The Federal Retirement Thrift Investment Board (FRTIB), the agency which administers the Thrift Savings Plan (TSP), held its monthly meeting today in which it discussed investment objectives of the TSP’s L Funds as well as legislation in Congress that could have significant ramifications for TSP participants.

Significant Roll-ins for TSP

In its recent meeting, the Thrift Savings Plan (TSP) reports April was a significant month for roll-ins to the plan with $142 million in assets transferred. It was the largest single month for roll-ins since January 2020. The increase may in large part be due to 90,000 people receiving an enclosure mailed to them about the advantages of rolling money into the TSP program.

In addition, post-separation withdrawals for 2021 are projected to be 26% higher than in 2020. The TSP attributes this increase to a larger number of participants reaching retirement age as increased access to their funds since the addition of a new withdrawal program. (See What Withdrawal Options Are Available for the TSP?)

Anticipated Rejection of Legislation Restricting Chinese Investments

Legislation has been introduced in Congress to restrict TSP investments in China. Senator Tommy Tuberville (R-AL) introduced the Prohibiting TSP Investment in China Act (S. 1665) which would prevent TSP funds from being invested in any entity based in China. Congressman Jim Banks (R-IN) introduced companion legislation in the House (H.R. 3295).

The intent of the legislation was to “send a message of zero tolerance towards Chinese aggression and financial manipulation” according to a press release.

The TSP Board has not been in favor of these restrictions, in part because they do not think it is in the best interest of TSP investors. If enacted, the legislation would have a complex impact on the Thrift Savings Plan and would likely increase expenses for investors. The legislation would also result in excluding a mutual fund window from being implemented in the coming year as it would be impractical to exclude funds that exclude China from the TSP investments.

At the recent meeting of the Federal Retirement Thrift Investment Board (FRTIB), Director of Internal Affairs, Kim Weaver, expressed optimism that the legislation would not be passed by the Senate. There has not been reaction by the Biden administration regarding the legislation.

RESPOND Act and Climate Change Executive Order Endorsed by AFGE

In the monthly meeting of the FRTIB, there was discussion of impact on the TSP of the proposed RESPOND Act and the recent Executive Order on climate change issued by President Biden.

This monthly meeting included members of the Employee Thrift Advisory Council. AFGE’s representative in attendance was Jacqueline Simon, AFGE’s Director of Public Policy. AFGE recently issued a strong statement and press release entitled Largest Federal Employee Union Applauds Biden Push to Remove Fossil Fuel Securities from Retirement Funds.

The press release stated:

“Curbing investments in harmful fossil fuels is not only good for the environment and our planet – it’s good for workers, too.

According to Blackrock, the world’s largest asset manager, removing fossil fuel securities from the Thrift Savings Plan will have no negative impact on the rate of return federal employees’ get on their retirement savings. This change is an opportunity to take an important step toward addressing our climate emergency and saving our environment with no sacrifice in employees’ retirement savings.

That’s why we support President Biden’s call to mitigate the impact of federal agencies’ financial activities on the environment. We also support the RESPOND Act, which would formally establish a process for reviewing and eradicating the financial risks of climate change in the TSP, and look forward to working with Congress on its passage.

AFGE’s National President in the written statement and press release strongly supported the Executive Order and the RESPOND Act. When questioned at the meeting, AFGE’s representative appeared to temper the unequivocal endorsement. Ms. Simon phrased the union’s position as seeking an answer to the central question of how eliminating fossil fuels would impact TSP returns and that AFGE is seeking formal studies on the impact this action would have.

Kim Weaver noted the proposals could result in creating a new index fund or disinvestment of fossil fuels. Previously written talking points from the FRTIB on the subject read, in part, as follows:

The RESPOND Act is the latest assault on the carefully crafted mission of the TSP and could, if enacted, be the first of a cascading number of debilitating changes to federal retirees’ investment opportunities.

Creating an advisory committee on climate change within the FRTIB will make it nearly impossible to limit additional changes or restrictions to the TSP funds, given the many highly focused issue advocacy groups with organized representation. If Congress were to enact any social or political fund limitations or proposals, it is unclear how further legislation creating additional restrictions on the investments of the TSP Funds, or even legislation creating additional funds, could be prevented.

The complications and limitations of creating this advisory committee would be devastating for the TSP, which for more than thirty years has been highly successful. The TSP has become a model for the 401(k) industry by offering a very limited menu of broadly diversified, non-overlapping, index funds designed solely to advance the financial interests of TSP participants and their beneficiaries.

