The stock market has gone down rapidly in February. No doubt, there are fewer millionaires in the government’s Thrift Savings Plan (TSP) than there were 27, the C Fund was valued at $43.6997 per share.

If a TSP investor owned 10,000 shares of the C Fund on February 19, that investment had a value of $496,572. A few days later, on February 27, that investment went down to $436,997—a loss of $59,575 or about 12%.

No one likes to lose this much money, particularly in such a short time. For a person planning on retiring in the near future, it is easy to imagine the intense emotion this near-term retiree must feel and the concern about losing a big chunk in future retirement income.

What is an investor to do?

Many will start selling their shares. And, if prices continue to go down, more shares will be sold. The thought process will lead some to conclude: “I have already lost almost $60,000 dollars. I could lose another $60,000 in the next few days or few weeks. I am selling my stock investments now to avoid losing any more money.”

Panic can quickly set in when watching the stock market ticker descend quickly. Any stock investor who claims not to have felt this pressure and urge to sell in a down market is likely lying. We have all felt this emotional shock.

Investors who are panicking are not thinking logically. Nobody logically decides it is time to panic. Panic is an emotional response, not an intellectual one.

Nobody knows what stock prices will do next. The sharp drop in stocks does not mean that prices will recover quickly. But, based on past experience, prices do recover.

Sometimes they recover quickly. Other times it will take a year or more. Selling today risks missing the recovery that has always happened as we know from past experience.

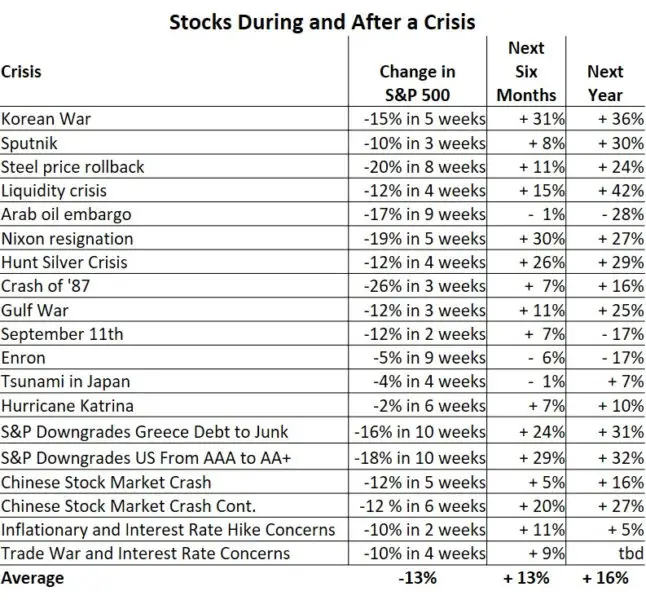

Here is a chart displaying how stock prices have fared after a list of crises that led to a plunge in stock prices and how stocks fared subsequently:

Buying High and Selling Low

To make money in the stock market, good advice is to buy when prices are low and sell when prices are high. That sounds easy. It is not easy to do.

When stock prices are up, enthusiasm is high, investing seems easy and we can enjoy the euphoria.

When stock prices drop like a rock, panic sets in, and many will start selling at low prices. At that point, investors have locked in their losses and will not benefit when the market recovers.

How to Lose Money in the Stock Market

Here is an example of human nature in action during a period of stock market volatility.

In 2000, before the internet was omnipresent, TSP participants received their December 2000 statements. Many realized for the first time what was happening to the value of their TSP stock investments—they were going down.

And stock prices kept going down through 2001 and 2002. TSP participants started selling their stock funds with abandon. From June through October 2002, when stocks were at their lowest levels, TSP participants pulled $3.8 billion out of the C fund and put their money into bond funds.

The timing of these investors was as bad as it could be. They sold their stock funds at the lowest levels just before the C fund jumped up 29% in 2003 (the I fund went up 38% and the S fund went up 43% in 2003).

And it wasn’t just these investors. TSP participants kept putting more of their regular pay allocations into stocks throughout the bull market. The highest percentage was 66% going into stocks in March of 2000 at the absolute peak of the stock market.

As stock prices fell, TSP participants put less and less money into stocks on a regular basis with just 47% going into stocks by the end of 2002.

TSP investors have proven that, for investors, the TSP program doesn’t prevent panicking and throwing away retirement money based on short-term gains and losses.

Why Do Stock Prices Drop Fast?

Investing can be an emotional issue. Money is important to us. In retrospect, stock prices seem to go up when investment fundamentals may be telling investors to take it easy. The emotional high feels good and “this time it will be different” often takes over.

When prices drop fast, there is often a triggering event. In this case, the trigger is our fear of the possible potential impact of the Coronavirus (COVID-19) on our lives.

Fear of the unknown can be scary. At the same time, others are concerned about the impact of the national elections on our economy. And other people have been expressing concerns about a recession or the stock market having hit new highs and no significant downturn in the stock market for a record-setting period of time. In other words, there may be plenty of reasons to be scared of the future and panic hitting the stock market is not unexpected.

No one can convince investors of the best way to invest for their future security when events beyond our control are hitting the headlines. One question any investor should ask himself or herself before deciding to sell a substantial amount of stock investments is whether they are just reacting in a panic likely to harm their financial future without having considered how scary events of the past have played out over time.