New Medicare Advantage plans have become available to federal annuitants over the last few years. For many, these plans offer the lowest estimated yearly cost for healthcare coverage in retirement. We’ll walk you through the basics of Medicare Advantage, available plan options, how much you can save by joining, how to enroll, and more.

What is Medicare Advantage, and what plans are available to FEHB annuitants?

Medicare Advantage (MA), or Part C, is an alternative way to obtain Medicare coverage from private insurers. MA was designed to look like Federal Employees Health Benefits (FEHB) Program, with private plans competing with each other and traditional Medicare during an Open Season. MA plans all cover hospital and physician services including skilled nursing care and home health care (Parts A and B). Most MA plans also provide Part D, or prescription drug coverage, at little or no extra premium costs. Most MA plans are open to all Medicare enrollees, but some are designed just for retirees from particular employers.

A handful of FEHB insurers offer MA plans that are specially designed for federal annuitants. The availability of FEHB MA plans varies depending on where you live. You won’t find these FEHB MA plans in the main sections of the plan brochure; if available, they’ll be described in section 9 as the Medicare Advantage plan or sometimes as “Senior Advantage” or “Retiree Advantage”. You’ll pay the regular FEHB premium and no additional premium for the MA plan.

Aetna Advantage, APWU High, and MHBP Standard MA plans are available nationwide to all federal annuitants. Rural Carrier and Compass Rose are available nationwide as well but have enrollment restrictions.

Kaiser plans are available in Washington, D.C.; Atlanta, GA; Denver, CO; Northern California; Southern California; Fresno, CA; and in Hawaii and Washington and parts of Oregon and Idaho.

United Choice plans are available in almost half of the U.S.

Humana Value is available in parts of Florida, Georgia, Arizona, Illinois, Kentucky, Missouri, Ohio, Texas, and Tennessee.

How much money can I save joining a Medicare Advantage plan?

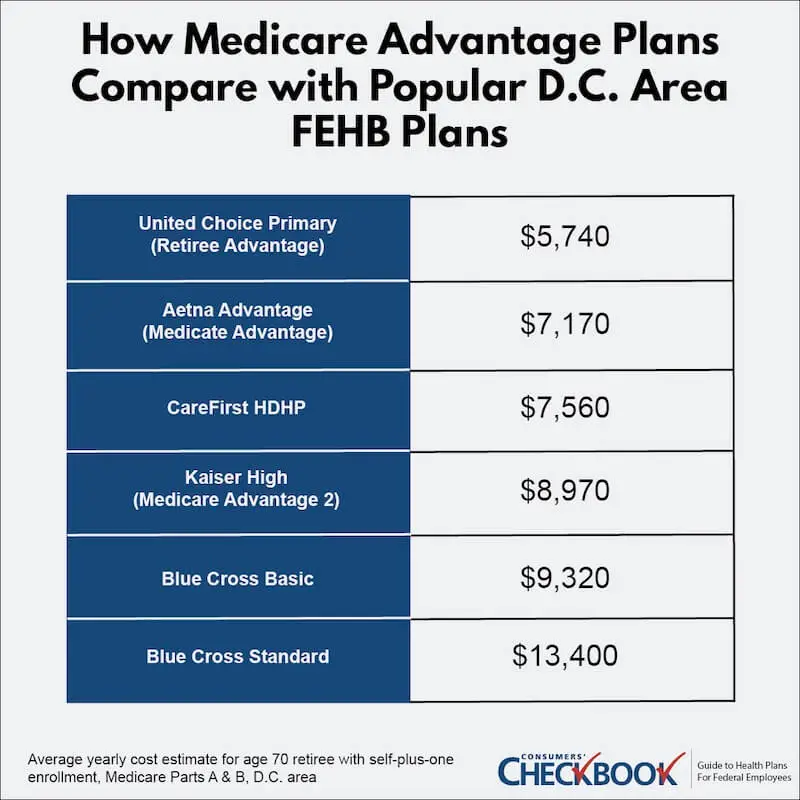

When we rank all options in Checkbook’s Guide to Health Plans by estimated yearly cost—the combination of premium plus expected out-of-pocket costs based on the user’s profile—we see dramatic savings for some of the FEHB MA plans because of almost no out-of-pocket health expenses besides prescription drugs, plus generous Part B premium reimbursements.

MA plans offered by APWU, UnitedHealthcare, Humana, MHBP, Compass Rose, Rural Carrier, and Aetna charge $0 for any inpatient or outpatient benefit, and they have no out-of-pocket maximum for healthcare expenses other than prescription drugs, with the caveat that the care is medically necessary and received from providers that accept Medicare.

All FEHB MA plans offer some Part B premium reimbursement, which ranges from $50 per month with APWU High to $148.50 per month with United Retiree Advantage to $250 per month with the Kaiser California Senior Advantage 2 plan. If you join some of these FEHB MA plans, you’ll pay little or no Medicare Part B premium after reimbursement.

