For participants in the Thrift Savings Plan (TSP), it’s more important to focus on tried-and-true disciplines that have worked over time versus what the stock market is currently doing or what the talking heads predict the market will do.

Rebalancing is one such discipline that can potentially reduce risk and increase long term performance, and may also help reduce some of the worry that accompanies times of increased market volatility.

What is Rebalancing?

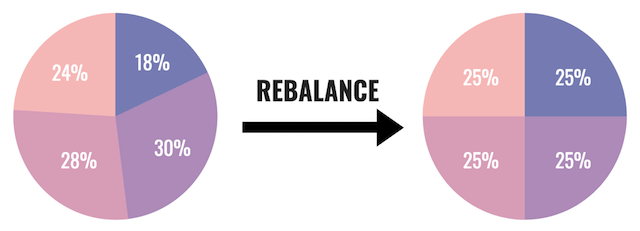

Rebalancing is the process of realigning the weightings of a portfolio to get back to a target asset allocation. It involves periodically buying assets that have decreased in value and selling assets that have increased in value. This discipline is intended to cause investors to buy low and sell high with the goal of maintaining an original desired level of asset allocation.

The figure below shows a target allocation with equal weighting into four different Asset Classes. If any one asset class moves above or below a predetermined percentage (ex. 3%, 5%, 10%) of its target allocations, it’s time to rebalance.

It’s Counterintuitive to Buy Low and Sell High

In times of market uncertainty and poor investment performance, selling better performing assets and buying more underperforming assets in your portfolio may seem counterintuitive. However, market corrections and deep bear markets represent rebalancing opportunities to increase ownership into positions that have experienced a significant drop in price.

For example, if you were happy to buy the C Fund at a particular price but then the price drops 15%, 20% or more, your first instinct might be to stop the bleeding and sell. However, if you do that you’ve now locked in your loss.

Setting up rules for when to rebalance before the market declines may save you from making the typical investor mistake of buying high and selling low.

When to Rebalance?

There is no “perfect” time to rebalance. If you want to take a disciplined approach that removes emotion, consider rebalancing every time your TSP drops or increases in increments of 3%, 5% or 10% in value. The percentage you select isn’t as important as committing to rebalancing when your reach the threshold.

A variation of this method is to rebalance anytime one or more of the funds is 3% or greater outside of it’s target allocation. Alternatively, you can use one of the broad market indexes as an indicator of a good time to rebalance.

Hypothetically if the S&P 500 drops 10%, you could use this as a time to buy low and sell high instead of panicking. Buy shares of investments when they are down so you will have more ownership if the investment recovers.

Note: If you have your entire TSP balance in one fund or just in the C, S or I, rebalancing may not be as effective if all funds are similarly down.

The figure below shows an example of when to rebalance and take advantage while others may be panicking and making mistakes.

Time to Rebalance

| Current Price | 150.00 | Date |

|---|---|---|

| -10% | 135.00 | |

| -15% | 127.50 | |

| -20% | 120.00 | |

| -25% | 112.50 | |

| -30% | 105.00 | |

| -35% | 97.50 | |

| -40% | 90.00 |

Simple and Actionable

Imagine how empowering it would be to have a simple, actionable plan in place if the stock market drops 10%, 15%, 20% or more that could actually help your investments long term. Consider letting your portfolio tell you when to take action and rebalance, not a media personality whose primary job may be to keep you afraid and tuned in for higher ratings.

Next Steps

- Establish the appropriate asset allocation for your personal risk tolerance and time horizon (when you need to use the money).

- Rebalance (buy low, sell high) your asset allocation established using one of the methods mentioned above.

- Update step one every few years.

Good luck!

Rebalancing is a strategy that can’t guarantee against a loss or better portfolio performance and could result from missing out on additional gains from appreciated assets. This is not intended to be financial advice. Please consult an investment professional on any strategy or your individual situation. Examples are for illustrative purposes only. Past Performance doesn’t guarantee future results.