The amount of the 2023 COLA estimate is up in the air, but expectations for a record-setting percentage are abundant.

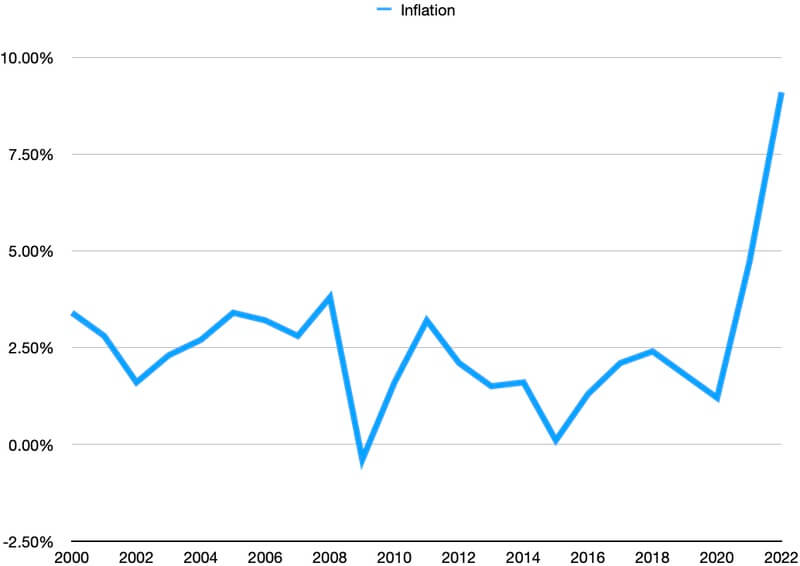

The inflation data this year show inflation at its highest since 1981. In 1981, inflation was at 10.3% and the annual COLA was 11.2%. But, in fairness to former President Carter, who was defeated in seeking a second presidential term in large part due to inflation, the economy and the Iranian hostage crisis, the method of calculating inflation has changed.

The current trend in inflation may actually be higher than it was during the Carter years if the way it was calculated had remained consistent.

About the 2023 COLA Estimates and Predictions from Politicians

Apparently, the prognosticators do not have a great deal of faith in political predictions about the inflation rate. Perhaps that is because President Biden initially said any inflation would be “transitory” or “temporary”. That prediction was before there were 13 months of higher inflation that is not transitory or temporary.

Treasury Secretary Janet Yellen said initially inflation was only a “small risk“. That was also wishful thinking.

It now appears the economy and inflation are likely to be a major factor in the upcoming national elections in November.

2023 COLA Could Possibly Be Largest In Over 40 Years

Social Security recipients and retired federal employees could receive one of the largest increases yet in benefits next year. The annual COLA could hit a 40-plus-year high, according to estimates from the Senior Citizens League, a nonpartisan seniors group.

It is unlikely though that, with the current inflation measurement, that inflation will exceed the 14.3% COLA of 1980.

The COLA for 2023 is likely to be 10.5%, the highest since 1981, when it was 11.2%, according to Mary Johnson, a Social Security policy analyst at the Senior Citizens League. The increase is 1.9 percentage points more than the 8.6% estimated in May as inflation continues to accelerate and outpace expectations.

The BLS data showed that the CPI index rose 1.3% for the month of June and 9.1% from a year ago.

Johnson noted that if inflation runs even higher than the recent average, the COLA adjustment could hit 11.4%. On the other hand, it also could stall at 9.8% if inflation runs “cold” or lower than the recent average, she said.

Another recent 2023 COLA estimate—this one from the Committee for a Responsible Federal Budget and released before the June CPI figures were announced—predicted a 10.8% increase.

How 2023 COLA Will Be Calculated

Here is how the COLA calculation works:

- Consumer Price Index (CPI-W) readings are taken from the third quarter (July – September) of the current year.

- These data are compared to the average CPI-W reading from the third quarter of the previous year (2022).

- The average reading from the third quarter of the current year (2023) is compared to the figure from the third quarter of 2022.

- The difference, rounded to the nearest 0.1%, is what beneficiaries will receive as an increase in 2023.

- The question is how much will inflation increase and what will the final COLA calculation be. The answer to this will be calculated and announced in mid-October.

- In 2022, federal retirees received a 5.9 percent COLA increase for Civil Service Retirement System (CSRS) annuities and Social Security benefits. There was a 4.9 percent increase for Federal Employees Retirement System (FERS) annuities beginning in January 2022.

As most readers know, the final amount of the 2023 COLA increase will not have any direct impact on the annual raise for current federal employees. Currently, a raise of 4.6% is the best guess. Obviously, if inflation continues to go higher in the coming months, this amount could change when Congress passes the next budget or President Biden issues an unexpected alternative pay plan for 2023.