Taxes are already a relatively complex thing to have to deal with. Fortunately for us, there are many great programs out there that can help make it easier if you have a relatively simple tax circumstance.

If you or your spouse are involved in equity partnerships or similar, you probably want to work with an accountant. Same thing for when you’re no longer working.

Federal employees are used to having their taxes come out of their paychecks. At the end of the year, they put together all of the tax information that they receive and then file their taxes.

Most of the time, they’ll likely have some sort of refund, which just means that they withheld too much in taxes throughout the year. Maybe they didn’t withhold enough and actually owe some taxes at the end of the year. Either way, it’s a pretty simple process. But when they retire, all of that changes.

For folks in the private sector (perhaps your spouse), they tend to have more taxable income in the years that they are working. That makes sense, for obvious reasons.

When they retire, their salaries have stopped, and they transition to living from a combination of their social security and savings. These are brokerage accounts, IRAs, 401Ks, etc.

Many of these people will be in a lower tax bracket than they were when they were working full time because they’re likely using both taxable (IRA, 401K, retirement accounts) and after-taxable money (individual accounts, joint accounts, savings).

Federal employees too, right? Not so fast.

Lower Tax Bracket in Retirement? Not necessarily.

As a Federal employee, one of your benefits of retiring includes the possibility of receiving a FERS/CSRS pension.

I’ve often seen employees make the mistake of thinking that only a portion of their pension is taxable, when in fact, nearly the entire portion is federally taxable as income to you. Each state has their own laws on federal pensions so be sure to check with your accountant about local laws for your state.

This means that even though you’ve stopped working and are no longer being paid a salary by your agency, once you retire and start receiving your pension retirement, it’s as if you’re still receiving a salary from a tax perspective. This is because the money that you’re receiving from your pension is considered fully taxable.

Technically, there’s a marginal amount that’s not and we won’t get into the details of why. For all intents and purposes, you should plan on the full amount being taxable to you as ordinary income. Trust me on this, it will just make your life easier.

Other Taxable Income

Okay, so let’s say you knew that already, and your pension is lower than what your salary was when you were working, so your tax bracket must be lower, right? Not always the case.

It’s quite probable that your income replacement in retirement is not just from your FERS/CSRS pension. You may be taking money from your TSP or your IRAs. That money counts as taxable income to Federal employees. Your Social Security may be taxable as income too.

Your spouse might also be taking money from their 401K or IRAs too, and if you file your taxes jointly with your spouse, then their withdrawals count as taxable income too.

Subsequently, Federal employees are often in the same tax bracket in retirement as they were while working. This can come as a surprise, so let me give you an example:

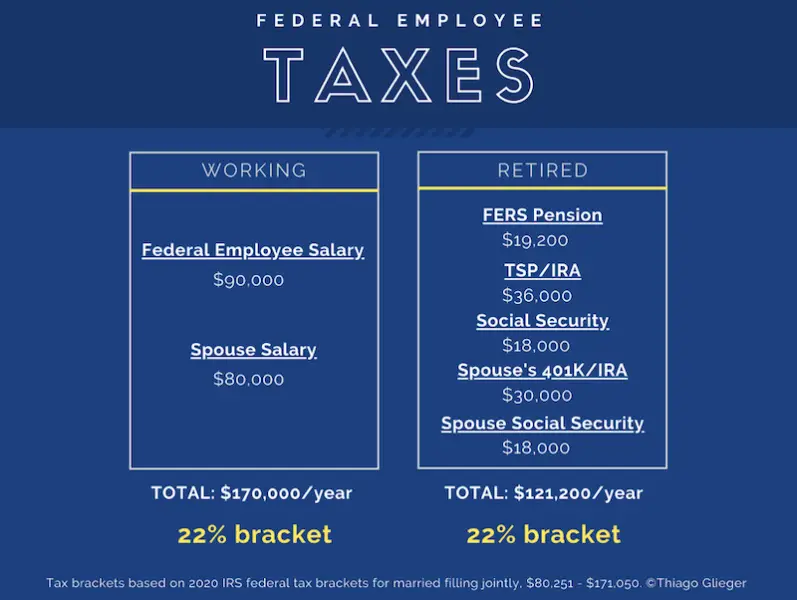

Let’s say that while you’re working, you and your spouse are making around $170,000 a year. In 2020, your federal tax bracket would be 22%. Let’s assume that you will retire next year, and let’s say your FERS pension income is $1,600 a month.

You still have a mortgage to pay, and so you decide to take out another $3,000 per month from your TSP or IRAs to help cover living expenses.

Then let’s say $1,500 a month of your Social Security is taxable, and your spouse also takes out $2,500 a month from their 401K or IRAs too. To make things simple, we’ll say $1,500 of their Social Security is taxable as well.

Here’s how it all breaks down:

In that example, while working, you fell within the 22% tax bracket for federal taxes (in 2020 the range for the 22% federal tax bracket is $80,251 – $171,050). Then when you retired, look at how much of your income is still fully taxable. Yes, you made significantly less in the year, but you still fell within the 22% tax bracket.

I’ve seen Federal employees make the mistake of thinking that they will be in a lower tax bracket, and many times that’s not always the case. Tax brackets change over time, but there’s a good possibility that as a Federal employee you may be in the same federal tax bracket as you were when you were employed by Uncle Sam.