For annuitants living in an area of the country served by UnitedHealthcare FEHB plans, you’ll save money—in some cases thousands of dollars in reduced premium costs and reduced or no medical costs—by joining their MA plan.

For example, for the 2022 plan year, a retiree who is 70 years old and living in the D.C. area with self-plus-one enrollment and Medicare Parts A & B with income below $182,000 can enroll in United Choice Primary Retiree Advantage and save about $1,800 in estimated yearly costs compared to the least expensive FEHB plan with Parts A & B, CareFirst HDHP. You can save even more if you switch to the United MA plan from one of the popular BCBS plans. If you enroll in the United MA plan, you’ll save about $3,500 compared to BCBS Basic, and you’ll save about $7,600 compared to BCBS Standard in estimated yearly costs.

There are multiple United Choice FEHB plans, but since you’ll be receiving the same United Retiree Advantage plan regardless of FEHB plan, enroll in the one with the lowest FEHB premium. For 2022, that’s United Choice Primary in all areas where this plan is offered.

If your area isn’t served by UnitedHealthcare, Aetna Advantage is a national plan that has the same $0 out-of-pocket cost feature (besides prescription drugs) for approved care from a Medicare provider, with a less generous Part B premium reimbursement of $75 per month. You’ll find that in your area the Aetna Advantage MA plan will be the least expensive option compared to the least expensive FEHB plan with Parts A & B.

What are some other reasons to consider FEHB MA plans?

MA plans must offer at least the same level of coverage as Original Medicare, or Parts A & B, but many plans have additional benefits. You’ll find some offer hearing aid coverage, vision care, and numerous wellness benefits such as tobacco cessation, weight management, fitness center memberships, and meal delivery services after a skilled nursing facility discharge.

You’ll also have a greater choice of providers with many of the FEHB MA plans. For example, with United Retiree Advantage you can see any provider in-network or out-of-network as long as they accept the plan and haven’t opted out of Medicare.

FEHB MA plans are great options for couples where one spouse is enrolled in Medicare, and the other spouse is younger and not yet Medicare eligible. The Medicare enrolled spouse can join the MA plan and will receive the MA plan benefits and the younger spouse will receive the FEHB plan benefits. Make sure that you review the FEHB plan thoroughly to understand the FEHB benefits that the younger spouse will receive including the plan provider network and prescription drug formulary.

How do I enroll?

Enrollment for the FEHB MA plans requires three separate steps that should be done in the following order:

- Apply for Medicare Part B at Medicare.gov. You won’t be able to join an MA plan without enrolling in Part B first. This takes the longest amount of time, so it makes sense to start here first.

- Enroll with OPM in the FEHB plan that corresponds to the MA plan that you want to join. Remember, retirement is not a qualifying life event, but you can change your FEHB plan every fall during Open Season or during the 30 days before you turn 65.

- Contact the provider to enroll in MA. Once you’ve joined in the correct FEHB plan with OPM, wait a couple of business days and then call the insurance carrier to enroll in the MA plan.

Aetna – 866-241-0262

APWU – 855-383-8793

Compass Rose – 844-279-9286

Humana – 855-235-8579

Kaiser – 800-581-8252

MHBP – 866-241-0262

Rural Carrier – 888-267-2637

UnitedHealthcare – 844-481-8821

Who shouldn’t enroll in a Medicare Advantage plan?

If you fall into one of the high-income categories that triggers greater Medicare Part B premiums and you expect your income to stay at Income Related Monthly Adjustment Amounts (IRMAA) levels throughout retirement, you likely won’t benefit financially from an FEHB MA plan. IRMAA kicks in when your income exceeds $91,000 as an individual or $182,000 as a couple.

Even at the first tier of IRMAA premiums—income above $91,000 and below $114,000 for an individual and above $182,000 and below $228,000 for a couple—the FEHB MA plans will not be your least costly plan choice available. You’ll find a handful of FEHB plans paired with Medicare Part A as the lowest yearly cost options. However, you’ll find the United Choice options still rank well and should be considered along with your decision about whether to enroll in Medicare Part B.

But, if your income will be that high only for a year or two, joining Part B and then enrolling in of the FEHB MA plans will avoid a late enrollment penalty for Part B, and save you money after you no longer pay higher IRMAA premiums.

If your income places you in the second IRMAA tier or above—income above $114,000 for an individual and above $228,000 for a couple—you won’t benefit financially from joining an FEHB MA plan or enrolling in Medicare Part B. You’ll have much lower annual costs sticking with your FEHB plan paired with just Medicare Part A.

