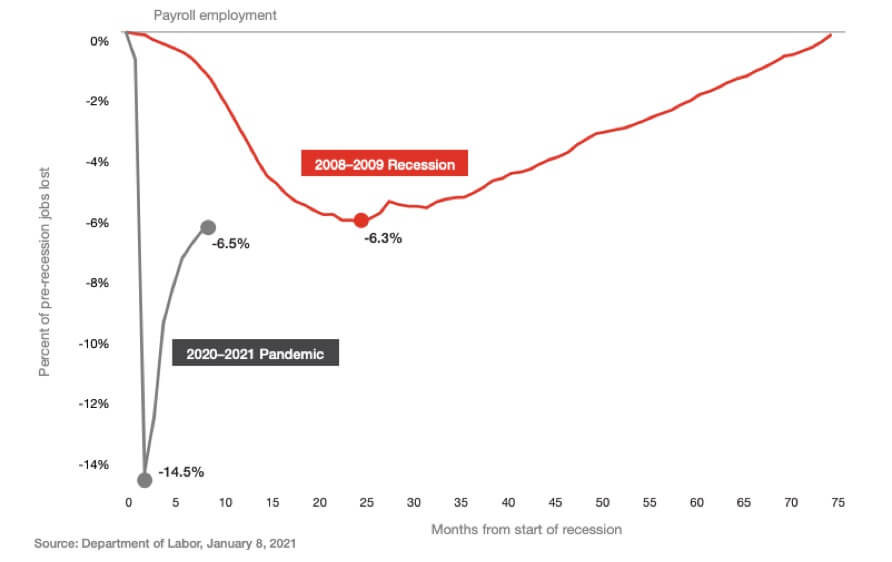

While many are still focused on the health impact of the pandemic, we can’t ignore that it holds a firm grip over the US economy, even as we are midway through September of 2021. Employers have added back more than half of the 20M+ jobs lost during the shutdowns last year. The DOL’s data shows that remaining loss in employment rival that during the 2008 Great Recession, in percentage terms. See graph from PWC.

To be clear, I don’t believe the US to be at risk for an immediate fiscal crisis – the current debt service costs are still manageable and interest rates remain low for the time being. The Federal Reserve has continued to commit to this, and as a result the average interest rate on outstanding federal government debt is projected to decline as the government rolls over higher yielding debt issued in earlier years (think US bonds). We have also begun seeing decreased demand of US bonds on a global level.

Long-term fiscal concerns impact short-term policy changes

It should be no surprise that the government had to offer significant support to the country to stimulate the economy. While necessary, it also created fiscal challenges for the future, especially as bond revenues are projected to decline as previously mentioned.

The Congressional Budget Office and economists writ large agree that the current fiscal path is not sustainable in the long term. The main concerns are spikes in inflation and interest rates, or an overall decline in the strength of the US dollar.

As a result, there are varying proposals of tax law changes to help mitigate these risks, many of which will have a direct impact on investors. These changes are anticipated to be substantial and far-reaching, and include corporate, individual, and capital gains tax rate increases, as well as international tax, and estate and gift tax changes.

Applicability to your daily lives

While not every change will impact every American, there are several that should change the way you are planning your finances, especially if you are a high earner. I see this frequently here in the DC metropolitan area, where many families are dual-income income households.

Most of my firm’s clients fall into this category, and the discussion and projections around the potential impact to their economic picture have been sobering. While it’s still premature to fully start making changes to your financial plan, it’s imperative that your financial planner is having these conversations with you and your accountant. It will be a team effort to ensure that you insulate yourself as best as possible against these potential changes.

If these are not professional relationships that you and your family currently hold, I strongly urge you to seek out developing these relationships. You should ensure that they are working in a fiduciary capacity, and that they possess both the experience, expertise, and academic background to fully understand your total financial position, especially as federal employees.

Getting started now is important – the process of developing a relevant, actionable, professional-level financial plan takes time, and you don’t want to wait until tax laws have changed before starting to research firms to work with. That is when everyone else will be making the same phone calls.

Potential Tax Policy Timeline

I won’t go into every single detail of proposed changes. You’re reading this article in anticipation that this information has been condensed for you so that you do not need to read the tax code proposals yourself.

Ask and you shall receive. Below is a summarized list of many of these proposals. Some may be very real changes to your financial position. Others are likely to be completely irrelevant, as they apply to 1% of the population, but are, nonetheless, still interesting to an economic nerd like myself, so I included it for your reading leisure too.

Effective July 1: Thirteen states have notable tax changes, with most changes increasing taxes in some capacity.

Pending Legislation

American Families Plan

- would raise the top marginal income tax rate from 37 percent to 39.6 percent

- would make permanent many aspects of the American Rescue Plan such as Earned Income Tax Credits, Child Tax Credit, and expanded health insurance Premium Tax Credits.

- would tax long-term capital gains and dividends as ordinary income for taxpayers with taxable income above $1 million.

- would expand the 3.8 percent Net Investment Income Tax (NIIT) to apply to all sources of income above $400,000, including active pass-through income.

- would tax capital gains at death for unrealized gains above $1 million ($2 million for joint filers).

- would limit 1031 Like-Kind Exchanges by eliminating deferral of gains above $500,000.

- would make permanent the 2017 tax law’s Section 461(l) limitation on pass-through business losses above $250,000 for single filers and $500,000 for joint filers.

- The budget calls for the increase in the top capital gains rate to be implemented retroactively (not clear exactly when).

American Jobs Plan

- would increase the federal corporate income tax rate from 21 percent to 28 percent

- would impose a 15 percent minimum tax on corporate book income, which would be levied on a firm’s financial profits instead of taxable income for firms with revenue over $100 million.

- would raise the tax rate on global intangible low-taxed income (GILTI) to 21 percent, calculate it on a country-by-country basis, and eliminate the exemption of a 10 percent return on tangible investment abroad (QBAI).

Ultra Millionaire Tax Act of 2021

- would tax household net wealth above $50 million at a 2 percent rate per year and above $1 billion at a 3 percent rate.

- proposes a 1 percent tax on wealth above $32 million for married couples ($16 million for singles) that increases to 8 percent for wealthier households.

FY2022 Budget Resolution Agreement Framework

- proposes relieving the cap on the itemized deduction for State and Local Taxes (SALT cap)

- proposes extending the expansion of the Affordable Care Act’s Premium Tax Credits.

The For the 99.5 Percent Act

- would reduce the estate tax exemption to $3.5 million (from $11.7 million in 2021) and increase the progressivity of the estate tax with rates from 45 percent to 65 percent, among other changes.

Sources

- https://taxfoundation.org/2021-state-tax-changes-july-1/

- https://taxfoundation.org/biden-tax-plan-tracker/

- https://www.pwc.com/us/en/tax-services/publications/assets/tax-policy-outlook-2021-the-changing-horizon.pdf#page=3

- https://www.jdsupra.com/legalnews/2021-tax-reform-expected-to-be-6043266/