If you are a federal or postal worker with a serious medical condition, you may be entitled to FERS Disability Retirement (FDR), Social Security Disability Insurance (SSDI), or both. In fact, if you are applying for FDR, the Office of Personnel Management (OPM) requires you to apply for SSDI.

But what happens if you are approved for both FDR and SSDI?

The answer can be found on OPM’s website:

Social Security Benefits

If you are under age 62 and your [FDR] annuity benefits were computed using either 60% or 40% of your high-3 average salary, the Office of Personnel Management will reduce your monthly annuity by all or a portion of your Social Security benefits. While you are receiving an annuity computed using the 60% computation, OPM must reduce your monthly annuity by 100% of any Social Security disability benefit to which you are entitled. While you are receiving an annuity computed using the 40% computation, your monthly annuity will be reduced by 60% of any Social security disability benefit to which you are entitled. This reduction only applies for months in which you are concurrently entitled to both FERS and Social Security benefits [emphasis added].

To illustrate, let’s look at some examples.

Sample Computations

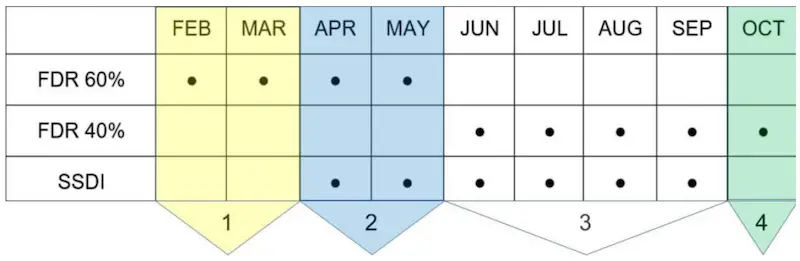

For the following examples, let’s assume that Jane Doe is a federal employee with a high-three average salary of $45,000 at the time she is approved for FDR. Let’s also assume that Jane has been approved for SSDI for the months of April through September with a monthly payment of $1,000. The following chart shows a summary of Jane’s benefits over an arbitrary nine-month period:

Example 1: FDR 60%

In February and March, Jane receives her FDR annuity at the 60% computation, and she does not receive SSDI. Therefore:

Jane’s total monthly payment = FDR 60%

= $45,000 X 60% ÷ 12

= $27,000 ÷ 12

= $2,250.

Example 2: FDR 60% + SSDI

In April and May, Jane is eligible for both FDR (at the 60% computation) and SSDI. However, OPM must subtract 100% of Jane’s SSDI earnings from her FDR annuity. Therefore:

Jane’s total monthly payment = FDR 60% + SSDI

= $2,250 – ($1,000 X 100%) + $1,000

= $2,250 – $1,000 + $1,000

= $2,250

Note that this amount is equivalent to Jane’s non-reduced FDR annuity at the 60% computation.

Example 3: FDR 40% + SSDI

In June, July, August, and September, Jane is eligible for both FDR (at the 40% computation) and SSDI. However, OPM must subtract 60% of Jane’s SSDI earnings from her FDR annuity. Therefore:

Jane’s total monthly payment = FDR 40% + SSDI

= ($45,000 X 40% ÷ 12) – ($1,000 X 60%) + $1,000

= $18,000 ÷ 12 – $600 + $1,000

= $1,500 – $600 + $1,000

= $1,900

Example 4: FDR 40%

In October, Jane receives her FDR annuity at the 40% computation, but she is no longer receiving SSDI. Therefore, Jane’s total monthly annuity is $1,500 (as computed in Example 3).

The Bottom Line

The main takeaway from the above examples is this:

When you receive both FDR 60% and SSDI, it’s a wash. In other words, it’s the equivalent of only receiving FDR 60%. Therefore, during your first year of FDR, there is no added financial benefit to receiving SSDI (unless your monthly SSDI payment exceeds your monthly FDR payment).

However, when you start receiving FDR 40% and SSDI concurrently, you end up getting more money than if you just had FDR 40% alone, because it’s the equivalent of receiving FDR 40% + 40% of your SSDI benefits.

To get a solid idea of what your monthly income would be if you were approved for both FDR and SSDI, ask your agency for a “FERS Benefits Estimate” and request a copy of “Your Social Security Statement” from the Social Security Administration.