Your Thrift Savings Plan (TSP) stock funds have experienced a very volatile year in 2020. Despite the insecurity this volatility can have on investors, 2020 has been a good year for TSP investors.

Best Performing TSP Stock Fund in 2020

Almost all of the stock funds have had a good return this year. As of October 23rd, the C Fund, which is the most popular stock fund in the TSP, is up 8.8% in 2020. The S Fund has the best performance so far this year and it is up 10.88% so far in 2020.

The only fund that is down in 2020 is the I fund which has a negative return of 5.33%.

Performance of the Safest TSP Fund

The G Fund, which is the largest fund in the TSP stable, is up 0.81% for the year. More than 40% of TSP assets are in the G Fund ($261.7 billion).

The G Fund is less volatile and often thought of as the safest of the TSP funds. While it is the least volatile, it is often also the fund with the lowest return over time. Of course, there are years when stocks are down and the G Fund still does up which is where it the reputation as the safest of the TSP funds.

Those who may want more information on annual returns for the TSP funds can check the annual returns for all TSP funds for all years at TSPDataCenter.com.

Average TSP Balances

The largest segment of TSP investors, with almost 3.6 million participants, is those in the FERS retirement system. As of September 30, the average balance for these participants is $152,353. 683,000 FERS retirement participants invest in a Roth TSP account. The average Roth balance is $16,906. For more information on this disparity in the investment balances, see Why Isn’t the Roth TSP More Popular?.

There are less than 300,000 CSRS participants in the TSP. Their average balance is $163,986. There are 10,155 CSRS participants with a Roth account and their average balance is $24,888.

Overall, there are more than six million TSP investors and the average balance is $107,459. There are more than 1.7 million Roth participants in the TSP and the average balance is $12,747.

TSP Millionaires

As of September 30th, there were 55,183 TSP investors with more than one million dollars in their TSP accounts. For comparison, the number of millionaires at the end of December was 49,620 – an increase of 11.2%.

According to the TSP, one investor accumulated $7,859,534 as of September 30, 2020.

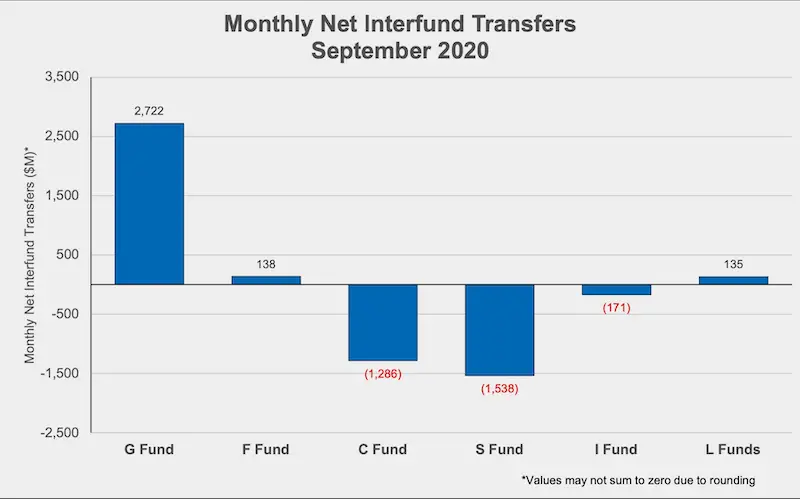

Billions in Stock Funds Transferred to G Fund

The TSP stock funds did very well in August and went down in September.

During September, TSP investors transferred more than $2.7 billion into the G Fund, $138 million into the F Fund, and $135 million into the Lifecycle Funds. At the same time, large amounts were transferred by investors out of the C and S Funds.

Whether the transfer to the safety of the G Fund was in reaction to the poor performance of stock funds during September is unknown. There is often a similar reaction by investors when the stock funds go down and emotions skyrocket as the market drops and TSP balances go down.

In March, for example, TSP investors transferred more than $15 billion into the G Fund. How much of this $15 billion was transferred into the G Fund before and after March 23rd, we do not know. Based on past history of how investors reacted in significant stock downturns, it is likely the amount of the transfers into the G Fund continued to go higher as stock prices continued to drop quickly.

From the low point in March, stock prices went up dramatically. For those investors who panicked and sold when the market went down quickly in reaction to COVID-19, they locked in their losses when selling shares. Of course, no one knew when the market would go back up, and selling at a steep loss may have seemed like a good idea to preserve retirement assets.

Fortunately, FERS retirees have a guaranteed pension as well as the TSP to fund their retirement. Nevertheless, selling stocks based on negative emotions that show up when the market drops can have a dramatic long-term impact on TSP balances.

FedSmith will publish the entire results for the month of October on November 2nd.