Several years ago, I was on a plane flying into Reagan National here in DC. I know, remember flying on airplanes?

As we’re approaching the runway, the pilot lets everyone know that there’s some local weather that could cause turbulence. What he didn’t tell us is that he wasn’t certain about how smooth this landing was about to be—rather, not be.

As we fall from the sky toward the tarmac, there’s a nervous murmur among passengers and a few muffled screams. Our miraculous, safe landing is accompanied by the flight attendant getting on the horn to say, “Welcome to Reagan National airport, the captain will shortly shuttle what’s left of the plane to the loading dock.” The murmur switched to laughter, as people picked up their dropped books, cell phones and tablets.

I forgot about this story until recently. You see, we don’t remember the soft landings, and we often don’t remember the hard landings either, just getting to the destination.

Hard landings feel like a crash while they’re happening, only to fade away in memory as we move on with our lives. Right now, our economy is experiencing turbulence, and can’t know whether we’ll spill our drinks. Every market decline of this magnitude has its own unique precipitating causes.

It’s fair to say that the current episode is a response to a confluence of issues, including but not limited to severe inflation, the Fed’s “late to the dance” and extreme response to same, Russia’s war on Ukraine and domestic and international supply chain issues, among others.

To make matters worse, the financial edutainment pundits continue terrifying investors, causing them to panic and reach for their parachutes at dangerous altitudes. They bring us their “The end is near” drama with a barrage of Breaking News chirons, complete with the graphic containing the red double down arrows and the word “TURMOIL” in all caps, as the S&P 500 approached its not-unanticipated official bear market territory.

Peek Behind the Curtains

What’s next in the markets? We seldom can pinpoint the “when”, but the “what” is rather formulaic.

Markets move between bull (up) and bear (down) historically around every 5-7 years. There are things we see coming, and there are things that we cannot anticipate, formally known as “black swans” which are triggers for these turning points. COVID was an example of such.

While we can’t predict a bull, because it’s not predictable, we can and do anticipate it. And more importantly, we can control our response. We are all uniquely participating in the markets and use them as an important tool to help reach our goals. This is why focusing on planning is so important.

Markets are cyclical. Some things are predictable: right now when rates are rising, tech stocks, including biotech, are retreating in part because they finance themselves by borrowing in a market where the cost of borrowing is increasing. Consumer spending is different now than it was at the height of the pandemic because people are going to the theater and eating at restaurants rather than relying on DoorDash and Netflix to keep them physically and emotionally sated. Company profits have changed, and thus so do investment strategies.

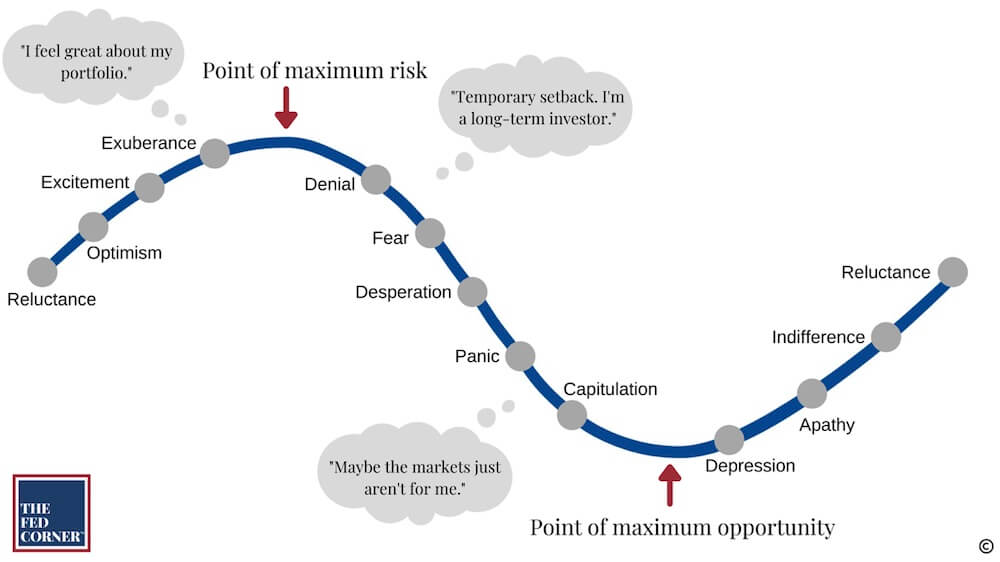

Psychology indicates that we hate losing more than we love winning, which is why we run for the gates at the first sighting of a bear. When markets are good, everyone becomes aggressive. When markets are bad, everyone becomes conservative. It’s a visceral response.

There’s a reason there’s a Nobel prize in behavioral economics. Having a portfolio structured to a place that manages the volatility before your gut exerts its power over your brain helps protect you.

