Allow me to paint a picture: an investor tosses a dart towards a wall full of investment choices. Over the last decade or so, they were bound to hit a winning one. Even the most unthoughtful, disorganized strategies were experiencing incredible returns. Investors across the globe felt like they could give Warren Buffett a run for his money, in jest.

This in turn has created a sense of security in what many people have called their investment policy–picking six index funds to hold and logging out of their investment portals. Index funds are an integral part of a portfolio, but like every tool, there’s a right and wrong way to use it. We use indexing for nearly all our clients, but the set-it-and-forget-it method isn’t appropriate for anyone already retired or approaching it in less than five or so years.

When markets trend towards a favorable direction, investors convince themselves that the short-term volatility they experience during it, is the volatility that comes with investing. While that’s somewhat true, it’s not the full story. We have not seen a more “normal” pullback period arguably since the housing financial crisis. Prior to this last cycle, investors experienced a true bear market and recessionary period more frequently. This meant that it was fresher on their minds.

Today, most federal employees approaching retirement now/soon couldn’t be bothered to care so much 13 years ago. They weren’t paying nearly as much attention as now, and it makes sense—if you have 10+ years before you stop working and you’re well-diversified, volatility is much less of a risk to you.

So, they placed their trades, tried not to look at their accounts too much when things were down, kept living their lives, raising kids, and contributing to their portfolio. Fast forward a decade, and those same investors are now approaching the end of their careers, and we finally begin to experience negative returns for longer than 4-6 weeks in the markets (COVID).

Investors are seeing headlines about tumbling markets more frequently, their account balances keep falling, there’s more talk about how poorly their TSP and other investments are performing, and people start to doubt whether they’ll actually retire in the next year or two like they wanted.

But then they remember the article they read about what to do when volatility like this comes back. They’re reminded that volatility is temporary, never to time the markets, and that having a solid investment strategy will allow them to weather the storm.

But remember, what’s their investment strategy? Picking six index funds and walking away. It’s not even their fault. If we look at performance reports of index funds, most of them report only the last 10 years. And what do we know about the last 10 years? That while this strategy worked for this period, it is not representative of a true full market cycle. This core fact is the reason that some fund managers do really well for periods of time and get destroyed during others. The markets’ cyclical nature demands a new strategy in each cycle.

But what if the markets do rebound quickly like they have? Then you’re still on track to meet your goals. But the real risk is that what if they don’t? That comes at a cost. The cost looks differently for everyone, but in many cases, it means someone isn’t able achieve a life of financial dignity and independence.

Market Cycles Determine Emotion Cycles

Unemotional experience is the key. Creating and executing upon an investment policy statement (IPS) can be an incredibly temperamental process, especially so when volatility returns as it has lately. This is the reason an IPS is created, to memorialize and remind ourselves of the objectives. It’s not just a fancy term, it’s a mandate in portfolio management theory.

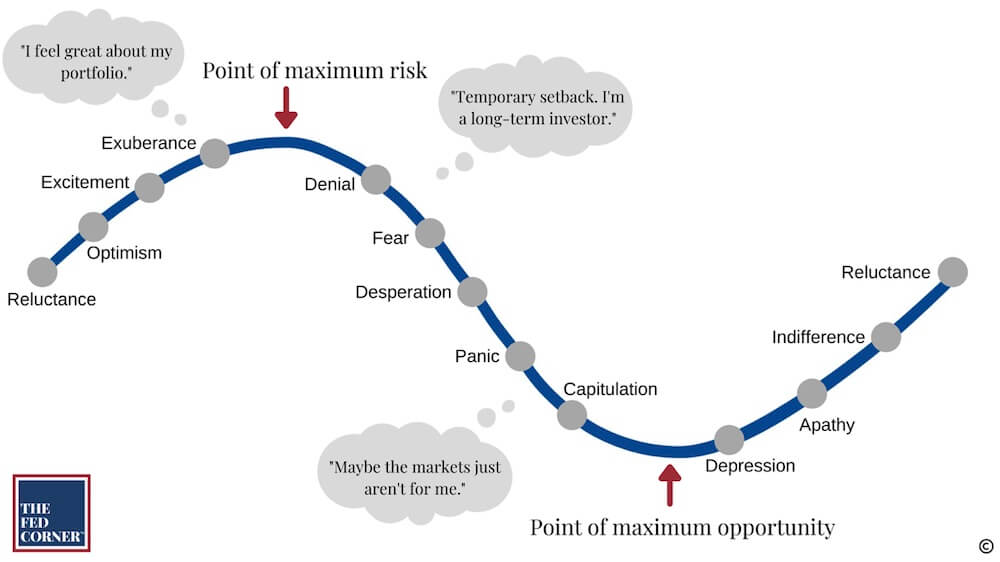

We experience emotions as humans, and if you add your own money to the mix, those emotions become compounded. I’ve shared this image before, but it’s applicable here again. This graphic illustrates the emotional cycle that investors feel. The blue line represents the overall stock market’s pricing.

