Many of us have noticed that the cost of almost everything has increased significantly since this time last year.

Home prices have skyrocketed. Health care expenses have surged. And even grocery prices have jumped.

We all have dealt with this to some degree over our career but how do these price changes impact your federal retirement?

Or in other words, can your retirement plan afford to take the beating of higher than average inflation?

Inflation in Retirement

As a federal employee you have at least 3 sources of retirement income. Your FERS pension, Social Security, and your TSP.

To understand if your retirement plan is ready to handle inflation then you have to know how each of these income sources react to price increases over time.

FERS Pension

When it comes to your FERS pension, the good news is that once you are retired and at least 62 then you will receive a COLA (cost of living adjustment) every year.

Basically, what this means is that your pension will get a little bigger every year in efforts to keep up with inflation.

The bad news is that if you retire before age 62 then you will have to wait until 62 to receive any COLA. And if inflation happens to be higher than normal (like it has been in 2021) then this could really hurt your buying power.

For example, if you retired at 57 and inflation was 5% for the next 5 years then your buying power would be decreased by 25% by the time you hit age 62.

FERS Pension COLA

But even once you start receiving COLAs at 62, you aren’t out of the woods yet.

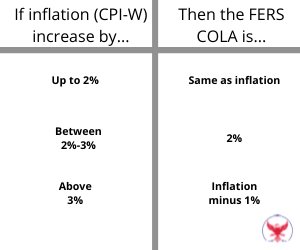

Your FERS pension COLA is based on the CPI-W which is an index that is used as a proxy for inflation. Basically, if the CPI-W shows that prices have gone up then FERS pensions will go up as well.

Social Security gets COLAs based on exactly what the CPI-W grew by but the COLA for FERS pensions isn’t as generous.

This is how it works.

So basically, if inflation is less than 2% per year then your FERS pension will keep up 100%. But if inflation rises above 2% then it will lag behind. And when inflation is above 3% then FERS pensions will lag a whole 1% behind inflation every year that occurs.

That is why it is not great for FERS retirees when inflation is high. While your pension will increase the cost of everything you normally buy increases by a larger amount. And while 1 year of this might not make a huge difference, it certainly will compounded over multiple years.

So as the law stands today, FERS retirees better hope that above average inflation doesn’t become a norm in the coming years.

Social Security

The good news about Social Security is that the COLA will track the CPI-W directly and won’t lag behind like your FERS Pension COLA does in times of high inflation.

The bad news is that in recent years, health care expenses have risen at a faster rate than general inflation.

This means that Medicare part B premiums could continue to rise at this higher rate as well.

And because Medicare part B premiums come directly out of your Social Security benefits (assuming you have started Social Security by then) then higher premiums will lower your net Social Security.

Your TSP (Thrift Savings Plan)

Your TSP can be an incredible tool in retirement because you control how you use it and how you invest it.

And if invested well, your TSP can grow faster than inflation over time which will help tremendously in maintaining your standard of living.

And while it is crucial to not invest too aggressively in retirement, you certainly don’t want to invest too conservatively either.

Investing too conservatively (i.e. putting 100% in the G fund) puts your TSP in danger of being eaten away by inflation as well.

How to Guard Against Inflation

There are many things in retirement that we simply can’t control. This includes inflation, tax rates, and the performance of the stock market.

This is why it is so important to have some wiggle room in your retirement plan.

If your retirement numbers are really tight then any small change is often enough to make retirement not so comfortable.

And while we don’t know exactly what challenges will come our way in retirement, we can be prepared by building some margin into our plan.