Stocks are Surging

The stock market bull is surging. The Dow Jones Industrial Average (DJIA) posted its biggest one-day gain in a year on the last day of November. The DJIA average went up more than 330 points in one day to close above 24,000 for the first time.

The S&P 500 index, on which the C fund in the Thrift Savings Plan is based, went up 21.51 points on November 30th.

As noted in the Wall Street Journal, one professional stock trader noted: “Markets are expecting the tax bill [to pass] and are optimistic about what that means for the economy.” Whether this optimism is justified for passage of the tax bill still remains to be seen.

The economic expansion is now nine years old. The American economy is now performing at its full potential for the first time since 2007. This data is based on the potential of the economy to produce goods and services in an estimate from the Congressional Budget Office. In an economic downturn, output drops and inflation slows down. No one can be certain how long the economic expansion will last but the expansion has been good for stock market investors.

Where Are TSP Investors Putting Their Money?

An estimated of $9.6 billion went into U.S. mutual funds and exchange-traded funds in October. In the previous six months, more money had been withdrawn from these funds than had been deposited into them.

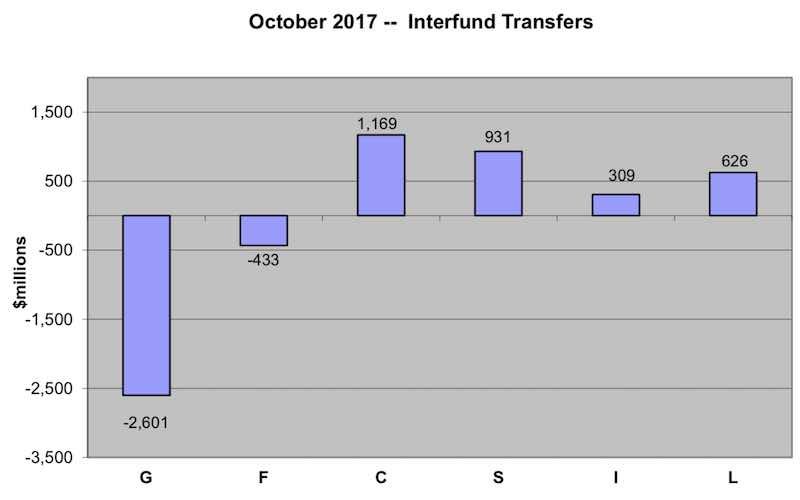

TSP investors followed this same trend. More than $2.6 billion was transferred from the G fund and $433 million from the F fund in October. In the same month, more than $1.1 billion was transferred into the C fund, $931 million into the S fund and $309 million into the I fund. $626 million was transferred into the L fund.

Which TSP Funds Have Provided the Highest Returns in 2017?

The I fund has the highest return for investors for the year-to-date (YTD) and for the past year. The I fund’s 23.44% return so far in 2017 is almost 3% higher than the C fund, which is in second place, and which provided investors with a YTD return of 20.49%.

Among the lifecycle funds, the fund with the highest rate so far in 2017 is the L2050 fund with a return of 17.63% and a 12 month return of 20.03%.

For conservative investors, the G fund has a YTD return of 2.12%. The L Income fund, which includes about 20% of its investments in the TSP stock funds and about 80% of its investments in the TSP bond funds in its portfolio, had a YTD return of 5.76%.

Latest Performance of All TSP Funds

Here is how all of the TSP funds performed in November, the year-to-date (YTD) and for the past 12 months:

| G Fund | F Fund | C Fund | S Fund | I Fund | |

|---|---|---|---|---|---|

| Month | 0.19% | -0.11% | 3.07% | 2.90% | 1.06% |

| YTD | 2.12% | 3.33% | 20.49% | 17.67% | 23.44% |

| 12 Months | 2.33% | 3.49% | 22.87% | 19.80% | 27.69% |

| L Income | L 2020 | L 2030 | L 2040 | L 2050 | |

|---|---|---|---|---|---|

| Month | 0.62% | 0.99% | 1.55% | 1.80% | 2.03% |

| YTD | 5.76% | 9.23% | 13.61% | 15.71% | 17.63% |

| 12 Months | 6.43% | 10.47% | 15.42% | 17.81% | 20.03% |

2017 has been a good year for those putting money into the TSP funds to provide for their future retirement income. TSP investors can track the daily, monthly and annual returns for all of the TSP funds at TSPDataCenter.com as well as set up a program to monitor an investor’s personal rate of return after creating a TSP Portfolio Tracker™ account.