As congressional leaders went back and forth on the Build Back Better initiative, there was a game of red-light-green-light being played with many near retirees’ tax-planning measures. Why? Because the BBB had dangled the idea of an extension to the tax cuts implemented by the Tax Cuts and Jobs Act (TCJA) of 2017. If enacted, the bill would have extended the tax cuts for those individuals making under $400,000 and households reporting less than $450,000 – offering many Feds an extended opportunity for tax planning at discount rates.

The starts and stops surrounding this bill frustrated many both on and off “The Hill”. Trust me, I have had to sit on a full-length retirement and tax planning book for nearly a year while waiting for the politicians to sort out the very rules I am writing about!

Originally, the TCJA was passed by way of “Budget Reconciliation” which simply meant that the tax changes being implemented by that bill were not going to be signed into permanent law but rather have an 8-year shelf life. This lowered the marginal tax rates for Americans at nearly all income levels and most saw their federal income tax expenses go down significantly. The TCJA essentially put taxes “on sale” for the 8-year period from 2017-2025 with the sale coming to a close for income reported in 2026.

The BBB initiative would have extended those tax cuts for another 8 years (2022-2030) through a second round of budget reconciliation – extending the “sale” on income taxes, but it appears this bill will not be passed (although there are still rumors of one last hail-Mary vote attempt for this signature legislation).

If in fact the BBB never passes, that has major implications for the timeline retirees and pre-retirees have to emphasize the creation of tax-diversity in their portfolio. Rather than 8 new years of “sale pricing” on our tax liability, the reduced rates are only viable for the next 4 years (including 2022).

If the general goal of tax planning is to clear your personal tax liability at the lowest rates possible while positioning your portfolio to continue growing without any future tax liabilities (creating tax-free distributions), then it is even more important to be proactive in defusing the tax-deferred time bomb during these remaining years.

Why is tax planning particularly important for federal retirees?

Taxes are one of the most erosive forces in all of finance, especially in retirement, because it impacts nearly every dollar the average retiree receives. Federal Employees often have to report 99% of their FERS pension, 85% of their Social Security benefits, and 100% of their Traditional TSP distributions as income on their tax return. While having the FERS 3-Legged Stool generating robust retirement income for you is amazing, having a robust taxable retirement income creates a robust tax liability for you in your golden years as well.

How do experts anticipate those unknown, future tax rates will compare to our known (and historically low) tax rates today? Not favorably!

Where might taxes go in the future?

We know that at the end of 2025 the “sale rates” will go away and marginal income tax rates will revert back to those seen in 2017 – which will increase the tax bill for most Americans.

Look at the table below comparing the marginal tax rates and income thresholds today (as part of the TCJA) to the 2017 rates (which return in 2026).

| 2017 Tax Rates – Married/Joint | 2018 TCJA Tax Rates – Married/Joint | |||

|---|---|---|---|---|

| Taxable Income | Marginal Tax Rate | TCJA Savings | Marginal Tax Rate | Taxable Income |

| $480,050 + | 39.6% | 2.6% | 37% | $600,000 + |

| $424,951 – $480,050 | 35% | 0% | 35% | $400,001 – $600,000 |

| $237,951 – $424,950 | 33% | 1% | 32% | $315,001- $400,000 |

| $156,151 – $237,950 | 28% | 4% | 24% | $165,001 – $315,000 |

| $77,401 – $156,150 | 25% | 3% | 22% | $77,401 – $165,000 |

| $19,051 – $77,400 | 15% | 3% | 12% | $19,051 – $77,400 |

| $0 – $19,050 | 10% | 0% | 10% | $0 – $19,050 |

Note: Not only did marginal tax rates go down but income thresholds also went up with the implementation of the TCJA, helping reduce one’s tax bill in two distinct ways!

For example, let’s say the Jones’ have a taxable income of $250,000 – they would be in the 33% tax bracket in 2017, but in 2018 that same level of taxable income would only be in the 24% bracket because the income thresholds increased! Keep in mind that Jones’ not only saw a 9% savings on their top marginal tax bracket (33% vs 24%), but they also saved 3-4% on a number of the lower brackets as well.

The approximate tax bill for a household reporting $250,000 of taxable income in 2017 is $57,224. That same household with that same income one year later (2018) saw their total tax liability reduced to $48,579. The TCJA reduced the tax bill by $8,645 (or roughly 15.1%) from the previous year. So, at the end of 2025, when the TCJA goes away and rates revert to the 2017 levels, we would see this process play out in reverse – increasing the cost of future tax bills and tax planning measures.