Federal Employees Health Benefits (FEHB)

There’s a quick point I wanted to remind Federal employees about that affects their FEHB.

While working, the premiums that you pay for your health plan are paid from your salary before you’re taxed. After retiring, the premiums paid by a Federal employee are paid on an after-tax basis.

The premium amount is relatively the same, but the money you used to pay for your premium while you were working wasn’t being counted towards your income tax. Now that you’ve retired, the Federal employee will start to pay premiums from money that has already been taxed.

This means that if you plan on keeping your FEHB plan, then you’ll need to plan accordingly for this change.

How does it work out mathematically?

While it’s true that premiums are technically the same for active employees and for retirees, if you paid $5,000 a year in premiums while employed, that cost may be closer to $6,000-$6,500 per year since Federal employees would need to first pay the taxes on the full $5,000 as well.

Making Smart Use of Your TSP

The TSP is an excellent benefit offered to Federal employees as an accumulation tool. While you’re working, you’re making deposits into your TSP and hopefully you’ve selected a proper balance of investment funds inside the TSP relative to your goals and needs.

If you’re a FERS employee, you’re also getting a match (which is essentially free money, by the way) as a part of your compensation. Over time, your TSP is able to grow, and when you retire, you begin to take money from it to help pay for your living expenses in retirement.

So far so good. Here’s where it gets tricky: there are different versions of the TSP.

One is the Traditional portion, and much like a Traditional IRA, money you put into that account becomes tax deferred, meaning you don’t pay taxes on it in the year that you earn it — only when you take it back out of the TSP.

This is helpful in growing your account faster, because you’re putting more in the account to begin with for compound interest to grow. The other version of the TSP is the Roth portion. With the Roth TSP, you pay the taxes now on that amount of money going into the TSP, and once it’s inside the TSP it will grow if it’s invested properly and when you pull the money back out, now it’s tax-free.

Tax-free money is a great thing. You’ve already paid the taxes on the original principal amount that you put in, but all of the growth that your investments experienced does not have to be taxed in a Roth. Why is this so important?

If you look back at the graph I put together above, you’ll notice that the Federal employee in that example still fell into the same tax bracket because all of their pension is taxable and so is all of the money that came out of their TSP.

If you had a Roth account, you would be able to help fill those income needs with tax-free money and it would not count towards your taxable income.

If you hypothetically replaced that $36,000 of TSP money that you withdrew with Roth monies instead, you could potentially be saving upwards of $8,000 in federal taxes.

Here’s where I say that I’m not a tax advisor and this is just an example. Taxes are complicated and there are many factors in determining a Federal employee’s tax liability. I over-simplified this example to drive the point home, which is: the Roth is another tool in your toolbox that can help you get the best out of your portfolio.

Drawbacks with the TSP

The TSP is a great program and I encourage every Federal employee to maximize their use of it. That being said, I think that there is room for improvement in the TSP.

There are certain features about the TSP that make it less efficient and less useful as an investment vehicle for people in retirement. Earlier in this column, I mentioned that it is my personal opinion that the TSP is an incredible accumulation tool.

In other words, while you’re working and growing your nest egg for retirement, the TSP is an incredibly low-cost investing platform with a lot of great features. However, when you’re drawing near retirement or already retired from service and are taking money from your TSP, you’re in the “decumulation” phase.

When Federal employees submit a request to withdraw money from their TSP and they have both a Traditional TSP portion and a Roth TSP portion, half of their money will come from the Traditional portion and the other half will come from the Roth.

You might be asking, “So what?”

The challenge is created when they are trying to be as tax efficient as possible. Going back to good financial planning techniques, it makes sense that when tax rates are higher (tax rates tend to change with each administration by the way), they forego taking money from accounts that are fully taxable.

If they take money from their TSP, they cannot pick which tax status the money comes from. It comes out proportionally and they’re forced to pay the tax rates in that year. The private sector has solved this problem by not commingling Roth IRA monies with Traditional IRA monies.

Inheriting a TSP Account

There’s another point I’d like to make about TSP taxability, and that’s when someone is inheriting your TSP. If it’s a federal employee’s spouse, not much is changed other than that it’s considered a beneficiary TSP.

But let’s say the next in line to inherit their TSP are their two children. When they inherit that TSP from the last surviving spouse, the account is split however designated, and then the full amount being transferred is considered taxable to those children, all in the same year they inherited it.

So, let’s say there’s $500K in your TSP being split 50/50 between two kids. If each child is making $90K a year in the year they inherit the TSP, they will have a total income of $340K for the year. The tax is immediately due, and it greatly increases their tax bracket and tax liability.

This can be avoided in the private sector with proper estate planning, but it is a feature with the TSP that is critical to know about so that Federal employees may plan accordingly.

In Summary

As you can see, Federal employees must consider a variety of unique features about their benefits package when making decisions about their money. Doing so without fully understanding how each program works can cost you a lot of money.

There are many features that can catch an employee by surprise if they are not careful, and each of these can be exacerbated if the employee has a spouse in the private sector — their rules have to be combined with yours and planning properly can be challenging.

OPM’s website has a lot of information and can be overwhelming. There’s help that you can get from advisors; just make sure that they specialize not only in knowing your myriad benefits but, more importantly, how they impact the rest of your finances. It’s critical for the safety and success of your financial goals.

This content is considered to be informational only and is not intended as advice. Consult with an advisor before making changes. Tax brackets pulled from IRS.gov.