I heard a wise old financial planner once say, “Investing is like a roller coaster. It goes up; it goes down. You start and end in the same place. But after the ride, you’re never quite the same.”

Wow, investing sure does feel like that, more now than ever. Unless you’ve been under rock, you’ve probably watched your TSP balance go up or down like the biggest rollercoaster at Cedar Point or Six Flags. (if you are from Ohio or Michigan you know Cedar Point)

Some people, myself included, love these rides, but I didn’t always love them.

I recall my very first coaster experience; it was the Corkscrew at Cedar Point. I was 12 years old, a bit scared and very nervous. Heck, it went UPSIDE DOWN!

I put on a brave face and got in my seat. Well, 90 seconds later I returned to where I started, shakily emerged from the death trap and bravely attempted to push down the bile rising in my throat. My younger cousin was my riding partner and excitedly asked if I wanted to do it again.

“Ye,..ye..yes. yes,” I said sheepishly. We rode it again. Then again. And again. Each time I got more used to the feeling and began to enjoy the ride, the drops, the fast speeds, everything. By the end of the day, I was even putting my hands in the air during the ride, the mark of a true daredevil!

What changed? Did the rollercoaster make an adjustment? Did it become less risky? Did it adapt to my anxiety?

Of course not. These machines are finely tuned and designed for precise and repeatable performance. If not, they wouldn’t be safe to ride!

No, it didn’t change. I did. What had been extremely new and scary for me became normal.

The ride on the stock market can feel very much the same. Make no mistake: each time we invest in equities such as the C, S, or I Funds, we are jumping on that ride, ups, downs, spins and all. Just like riding a roller coaster, investing in the market will always elicit strong emotional responses and may even make you sick occasionally.

So why do we put ourselves through this? Is the market truly like a rollercoaster?

The mathematical odds of the stock market finishing positive on a daily basis is a little greater than a coin flip. We also know the market on average will rise and then drop 10% annually.

Like the changing of the seasons, every few years, the market will drop by more than 20%. We call this a bear market and we just had one in March. Normally bear markets occur after a sustained period of positive market performance.

We don’t know when these rises and falls are going to happen, we just know that they will. What is mind boggling is that these bull and bear markets are always treated as something outrageous, calamitous or unexpected. Trust me, they are not unexpected at all. They are a normal part of the ride as you can see from the graphic below charting the frequency of market declines.

The key difference between the corkscrew at Cedar Point and our stock market is that over time, contrary to the roller coaster, the stock market eventually returns you to your starting point, but just a bit higher than when you started.

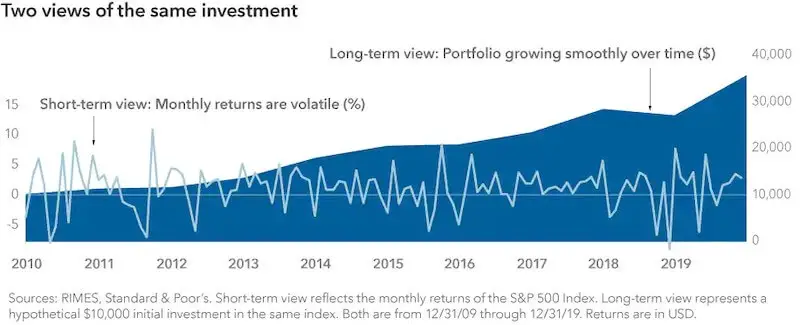

The chart below illustrates this gradual rise perfectly.

The key to success when investing? Stay the course. Ride the ride.

So, we know that eventually the market will reward us. Therefore, just like a good time at an amusement park, you want to ride that ride as much as possible. The more time you ride (e.g., remain invested), the greater chance of success. Ride the ride, keep your cool, and you may reap the benefits.

But reap the benefits only if you don’t jump off in the middle of your journey. Imagine if you got scared in the middle of your rollercoaster ride and decided to get out of your seat. Not a good idea. Thankfully this is basically impossible on actual roller coasters due to modern safety equipment.

Unfortunately, those same harnesses and seat belts designed to keep us safe don’t exist in the world of investing. Because of this, we see people bailing on the ‘investment’ ride all the time.

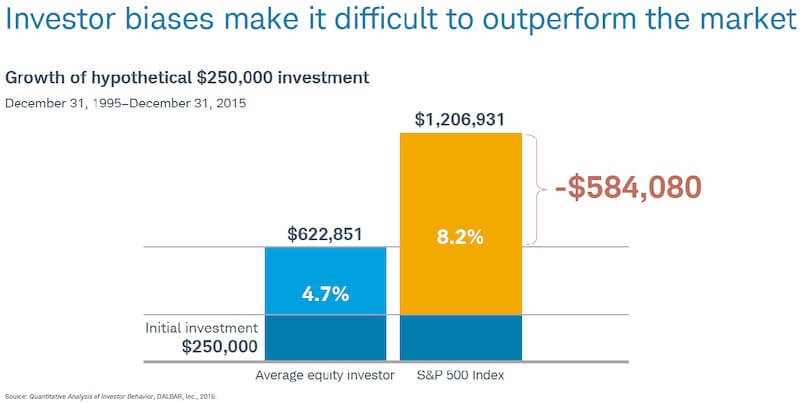

The Dalbar Inc. annual study on investor behavior done consistently shows that investors underperform the market, and often dramatically.

As much as people want to buy low and sell high, they end up doing the opposite. Humans love the ups, but hate the downs. Once the ride gets rough, fear takes over, and without those seatbelts, we abandon our investments at the worst possible time. Repeat this enough and you could cost yourself thousands of dollars. (see below)

What’s the solution?

Pick a smaller rollercoaster.

From an investing standpoint, start with something a little more conservative and see how you feel. Within the Thrift Savings Plan, having an allocation to the G or F Fund can allow you to endure the ups and downs of investing.

If you handle more risk, then do so gradually. However, never, ever think for a moment you can cheat the system. Reaching for returns, or a bigger thrill, always comes with more risk, volatility and perhaps nausea.

Before you invest, you also need to do some self-reflection and assess your personal risk tolerance. These assessments are free on the internet, and a good financial planner acting as a fiduciary can also help you determine how big of a thrill you can endure and design a portfolio so you don’t jump off.

I believe a quality investment portfolio needs to have three essential ingredients:

- Financial objective with a defined time horizon.

- Asset Allocation mirroring your risk tolerance.

- Pre-determined emotional response strategy for when markets fall.

When (not if) your account drops, what do you plan on doing? If the answer is making wholesale changes, jumping in and out of the market, you’re on the wrong ride. Get out of the line. Start over again. Pick a more conservative option.

A final thought. Find your safety belt.

After all the prep work and design, you still have to ride the rollercoaster, and there is no substitute for the real thing. Once on, you still might find yourself succumbing to fear and pushing that eject button on your investments. It’s at this time that having a good financial advisor will serve as your harness and safety belt. They will keep you in your seat. They will remind you why you are investing in the first place, that you expected this, and assure you that jumping off is always worse than staying the course. If you don’t have one, or don’t want one, that’s ok. You should still get someone you trust to help you get through a tough patch.

So, the next time you feel your stomach drop, either from investing or from a wicked roller coaster, ask yourself, am I really ready for this?

The ride won’t change, but you can.

“The opinions and forecasts expressed are those of the author, and may not actually come to pass. This information is subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any specific security or investment plan. Past performance does not guarantee future results.”

Securities offered through Securities America, Inc., Member FINRA/SIPC. Advisory services offered through Securities America Advisors, Inc. Mission Point Planning Group and Securities America are separate companies