Does reverting back to 2017 tax rates generate enough tax revenue to fix our nation’s fiscal trajectory?

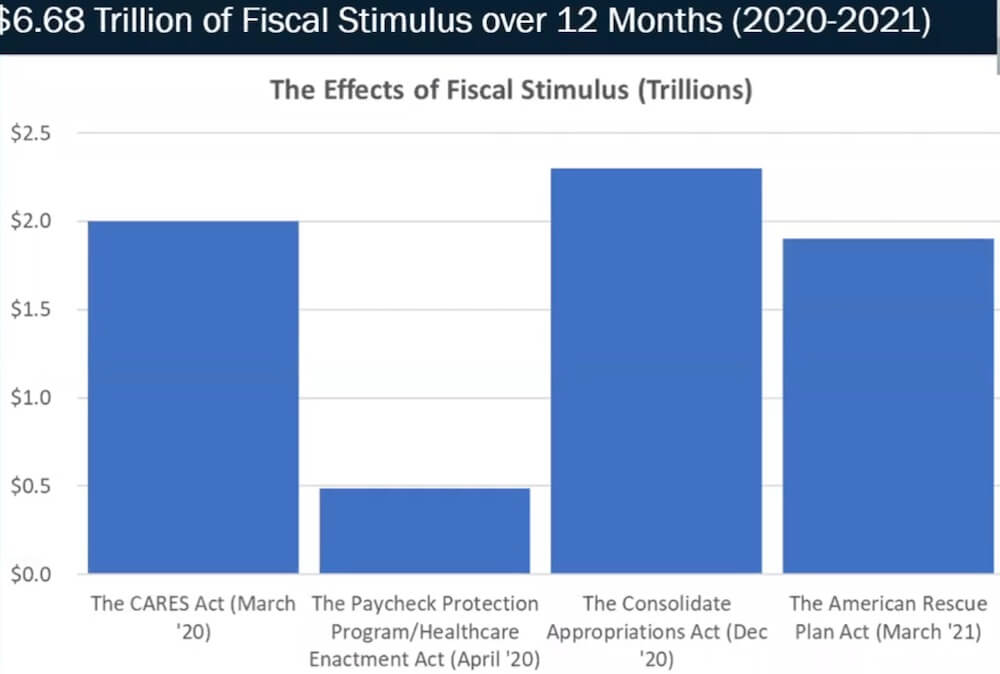

Absolutely not! Even before the pandemic punched a $6 Trillion hole in the economy that needed to be bridged by unprecedented stimulus efforts, we were already in an unprecedented fiscal pickle.

Medicare/Medicaid and Social Security were already the top two expenditures in our fiscal budget, but in the coming decade we will see the ranks of entitlement-eligible Americans continue to swell until eventually 1/3 of the population (population, not workforce!) are eligible for Uncle Sam’s entitlement payroll.

Furthermore, the cost of our existing debt will go up as interest rates rise from the record lows we have enjoyed since the financial crisis… Yet even at today’s rates, the cost of making interest only payments on our existing national debt is already the 4th largest annual expense to Uncle Sam each year!

The combination of Congress repeatedly spending way more than is raised in tax revenue each year and the pandemic means we will face the difficulties of supporting an aging population while servicing $30 Trillion of national debt. Aging demographics already mean more entitlement expenses and less payroll tax revenue (because retirees are done working) but it becomes extremely difficult to navigate that with the added hurdle of rising interest rates. See, while you may have locked in a sweet 30-year fixed-rate mortgage during the last 18 months, Uncle Sam doesn’t have that same luxury. Uncle Sam’s debt is more akin to a variable-rate mortgage, meaning higher interest rates will increase the cost of our interest-only payments on that existing debt!

In 2022 the US anticipates receiving tax revenues totaling roughly $4.05 Trillion but Medicare/Medicaid, Social Security, and the interest assessed on our existing national debt cannibalizes $2.8 Trillion (or 69%). This only leaves 31 cents from every dollar of tax revenue to run the rest of the country on… and that ratio is expected to get worse as all 3 of our main expenses continue to increase in the coming years.

So what gets prioritized? No one knows. What we do know is that only one of those 3 expenses are guaranteed in the Constitution… interest on the national debt.

How did the pandemic impact our fiscal trajectory?