If you’re attempting to save your portfolio by changing allocations to cut your losses, it’s too late. Investors cannot attempt to make tactical “bleed-stop” moves during explosive periods in the markets.

Investors have had very brief and ephemeral periods of negative feelings towards the markets over the last decade. COVID-19 created a lot of panic, but its impact on the markets were incredibly short-lived. Extended periods of recessionary markets can do very bad things not only to your net worth, but also to your attitude towards the markets.

It’s important to remember that long-term successful investing is a skill, and a change in attitude can cause investors to make poor choices. You must be able to quickly identify this change in yourself and identify whether you are rationalizing with yourself about your choices. One such example was how many federal employees moved chunks of their TSP to the G Fund when the markets tanked in Spring/Summer of 2020. Many of them never realigned themselves to participate in the rapid growth that followed.

Portfolio Torpedo

One of the greatest risks to federal employees that are retired, or nearing retirement, is something called sequence of returns risk. If your portfolio takes a large blow two to three years early in retirement because major index funds are falling from the sky, that single moment can be the death touch to your financial independence. One of our previous columns discusses this concept and shows a real example about what can happen to a portfolio. Make sure you read that article too and look for the chart that illustrates this.

This risk is compounded by having a portfolio strategy based on the recency bias of the last decade. Utilizing solely the major index funds will inherently cause you to experience the massive swings that the market offers. This behavior—participation in full market swings—is by design; it is fundamentally why index funds were created, to offer this broad exposure.

You see, this can be a wonderful thing during the early and middle portions of your career in service, as this broad exposure gives you ample exposure to build wealth over long periods of time. However, these same characteristics becomes a double-edged sword once you have accumulated a significant amount of assets that you need to prioritize protecting.

This is one of the major challenges of the TSP and many other limited retirement plans. Adjusting your allocation on the risk scale is allowed merely by changing your stocks to bonds ratio. Sometimes investors need to maintain the same stock/bond allocation while still taking risk off the table. This is less effectively done with a limited selection of investments. We’re hopeful as planners, that the introduction of the mutual fund window will alleviate this issue.

It’s imperative that federal employees internalize the fundamental concepts of index funds and not fall prey to unbelievable success that a completely passive approach to the markets has worked lately. The high levels of volatility offered by the major index funds is risk in the short term, and opportunity in the long run. If you have less time, you need to address how much risk you’re taking and whether this risk can force you to have to change your goals, timelines, or lifestyle.

Understanding Indexing

Index investing works. As mentioned, we use index funds for most of our clients. There has been countless research about its effectiveness, but it’s not a standalone approach. A doctor might recommend a specific diet for a patient, for a certain period of time. If every person adopted the same diet for their lives, they may get results they weren’t planning for.

Indexing uses two important components of successful investing, low costs and broad diversification, but most indices are not tethered to fundamentals or systematic trading, nor do they cater to any one individual investor’s bigger picture, like their retirement goals or cashflow needs. It doesn’t know your risk tolerance, tax considerations, or personal values.

If one of your goals is to retire, you must understand that index funds will not move in sync with your ever-changing cashflow needs and expenses, financial and planning circumstances. This creates a risk that the index performs in a way that does not support your goals. Subsequently, you must understand how to use the index in a manner that helps, not inhibits, the success of your objectives. Therefore, it is not simply using index funds that grants you success, it is knowing how to best apply them in each season and circumstance of your life.

For example, the yield on the S&P 500 (C Fund) has fallen to all-time lows over the last few years. This makes it fall out of line to accomplish the needs of investors that require both income and growth. An index fund cannot be all things to all people.

Another inherently challenging feature of index funds is its incredibly passive approach to rebalancing. While creating an asset allocation with several layers of indices can dampen volatility, a portfolio solely of major indices tend to experience high volatility and produce less cashflow to support lifestyle. The big equity-based ones tend to experience massive slashes around once a decade, like the S&P 500 in late 2000-2002 and 2008.

