Here is a summary of all TSP monthly returns for April 2021.

Best TSP Monthly Returns

The C Fund in the Thrift Savings Plan (TSP) continued to have a good year in April.

The C Fund had a return of 5.33%—the highest return for the month of any of the core TSP funds. Over the past 12 months, the C Fund has returned 45.96%.

Best TSP Return Over 12 Months

While a return of almost 46% in any year is a splendid return rate, the best 12-month return belongs to the S Fund. Over the past 12 months, the S fund has a rare return rate of 78%.

Best TSP Return Year-to-Date

The S Fund also comes out ahead of all of the other core TSP Funds with a return of 12.34%. The C Fund is second-best with an 11.83% return. The I Fund returned 6.73% so far in 2021.

All of these return rates are high and certainly good news for any TSP investor.

Lowest Rate of Return

The lowest rate of return of the core funds for the month, for the past 12 months and for the year-to-date is the G Fund. Its highest return rate is for the past 12-months at 0.89%.

Another fund considered to be a safe fund is the L Income Fund. With the stock market hitting spectacular returns, the L Income Fund has done better than the G Fund as it includes some of the underlying stock funds in its portfolio while the G Fund does not have any stocks.

About the L Income Fund

For those who are curious, here is a quick summary of the L Income Fund.

The objective of this Fund is to achieve a low level of growth with its major emphasis on preserving assets. The L Income Fund’s asset allocation does not change quarterly. However, like the other funds, it is rebalanced daily to maintain its target investment mix.

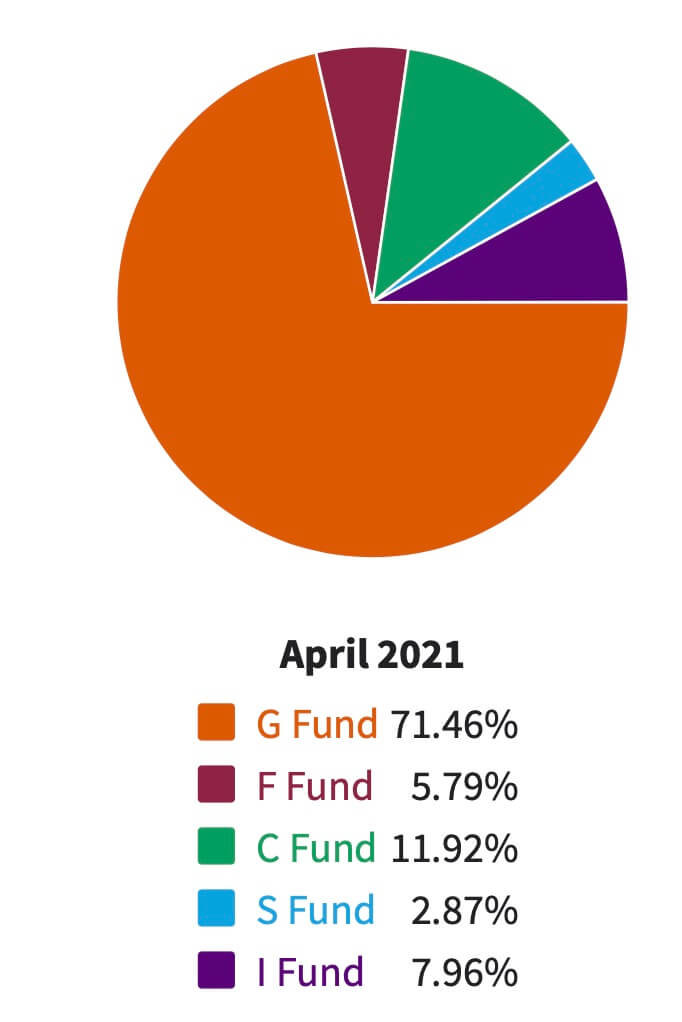

Here is a chart displaying the allocation of the underlying TSP Funds that make up the L Income Fund. As the long-term returns of the L Income Fund are likely to be higher than the G Fund while still maintaining a high level of safety, this Fund is worth consideration by those seeking a safe investment with the potential for higher returns than the G Fund.

Monthly TSP Returns for April

| | G Fund | F Fund | C Fund | S Fund | I Fund |

| Month | 0.13% | 0.82% | 5.33% | 4.23% | 3.09% |

| 12 Month | 0.89% | -0.17% | 45.96% | 78% | 40.34% |

| YTD | 0.40% | -2.55% | 11.83% | 12.34% | 6.73% |

| | L Income | L 2025 | L 2030 | L 2035 | L 2040 |

| Month | 1.14% | 2.15% | 2.74% | 2.99% | 3.24% |

| 12 Month | 10.04% | n/a | 27.55% | n/a | 33.47% |

| YTD | 2.39% | 4.76% | 6.01% | 6.56% | 7.12% |

| | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Month | 3.45% | 3.66% | 4.35% | 4.35% | 4.35% |

| 12 Month | n/a | 38.84% | n/a | n/a | n/a |

| YTD | 7.60% | 8.10% | 10.05% | 10.05% | 10.05% |

Get more current and historical TSP performance data at TSPDataCenter.com.

Beware of Complacency

We have been in the midst of a good run for stocks. That is good news for all TSP investors. Stocks have had a very good year so far in 2021 and the returns in 2020 were also very good. The stock returns in 2019 were also very good!

With a record like this, it is easy to think bear markets are a thing of the past. However, it is sometimes important to remember that bear markets have never gone away. They are just hibernating for a while.

Note this recent quote from the Wall Street Journal:

The S&P 500 has fallen at least 20%—the conventional definition of a bear market—26 times in the past nine decades, according to Dow Jones Market Data. Recoveries to previous highs have typically taken almost three years, often much longer.

This is a good time to review your portfolio. If you are a new federal employee in your twenties or thirties, retirement may be a long way off. If you are close to retirement or already retired, are you financially prepared to go through a bear market and watch your portfolio drop by 20% or more?

Considering negative possibilities is always a good idea when your returns are looking good. It is better to do it now than to start selling your assets after their value has already gone down. That always happens to investors.

Don’t let it happen to you!

In the meantime, sit back and enjoy looking at your TSP returns. Your Thrift Savings Plan is one of your best benefits as a federal employee.