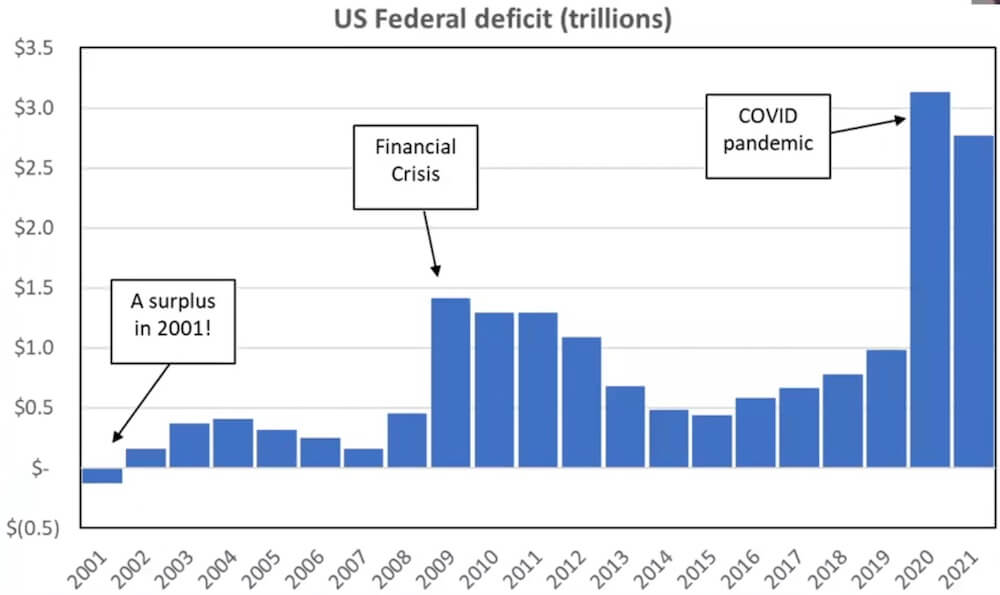

As you can see below, in 2019 the US ran a federal deficit of nearly $1 Trillion dollars – meaning they spent nearly $1 Trillion more than they raised in tax revenue. That is a deficit threshold that had only ever been breached during the financial crisis when stimulus was needed to steer the US banking system away from the fiscal cliff. That 13-digit deficit in 2019 was extremely alarming to experts – especially since it was incurred during a period of relative peace and prosperity – but even it doesn’t hold a candle to the deficits of 2020 and 2021.

Was injecting trillions of dollars into the system in 2020 enough?

Unfortunately it was not because 2021’s deficit was still more than twice the pre-pandemic record. In the last 24 months, we have seen unprecedented levels of stimulus provided to help Americans and American businesses navigate the pandemic. Roughly 30% of all of the physical money ever printed in the US was printed in 2020 alone!

These stimulus numbers are shocking enough to be scary in their own right, but the pandemic did not happen in a vacuum; it came at a time that our nation’s changing demographics were also coming to a head. Before the pandemic, Congress was already facing very difficult decisions in the next 10 years or so as the trusts for Medicare/Medicaid and Social Security were both set to run out right around the time that many baby boomers were leaving the workforce, beginning their fixed income, and starting to rely on the nation’s social safety nets.

So it is the combination of these macro forces (aging demographics, rising interest rates, previously existing debt, a temporary sale on tax rates) in conjunction with the debt-financed stimulus of the pandemic that has led taxes to be such an unprecedented threat to your retirement. The fear is that taxes will have to increase dramatically to simply maintain Uncle Sam’s entitlement promises and stop adding new debt onto the nation’s existing credit card balance!

What does this all mean for your retirement?

If the BBB bill is actually dead, then it means that we have only 4 years to utilize the TCJA tax sale for Roth conversions and strategic tax planning.

With the tax sale expiring at the end of 2025, increased marginal tax rates mean we must anticipate higher costs for a Roth conversion in 2026 and beyond. But we also know that the math simply doesn’t work for that to be the last tax hike that your retirement will ever have to overcome – that small increase in tax rates is nowhere near sufficient to completely fund/address all of the issues previously outlined. Most economists agree that as the dust settles, Uncle Sam will be left with a politically unsavory set of options to choose from: reduce entitlement spending or increase tax revenue dramatically.

So, as the scope and scale of our fiscal trajectory issues come to light and are juxtaposed against the realization that the IRS loves most federal retirees (because their robust retirement income is robustly taxable), it becomes clear why so much emphasis is being put on proactive planning during the 4 remaining years of the TCJA tax sale!