Modeling TSP’s Glide Paths

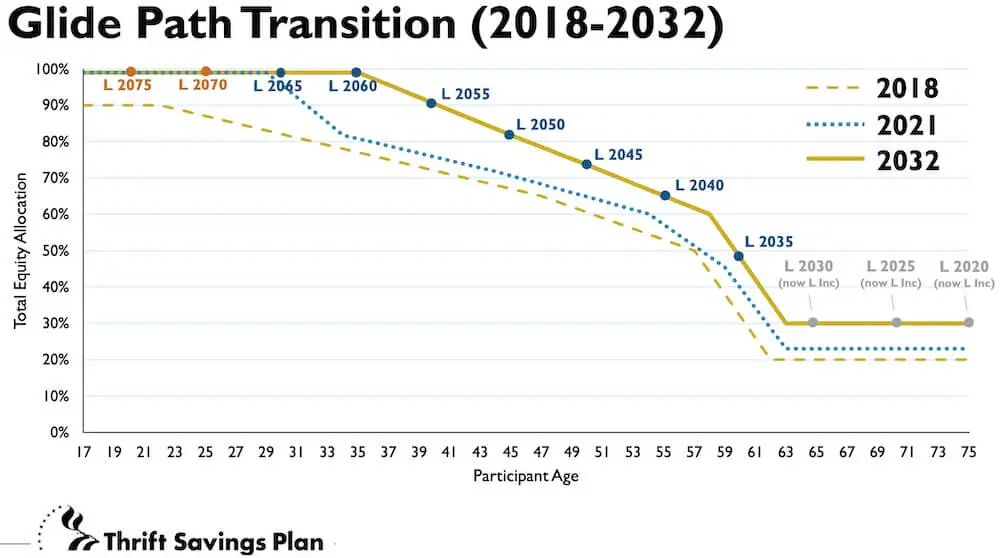

A Glide path displays the mix of stock and bond changes as a Lifecycle Fund gets closer to its target date (or your retirement year). The TSP uses glide paths to display and track the mix of stocks and bonds from the underlying core TSP Funds in each Lifecycle Fund.

The TSP has reported on the results of a consultant study to complete the 2021 annual L Funds glide path asset allocations in the Lifecycle Funds. In short, the TSP’s projected demographics suggest the current risk level of the L Funds’ glide path and the projected path are reasonable for accomplishing the investment objectives.

The current glide paths are designed to add more stocks into the mix of the L Funds. The goal is to replace 70% of a retiree’s income after retirement with a person’s total retirement income sources, including the TSP.

Here is a table outlining the current glide path asset allocations.

Current Glide Path Asset Allocations as of July 2021

| Asset Allocation | L 2065 | L 2060 | L 2055 | L 2050 | L 2045 | L 2040 | L 2035 | L 2030 | L 2025 | L Income |

| C Fund | 49.6% | 49.6% | 49.6% | 41.0% | 38.7% | 36.6% | 33.8% | 31.0% | 23.6% | 12.1% |

| S Fund | 14.8% | 14.8% | 14.8% | 12.1% | 11.2% | 10.1% | 9.1% | 8.1% | 5.9% | 2.9% |

| I Fund | 34.7% | 34.7% | 34.7% | 28.6% | 26.9% | 25.1% | 23.1% | 21.0% | 15.9% | 8.1% |

| F Fund | 0.6% | 0.6% | 0.5% | 7.9% | 8.1% | 7.6% | 7.4% | 6.6% | 6.2% | 5.8% |

| G Fund | 0.4% | 0.4% | 0.5% | 10.3% | 15.1% | 20.7% | 26.7% | 33.2% | 48.4% | 71.2% |

| Total | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

Here is a table provided to the FRTIB that outlines the considerations in deciding how to allocate the core TSP funds within each of the Lifecycle funds to have the best chance of achieving the desired investment results. This chart will also help readers understand how the L Funds are structured to see how the current funds will be allocated as of July 2021.

| Key Characteristics | L 2065 | L 2060 | L 2055 | L 2050 | L 2045 | L 2040 | L 2035 | L 2030 | L 2025 | L Income |

| Years to Maturity | 44 | 39 | 34 | 29 | 24 | 19 | 14 | 9 | 4 | 0 |

| Equity Percentage | 99.0% | 99.0% | 99.0% | 81.8% | 76.8% | 71.8% | 65.9% | 60.1% | 45.4% | 23.0% |

| Non-U.S. / Total Equity | 35.0% | 35.0% | 35.0% | 35.0% | 35.0% | 35.0% | 35.0% | 35.0% | 35.0% | 35.0% |

| SMID / Total U.S. Equity | 22.9% | 22.9% | 22.9% | 22.8% | 22.4% | 21.6% | 21.1% | 20.7% | 20.1% | 19.2% |

| G Fund / Total Fixed Income | 36.0% | 44.0% | 50.0% | 56.5% | 65.0% | 73.1% | 78.3% | 83.4% | 88.6% | 92.5% |

FedSmith will report on the upcoming TSP results for April in the next few days as soon as the data are available. Check FedSmith and TSPDataCenter for complete and timely reports on your TSP investments.