14.5% Increase in TSP Millionaires

The Thrift Savings Plan (TSP) has provided a more secure retirement for federal employees. As of the end of December 2021, there were 112,880 TSP investors who are now members of the TSP millionaires club.

The stock market has been going up, as most TSP investors know from the 2021 TSP returns. And, when the stock market goes up, it is reasonable to anticipate that the number of TSP millionaires will also go up.

That is what has happened. With the core TSP stock funds all providing very good returns last year, the number of TSP millionaires has increased from 98,253 to 112,880—an increase of 14.57% since the end of September.

Based on the latest data, 1.7% of all TSP investors are now TSP millionaires.

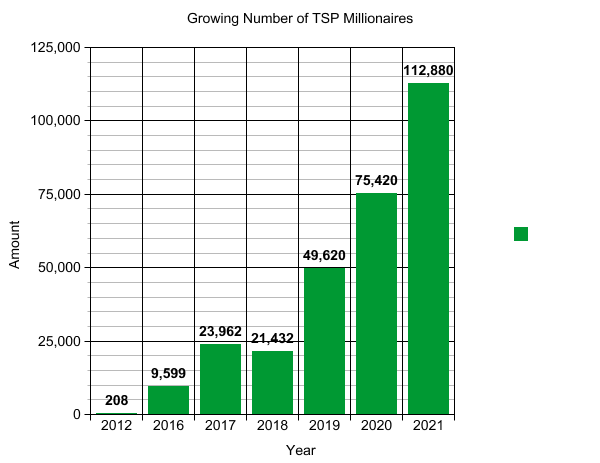

How Number of TSP Millionaires Has Grown

Here is a quick summary of how many TSP millionaires there are in the program.

| January 2012 | 208 |

| December 2016 | 9,599 |

| December 2017 | 23,962 |

| December 2018 | 21,432 |

| December 2019 | 49,620 |

| December 2020 | 75,420 |

| June 2021 | 98,879 |

| September 2021 | 98,523 |

| December 2021 | 112,880 |

Of course, most TSP investors do not become millionaires but, combined with an annuity, Social Security, and the TSP, a retired federal employee is likely to live very well with less than $1 million in his or her retirement account. On the other hand, there are probably not many investors that would not like to have at least $1,000,000 in their TSP account.

The number of TSP investors does not include beneficiaries. It does include investors under FERS, CSRS, and uniformed services so the data reflect this mixture of investors.

How Does Your TSP Balance Compare to other Investors?

The number of TSP millionaires is a relatively small number out of the total number of participants in the program. As one might expect, the largest number of TSP investors are in the “under $50,000” category of investors. On the other hand, one TSP investor now has $10,975,527 in a TSP account.

We do not know the identity or background of the investor who has more than $10 million in an account, but it is possible this investor rolled over money from another qualified plan into the TSP. While we sometimes see comments from readers that a career federal employee can never accumulate more than $1 million, the data indicate that is not the case.

The average TSP millionaire has more than 28 years of contributions to the TSP. As an extreme example (and an extreme lifestyle), one retired federal employee who had worked for the Internal Revenue Service died with an estate of more than $22 million.

Here is the breakdown of how many TSP investors are in each investment category as listed:

| Account Balance | Number of Participants | Average Years of Contributions |

| <$50k | 3,771,214 | 5.72 |

| $50k-$249k | 1,548,688 | 14.95 |

| $250k-$499k | 538,256 | 20.24 |

| $500k-$749k | 219,658 | 23.01 |

| $750k-$999k | 105,000 | 25.08 |

| ≥ $1 million | 112,880 | 28.21 |

| Total | 6,295,696 | 10.61 |

FedSmith first reported on the number of TSP millionaires in 2012. At that time, there was one TSP investor who had $4,041,671.71 in a TSP account as of January 18, 2012. That may be the same investor that now has in excess of $10 million in a TSP account. The formula for reaching the millionaire level has probably not changed.

At the time, 11 of the TSP millionaires were invested solely in lifecycle funds. 122 were invested solely in the TSP core funds (G, F, S, C, and I funds). 75 were invested in both the core funds and the lifecycle funds.

TSP investors who are seeking “safety” above all else put a significant percentage of their assets into the G Fund. 26.4% of participant allocations are in the G Fund as of November 20, 2021. On the other hand, 32.4% of participants have put their money into the C Fund. 11.7% is in the S Fund and 3.6% is in the I Fund.

To achieve a rate of return that will eventually reach at least $1 million, investing in the stock market will be essential. The low average return of the G Fund will not get an investor into the TSP millionaires club.