If you plan on living abroad in retirement and require routine medical care, you should not enroll in a FEHB MA plan. No FEHB MA plan provides routine medical care overseas. Since you are still enrolled in an FEHB plan, you will still be covered for emergency care overseas when you travel if you have a FEHB MA plan. All FEHB plans cover emergency overseas care. For routine overseas medical care you’ll be better off in a plan such as Blue Cross Standard, Blue Cross Basic, or Blue Cross FEP Blue Focus which all have international provider networks. Or, if you’re eligible you could join these restricted enrollment plans with good coverage abroad—Compass Rose or Foreign Service Benefit Plan.

What about quality?

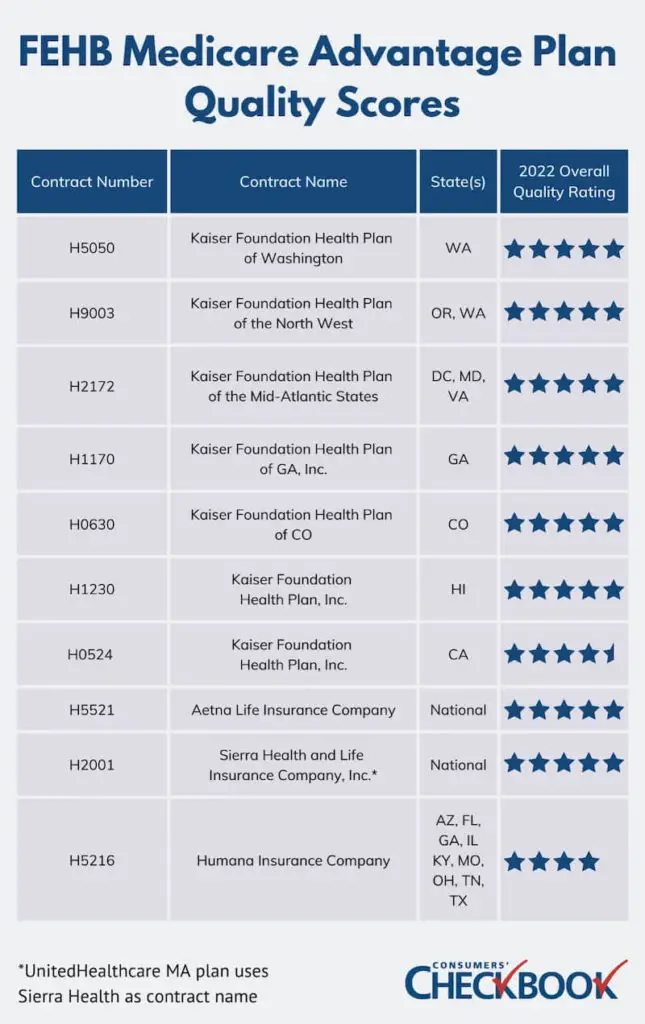

FEHB MA plans have quality ratings. However, unlike the FEHB plan quality data that uses just federal employees and annuitants to sample from, the FEHB MA plans include non-federal plan members as part of the survey sample. As a result, the ratings from the survey don’t entirely reflect federal annuitants’ experiences with an FEHB plan and an MA plan. But since others in the survey will experience similar plan management, the ratings will still be of value.

The FEHB MA plans score well for overall quality, and all have at least 4 out of 5 stars, with several plans rated at 5 out of 5 stars.

The Compass Rose and APWU High MA plans are managed by UnitedHealthcare. Use Sierra Health and Life for quality ratings. Rural Carrier and MHBP Standard MA plans are managed by Aetna and the Aetna plan quality ratings should be used.

There are individual quality measures, such as customer service, breast cancer screening, and dozens more that can be reviewed on the Medicare Advantage performance data site. You’ll need the plan contract number to review the information.

Should I suspend FEHB and join a Medicare Advantage plan?

Federal annuitants can suspend FEHB enrollment and join an MA plan. In this scenario, you would just pay the Medicare Part B premium and any additional MA premium, which is usually only a few hundred dollars per year and often nothing at all. You can switch out of MA during any future Open Season and rejoin FEHB as if you never left.

While this generates substantial premium savings, you’ll face higher out-of-pocket costs than with the FEHB MA options that have no out-of-pocket costs for approved care. That’s because you’ll be subject to either copays, coinsurance, deductibles, or sometimes all three for some or most of the medical services you use. These out-of-pocket costs erode premium savings and makes the suspend scenario less desirable financially compared to an FEHB MA plan with zero out-of-pocket costs, besides prescription drugs, and a Part B premium reimbursement.

Important note: You cannot suspend your FEHB enrollment and join one of the FEHB MA plans discussed in this article. Those plans require you to be enrolled in the FEHB plan to enroll in the MA plan option.

The Final Word

For federal annuitants who don’t need routine care overseas and are not subject to higher IRMAA Part B premiums, you absolutely must consider joining an FEHB MA plan. They offer most federal annuitants significant savings, enhanced benefits, and greater provider choice than your existing FEHB plan with Original Medicare.