A number of federal employees and retirees utilize the L Income Fund inside of the Thrift Savings Plan (TSP). They believe it to be a good alternative Lifecycle Fund when they need money for monthly retirement income or simply to protect their money from losses in the stock market.

Is the assumption that the L Income Fund helps protect one’s portfolio from stock market losses accurate? With interest and attention being given to this fund, why not examine how it is or is not accomplishing this conservative goal. Before that, let’s answer the “why”.

Why Invest in the L Income Fund?

The TSP website asks the question, “Why should I invest in the L Income Fund?” The answer they give is below:

You should consider investing in the L Income Fund if you are currently withdrawing money from your TSP account in monthly payments or you plan to begin withdrawing money before 2021.

The goal then is monthly income, so the allocation must be conservative to prevent market fluctuation. You can’t afford to lose money while taking monthly income as this could hurt your portfolio. It’s like heavily irrigating your crop during a severe drought; you’ll run out of water much faster.

Examining the L Income fund for its portfolio construction and goals can answer the question “how”.

Allocation of the L Income Fund

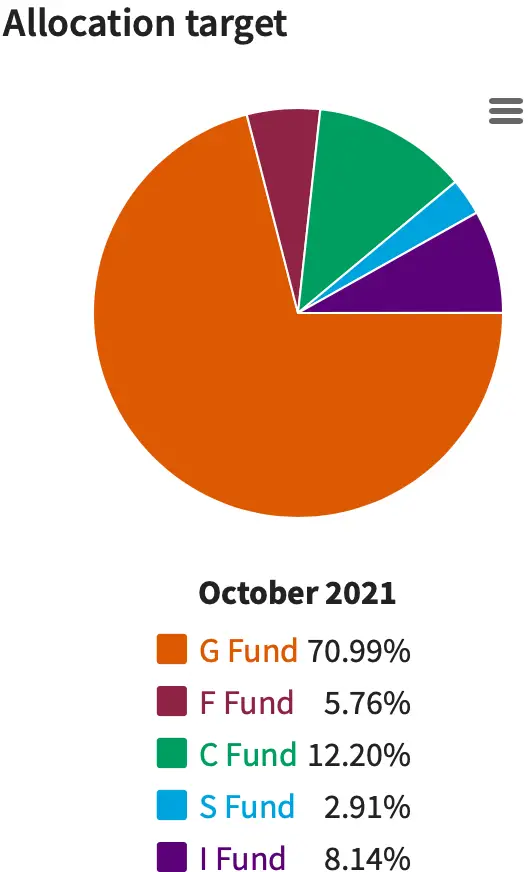

What is the allocation to bring about such stability inside the L Income Fund? In a word, the G Fund. Over 70% is in the G Fund. With a whopping .97% return in 2020, and projections on pace between 1.25-1.35% in 2021, returns may not be too exceptional, but stability is present. With inflation at historically high levels, the G Fund could be shrinking your money.

What is the allocation with the other 29%, and what is the goal there? Nearly 6% is in the F Fund with YTD (year to date) returns being 3.52% as of September 2021.

We have some dismal performance from the G and F Funds so far this year, and possibly continuing thru the next couple years. The F Fund is a bond fund, and with a rising interest rate environment on the horizon, it could mean negative performance for most bond funds. Typically as interest rates rise, bond funds usually go negative. Because interest rates are so very low, they’re likely to continue to go up and create havoc for bond funds. Notice the balance of the 5 funds in the pie chart format below:

What is the solution to counterbalance meager returns from the G & F Funds? The other 3 stock index funds: the C, S, and I Funds, albeit at risk of market loss, a seemingly necessary evil, given the G and F Fund returns so far.

For the remaining 23% of the L Income portfolio, however, I believe they are weighted too strongly towards the I Fund, or International. I say this because the breakdown is C 12%, S 3%, and I 8%.

Why is so much in the I Fund when historically it has been far outpaced by the handsome returns of the C & S Funds? It is because diversified portfolio theory states that we must have broader market exposure beyond just the domestic American stock market. I say why? This market is broad enough and grows enough that both the C & S Funds over the last 10 years have more than doubled the I Fund’s returns. Note the chart from TSP.gov below:

| Year | G Fund | F Fund | C Fund | S Fund | I Fund |

| Inception date | 4/1/1987 | 1/29/1988 | 1/29/1988 | 5/1/2001 | 5/1/2001 |

| 1 year | 1.20% | -0.71% | 29.98% | 42.32% | 26.04% |

| 3 year | 1.66% | 5.41% | 15.95% | 15.53% | 7.96% |

| 5 year | 1.98% | 3.06% | 16.86% | 16.39% | 9.17% |

| 10 year | 1.94% | 3.25% | 16.66% | 16.44% | 8.58% |

If we have winners consistently, then why not stick with them? Weighting more to the C and S Funds with a little in the I Fund, accomplishes this. This requires balancing it yourself or seeking guidance from a professional. It can be done and adjusted as the balance shrinks down or your goals change.

L Income Fund Risks

The enemies of the L Income Fund are primarily low returns from the G Fund and a rising interest rate environment for the F Fund. The advantages are the low cost stock index funds for growth. Like any balanced approach to investing, you should always have exposure to all types of funds, not just the safe ones. That’s why the TSP L Income Fund uses all 5 funds even though the goal is income and safety.

Moderation is key here as is balancing between conservative and growth investments. Ascertain your income needs and then formulate a plan. The TSP is a fine place for some of your retirement savings. There may be other investments to suit your needs for income and growth as well.

CD Financial is a Registered Investment Adviser. CA LIC #0G46793. Investing involves risk, including the potential loss of principal. Any references to security or guaranteed income generally refer to fixed insurance products, never securities or investment products. Insurance and annuity product guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company. CD Financial is not affiliated with the U.S. government or any governmental agency.