Retirement Myth #1: My cost of everyday living and leisure spending will be less in retirement

When helping federal employees plan for retirement, one of the most common concerns we see is the desire to be debt free before retirement. The goal is to have one’s house, car, credit cards, and other substantial debt paid off before retirement. This supports the common theory that being debt free allows one to spend less in retirement. While being debt free is a great place to start, what about unknown expenses? Listed below are a few examples of unplanned costs in retirement.

- Children and/or grandchildren – Some federal hires—such as Special Provisions employees—are eligible to retire as early as age 50. Due to this young age, many retirees find themselves paying for children’s college education or grandchildren’s living expenses.

- Federal Employee Group Life Insurance (FEGLI) – Many federal employees do not plan for the increasing cost of FEGLI coverage in retirement. More information on the increasing costs of FEGLI in retirement can be found here.

- Federal Employee Health Benefits (FEHB) – In 2020, average total FEHB premiums increased by 4% while federal retirees received only a 1.6% COLA on their annuity. Also, federal employees pay their portion of healthcare costs with before-tax dollars, but federal retirees pay their portion with after-tax dollars.

- Travel – After years of delaying trips due to work obligations, getting out and seeing the world is a desire of many federal retirees. It is common for them to want to enjoy traveling in retirement, from RV or tent camping to treks around the world; however, an increase in excursions also means a rise in travel expenses.

- Inflation – One of the greatest attributes to your federal pension is that it generally receives Cost of Living Adjustments (COLAs). As a CSRS retiree, you will begin receiving COLAs immediately in retirement, whereas a FERS retiree will begin receiving COLAs at age 62. One of the most common retirement myths is that the impact of inflation will be eradicated by COLAs. With the help of COLAs, the impact of inflation is reduced, but rarely is it totally eliminated.

When planning how much to spend in retirement, it’s important to evaluate your current lifestyle. Are you currently living below your means and allotting a sizable amount to savings every pay period? If so, you might expect your retirement income to cover most or even all your base expenses. Or, are you currently spending most of your salary every month? The answer to these questions will help guide you in the direction you need to go to plan for retirement, but don’t just blindly embrace the retirement myth that once you’ve retired your spending will decrease.

A wise consumer would begin planning now for the known and unexpected expenses applicable in retirement.

Retirement Myth #2: I will fall in a lower tax bracket in retirement due to a decrease in income

Based on RBI’s experience working with federal employees, we have found that depending on age and years of service, retirees will receive between 40-80% of their salaries in retirement. This leads to the expectation of having reduced taxable income that will result in a lower tax bracket in retirement.

If you have made this assumption in your retirement planning, rest assured; you are not alone. Here are a few tax implications that you may see as a retired federal employee.

Addressing the Income Gap

A wise consumer should evaluate one’s net income in retirement and compare it to net pay while working. Often a retiree finds a financial gap that needs to be filled to maintain the same standard of living.

Where will these funds come from? Options may exist to begin drawing Social Security or the Special Retirement Supplement benefit. Some may choose to begin accessing funds that were contributed throughout employment to the Thrift Savings Plan (TSP).

While Traditional TSP is a great savings vehicle, it is tax deferred. Employee contributions, the government contributions (for FERS only), and any growth made during the lifespan of the Traditional TSP, will be taxed upon withdrawal. Although we cannot predict future tax brackets, we can take a look at the current and ever-changing national debt. Many would assume that taxes may increase for prospective taxpayers.

Taxes Now or Later?

At Retirement Benefits Institute (RBI), we generally find that federal employees are at the top of a tax bracket while working. Then they find themselves at the bottom of that very same tax bracket in retirement before any withdrawals from TSP are made. As a result, they are required to pay additional taxes and have the need to make withdrawals from their traditional TSP. This proposes a few questions for the future retiree:

- Would you rather pay taxes now, or in retirement when your bring-home pay is less?

- How can you help reduce the impact of taxes in retirement?

Educating yourself on the investment vehicles available to you before retirement may be beneficial and help answer these questions.

As a federal employee, you also have the ability to contribute to a Roth TSP account. This account contains the same funds as the Traditional TSP: G, F, C, S, I and L. You may distribute your contributions throughout the funds as you please, while not exceeding the contribution limits.

For FERS employees contributing to Roth TSP, your government match will be contributed to your Traditional TSP, but nonetheless you will still receive your match. Roth contributions are made with after-tax dollars and your contributions, as well as your gains generally may be withdrawn tax free! This allows you to pay taxes on the dollar now as opposed to waiting until retirement.

Retirement Myth #3: You should stop saving and investing in retirement

The years while you’re working are frequently viewed as “a time period of savings.” You set goals to eliminate debt and send allotments to savings and Thrift Savings Plan (TSP) accounts. The working years are generally thought of as a time to build up the nest for use in retirement.

As you transition into retirement, you enter into a period of spending in which you live off of your accumulated assets. So, once you reach retirement are you free to stop growing your nest egg and simply spend down your assets?

The answer to this question depends on exactly how long will you live in retirement? Let’s do an exercise together.

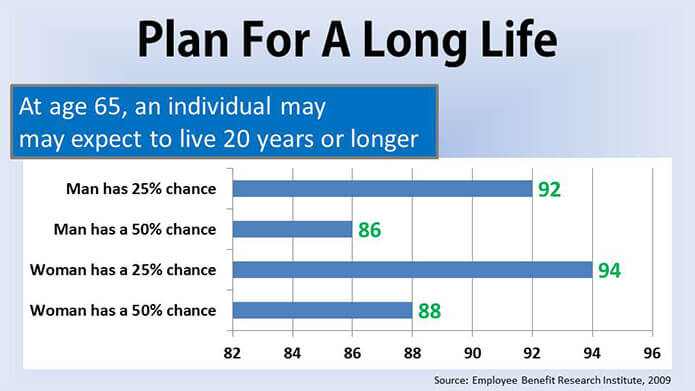

The number of ‘Years in Retirement’ is an estimated period when you must sustain your lifestyle solely on your pension and assets. As shown in the chart below, we find in our training events that this number may range anywhere from 20-35 years, which in most cases is close to the same amount of years that an individual worked for the Federal Government.

“Should I stop saving and investing in retirement to live exclusively on these funds?” The answer to that question really depends on the answer found in the above exercise.

If you don’t continue to invest and decide to draw on your assets, is that sustainable for twenty or thirty years? This is a great question to look at with a financial professional and certainly deserving of your time.

While the future is uncertain, we can predict that you will have to live on your savings in retirement. Plan to invest carefully so that your money may grow and be protected throughout retirement.

One savings vehicle that serves federal employees well is a Roth TSP/IRA account. This type of tax-advantaged account allows you to pay taxes on your contributions now while it grows tax free. You have immediate access to your contributions, but the gains may not be accessed until you reach age 59.5 and the account must have been open for five years. Once these two requirements have been met, you have complete access to your full funds and can withdraw from it tax-and-penalty free. This account helps federal employees with robust pensions have more control of an outside asset as needed while in retirement.

Disclosure: The information contained in these blogs should not be used in any actual transaction without the advice and guidance of a tax or financial professional who is familiar with all the relevant facts. The information contained here is general in nature and is not intended as legal, tax or investment advice. Furthermore, the information contained herein may not be applicable to or suitable for the individuals’ specific circumstances or needs and may require consideration of other matters. RBI is not a broker-dealer, investment advisory firm, insurance company, or agency and does not provide investment or insurance-related advice or recommendations. Brandon Christy, President of RBI, is also president of Christy Capital Management, Inc. (CCM), a registered investment advisor.