premiums for employer-sponsored health insurance were rising 3% for family plans and 4% for single plans.

Comparing FEHB most popular plans with private sector insurance

FEHB’s most popular health plan provider is Blue Cross/Blue Shield (BC/BS).

Comparing BC/BS with the average fee-for-service employer-provided health plan shows that the government and its workforce are paying more than the cost for the comparable average employer-provided health insurance.

Total cost (Federal government and employee premiums combined) of Self + Family coverage in 2018 will be $1,719.32 per month for BC/BS Standard Option and $1,522.21 per month for BC/BS Basic Option.

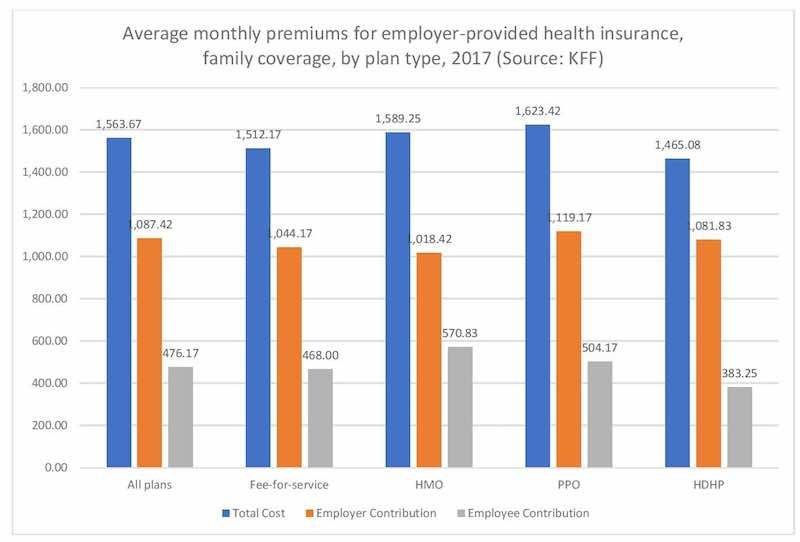

KFF found that total cost for fee-for-service plans averaged $1,512.17 for employer-provided family coverage.

In addition to total costs being higher, enrollees in the government’s BC/BS plans will be paying a higher percentage of those costs than in the private sector.

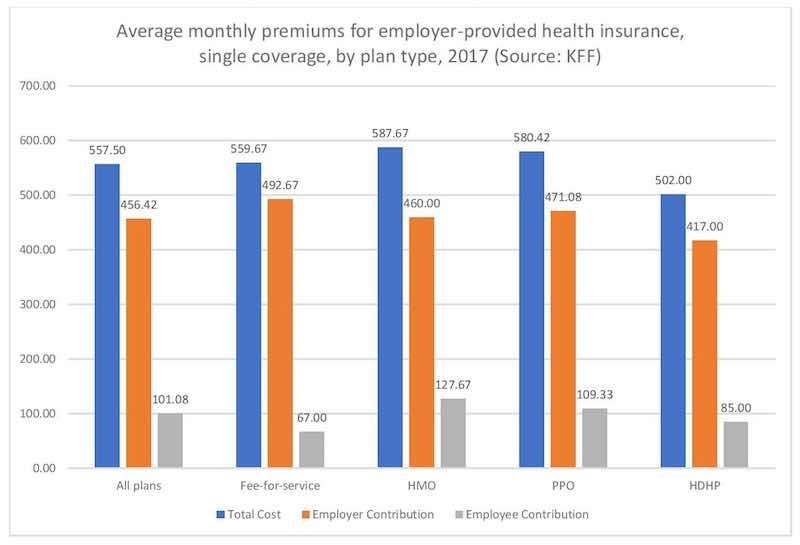

On average, employees paid 31% of the full cost for a family plan and 18% of the full cost for single coverage for employer-provided health coverage according to KFF.

For FEHB’s most popular health plan provider, Blue Cross/Blue Shield, employees will be paying 34.3% of the cost for Self + Family coverage under its Standard Option and 25.8% of the cost under its Basic Option.