These last couple of months were the worst for the NASDAQ 100 since the financial crisis in 2007-8. Let that sink in. Mindlessly indexing among the major indices that everyone talks about and says has been working for them for the last 10 1/2 years may end up being a torpedo to the wealth you’ve worked so hard to build.

During these large and protracted drawdowns, many investors lose the progress they’ve made, along with their long-term vision of their overall plan. This can be crippling, especially if they are retiring soon and don’t have the time needed to fully recover. This is why having a portfolio that takes only a stock to bond ratio into account for an asset allocation is bound to struggle in supporting every family’s needs.

Other Considerations

There are technical elements in economy and lives that should be considered as well. For non-retirement accounts, things like tax-loss harvesting, using tax-free/favored assets, tax-lot coordination, avoiding auto-rebalancing, managing holding periods, etc., can add huge value to an account by preventing excess capital gains and the opportunity cost of reinvesting.

For both retirement and non-retirement accounts, other elements include factors surrounding fiscal and monetary policy, momentum investing, cyclical rotations, dividend growth investments, volatility dampening, and others.

An example of this would be to take advantage of strong companies that have fallen due to a new season in our economy. Just because a stock price is down doesn’t mean that it’s a bad investment.

Many financial or technology companies had their stock prices destroyed in 2008, but simultaneously presented unbelievable growth potential for portfolios. S&P 500 index funds had many of them in the mix, but grossly underweighted many of those companies, because as an index’s job is to track the index, not make the best investment decisions for you and your family.

As a result, broad indices like the S&P 500 did participate in the following growth, but not nearly as well as other portfolios that incorporated a more well-rounded and specialized asset allocation—and here’s the kicker: still only with index funds. When markets sell off like they are now, you need to be buying the areas that make sense.

I reiterate that the challenge is not with index funds themselves, it is in the modality with which investors are using these tools, all while subject to the bias of how well it’s paid off lately to ignore the execution.

A well-constructed portfolio must be both strategic and tactical while accounting for the specific and unique makeup of the investor it’s supporting. Just because indices may be appropriate investments, it doesn’t mean that all of them will always do what you need them to do. Every single index, or manager of indices, will go through stretches of time where they simply do not perform well.

This is the fundamental nature of the stock market. Your goal as an investor should be to consistently maintain an asset allocation using those indices as is appropriate for your risk tolerance and supportive of your financial plan.

Mitigating Risk

One method of testing the success or failure of your strategy is by performing a Monte Carlo analysis on any certain portfolio asset allocation. This form of financial modeling is used to predict the probability of different outcomes when introducing random different variables, such as varying market returns.

The randomness of market returns is a variable for which investors need to account in their plan, and subsequently aligning their asset allocation accordingly. There is a certain acceptable amount of risk that a family can take and still have a successful retirement plan. Risks cannot be controlled, but they can be mitigated, through your participation and exposure to that level of risk.

One such way to mitigate idiosyncratic risk, or the risk of certain asset classes dropping in value, is by having a well-diversified portfolio. If you’re limiting yourself to a small variety of tools, like investment options, you’re limiting your ability to successfully mitigate such risk.

Investors should also consider increasing their cash or cash-equivalent reserves this year. We’re helping our clients talk through their expenses this year and planning accordingly. With volatile markets, the worst thing you can do is to force yourself to have to sell “down” investments to generate needed cash. This too is a challenge the TSP experiences, not allowing the fund selection from which to distribute cash.

During recessionary periods, traditional advice has pointed to as much as two years of cash reserves, in the event of job loss. This risk is less to federal employees so two years is likely excessive, but many families are considering as much as 12 months. Just be careful, high inflation erodes the purchasing power, and not being aggressive enough can will increase your longevity risk—the risk of running out of money before running out of time.

Despite the falling prices of bonds, they’re still an important part of a healthy portfolio for many retirees. If we have an impending recession in the future, rates historically will fall, allowing the bonds to provide the extra boost to your portfolio. Picking the right bonds is another conversation, involving various considerations. Right now, the use of higher yield may be appropriate, as may be TIPS and shorter-term fixed income instruments. The longer the bond period, the more subject to interest rate risk they become.

If your portfolio has taken a hit larger than you’re comfortable with, don’t fret just yet. There are things that can be done, but you need to act sooner rather than later. If you need help, then work with advisors you trust that will put your family back on track, because it’s not just your money, it’s your future.