Understanding and talking through your choices and the preferred options can enhance portfolio outcomes in a volatile market. “Set it and forget it” causes you to fall prey to the market’s redirection. Conversely, capitulation to a bear market by fleeing has often proven to be a tragedy from which an investor’s retirement plan may never recover.

The big market losers continue to be investors who get out at the bottom and put their money under the mattress until after the big recovery, when they once again think about getting back in.

We know how difficult it can be to see your money decline in value—we’re investors too. But the likelihood of this landing turning into a devastating crash landing is slim. Newer investors have less experience with big market selloffs, but as winter is followed by Spring, the regularly occurring bear goes back to his den, followed, their hungry devastation to be continued by the next bull, pulling the cyclically redirected market toward its next goals.

Past is not prologue, to be sure. But this has been the pattern since there was a market, while people screamed, “This time is different!” only to find that, once again, it is not.

Your goal should never be to completely insulate yourselves from the short-term swings of the markets. Doing so would mean that you’re not properly invested to reach your long-term goal of maintaining your financial independence. Our clients of many years have seen how portions of their wealth have different jobs in its overall mission of supporting them.

We believe strongly in the science of it. It’s in our name: Risk Management–calculating and measuring the appropriate types and amounts of risk to take. Investors need to set up portions of their portfolios for this exact moment in the market cycle, so that they can continue to live without the burden of financial uncertainty.

This comes from both good planning and solid research—understanding your objectives and their timelines, then aligning your resources in a way that best help you achieve them. Just as we change our wardrobe for the seasons, so must investors adapt to the changing environment and realign their wealth of resources.

Getting Technical

The last decade-and-change has been an incredible run-up of the equities markets. From the bottom of the global financial crisis in 2009 to the end of 2021, we saw the longest bull run that the stock markets have ever seen. Even through the pandemic, which caused but a momentary blip to the markets, equities continued to rocket to new highs.

But it’s evident that some part of that extraordinary accretion in equity values was due to excessive monetary stimulation by the fed, and to that extent, we are having to give some of that gain back, as the Fed moves to bring the resultant inflation under control. We should, I believe, want them to do this, even if it means the economy slows. In the long run, the cure (possible recession) is not more painful than the disease (inflation).

The fed is slated to pull out of the bond markets in June, and we’ve got that date circled on our calendars. The fed creates liquidity in the bond market as a modality of stimulating the economy.

They were still buying billions in bonds while house prices skyrocketed, and the markets hit newer highs. Growth has slowed significantly, and the fed insisted on raising rates. This caused part of the destabilization, so I don’t believe that the markets are over-reacting. In fact, this is nearly a textbook bear. It’s orderly, and the markets are trying to find footing after having been whiplashed in several directions.

In one way, this is the poster child of what a normal correction looks like. This decline is mathematical in nature, valuations are stabilizing for many transparent reasons, and people still have jobs. This is end-of-cycle behavior.

This isn’t a pandemic where we have no clue what can happen, nor are hundred-year-old banks collapsing. Unless the federal reserve pushes us into a deep and protracted recession, which is never off the table, right now this is merely equivalent to waking up late on a rainy Monday morning, and realizing you’ve run out of coffee as you stumble your way to work.

I heard a sobering stat recently. Here’s what the normalizing looks like on a practical basis: late last year, Zoom, a video conferencing software, was bigger than Exxon in terms of market capitalization. In the blink of an eye, Exxon has returned to 13X bigger than Zoom. Investments have a calculated valuation with that price being further adjusted by its sector, market consensus, how institutional investors feel it, and myriad other considerations.

Many technology names had rallied so far beyond acceptable levels, and this caused biased optimism among the tech indices, which drags many other positively correlated indices with them. Remember, many index funds include the same names and have overlap. Big swings in tech moved swaths of the market. We’re finally beginning to see a needed reset of valuations.

If there is a recession on the loom, then we have more to fall because trading multiples still need to come down from where they are right now, and corporate earnings would follow. The most important thing we can do right now is to focus on the fed. We’ve not seen the third act of the play, which is the fed backing out of the fixed income market this summer.

They do not care about stock market prices; the stock markets are just one component of the overall economy. But the fact is that they made a mistake with their policy and were contributors to the high inflation. Their job is to maintain price stability, and so now they take on the role as whip.

You’ve heard us say that market price corrections are like cliff-jumps, while market price accretion is like scaling a mountain. It’s sluggish, sometimes you stop, and sometimes there are dips before angling upward again.

There are many different topics in financial planning beyond your portfolio, and despite a currently less favorable market, a good plan can still help build towards a successful future.

Remember that the greatest sign of success is your ability to live your lives uninterrupted by what happens in the markets and economy. That’s what you should be building toward because it’s not just your money, it’s your future.

So be encouraged by the long-term successful progress and remember that this turbulence will too fade away in memory as just another rainy day.