For Self coverage under Blue Cross/Blue Shield, employees will contribute 33% of the total cost for Standard Option and 25% of the cost for Basic Option.

Overall, OPM estimates that the average enrollee share increase will be 6.1% and the average increase in the government share will be 3.2%.

For BC/BS plans, the enrollee’s share of its Standard Option, Self + Family, is increasing 7%, while its Basic Option, Self + Family, is rising 4.3%. For Self coverage, the increases are 6.8% for the Standard Option and 3.5% for Basic Option.

Increases for health insurance greater than rises in cost of medical care

The increases in both Federal government health insurance and in firms that offer employer-provided health insurance far exceed current inflation rates for medical care.

Currently, the Medical Care component of the Consumer Price Index for Wage Earners and Clerical Workers (CPI-W) is increasing by 1.9% according to the most recent 12-month CPI data ending in August. Within that index, consumers’ costs for health insurance have gone up about 0.2% over the past 12 months.

The CPI-W is the index used to compute the annual cost-of-living adjustment for Federal retirees and Social Security beneficiaries, and the Medical Care is one of the components contributing to the overall COLA.

If the inflation measures mirrored FEHB percentage increases, Federal retirees and Social Security recipients would find some offset to higher insurance costs through a higher COLA. Instead, the formula works against the recipients with the CPI rising slower than FEHB costs.

Reaction to FEHB announcement

After the announcement on FEHB rate increases, Richard G. Thissen, president of the National Active and Retired Federal Employees Association (NARFE), released the following statement:

“While the increases in FEHB premiums for 2018 are modest, they continue to cut into federal employees and retirees’ take-home pay, annuity and purchasing power.

“This is another year in which the federal community is reminded of the all-too-familiar cycle of low or no pay raises, small or nonexistent cost-of-living adjustments (COLAs) and rising medical bills. Like most Americans, federal employees and retirees are middle-class taxpayers, continuing to feel the pinch on their wallets every day. Years of no or low COLAs and pay raises that lag behind the private sector have created a financial burden on the federal community, increasing the need for meaningful reform.

“The latest rise in FEHB premiums demands that Congress pursue a new formula to calculate COLAs, one that accurately reflects the health care costs of our nation’s seniors, such as the CPI-E (Consumer Price Index for the elderly). This simple solution, rooted in common sense, is just one step in the right direction to help account for the rising cost of FEHB, and all health care premiums.”

Federal employees and retirees can attempt to reduce their 2018 insurance costs by switching to lower cost nationwide fee-for-service plans or regional HMO plans during the open enrollment period of November 13 through December 11, 2017.

A few nationwide fee-for-service health plans are showing reductions in the employee share of premiums for 2018. These include the APWU High Option Health Plan and the MHBP – Consumer Option plans.

Individuals may also want to consider high-deductible health plans (HDHP) that offer lower premiums and higher deductibles than a traditional health plan.

FEHB cost increases and increases in income

KFF noted that premium increases for employer-provided health insurance in private industry were similar to the rise in workers’ wages (2.3%) over the same period.

For Federal employees and retirees, the experience is different as they cannot expect as large a percentage increase in their income as the percentage increase in FEHB premiums.

Federal employees are expecting a 1.9% average increase, although some of that may be offset by higher retirement contributions depending on Congressional action.

Federal retirees are awaiting the final calculation of the 2018 COLA, which will be announced this week, but will most likely come in near 2%.

In addition, Federal retirees with Medicare are waiting for the official announcement of 2018 Medicare Part B premiums. Medicare officials have indicated that they expect no change in the regular Part B premium currently at $134 per month.

Officials have not indicated 2018 Part B premium amounts for premiums deducted from Social Security (currently at $109 per month) or premium surcharges for higher income recipients.

Health insurance will take an increasing share of their 2018 income for most Federal employees and retirees and will add to continued pressure on incomes for those employed by or retired from the Federal government.