Earlier this week, roughly 70 million Americans receiving Social Security also received some good news: the cost-of-living adjustment, or COLA, for 2023 may be the highest increase in 40 years. Moreover, this jump may be the highest that many currently receiving benefits have ever seen.

The estimates are out from the well-respected Senior Citizens League, based on a calculation derived from various factors, including the consumer price index, or CPI. They estimate that Social Security benefits could be increased by as much as 8.7% for 2023.

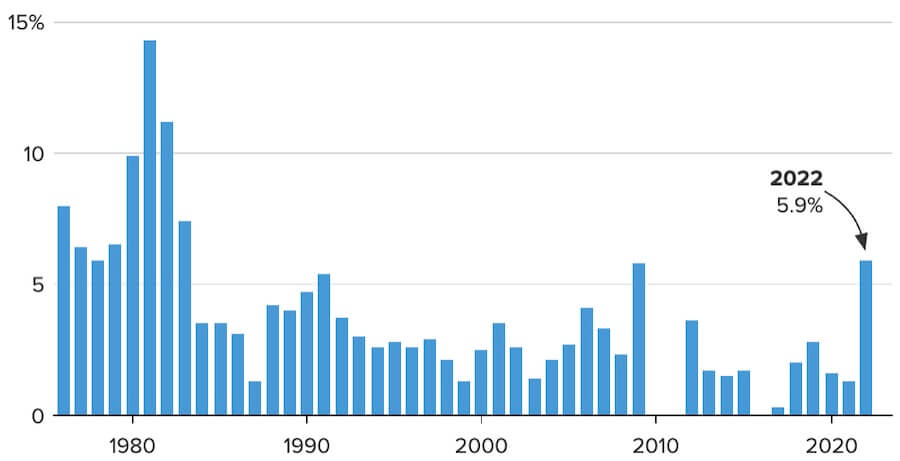

This is a marked difference from the increase experienced earlier this year of 5.9% and comes at a much-needed time as prices for goods and services continues to rise. Inflation remains high at over 8% for the month of August.

The last time the SSA approved bumps this high was in the late 1970s/early 1980s, as demonstrated by this graph below by CNBC with data from the Social Security Administration.

While it’s good to see an increased likelihood of COLAs being over 8%, there are three major points to consider and factor from a planner’s perspective.

The first is to understand that this is still an estimate. It’s down very slightly from the previous estimate but tracks closer to the real figures that the Social Security Administration will use when determining the final COLA figure in mid-October based on CPI-W figures for the months of July, August, and September.

Between now and then, there are several factors that could change this number, including if inflation tapers off and if the Fed continues its hawkish position, which is expected.

The second variable to watch for is September’s inflation data. If September’s inflation data comes out that we’ve reduced in inflation, that could have an impact on the SSA’s decision when finalizing benefit COLAs for next year.

The next factor to note is to put this new information through the filter of your personal circumstance. Everyone’s financial position is different, and there are variables that impact how much of your Social Security benefit you will take home.

Many federal employees take Medicare Part B as well as FEHB (or Tricare), and if you do, you know that the Part B premium impacts your Social Security paycheck. While the Medicare offices project that premiums will be similar for 2023, if there is an increase in the premium rates, the Social Security increase will be less impactful. We will receive more information on those changes in November.

Retirees also should remember that Social Security is taxed for most people, especially if you live in an expensive area. Your taxable income has to be relatively low in order to not have these benefits taxed. If you’re making withdrawals from your traditional retirement accounts (TSP, IRAs, 401k, 403b, etc.) to support your current lifestyle, those dollars are counting towards your taxable income and forcing most of your Social Security benefits to be taxed, as explained below.

Good tax-planning combined with well-planned distribution strategies can be a major factor in helping reduce not only direct taxes, but also in helping your Social Security benefits be as minimally taxed as possible.

Individual filers with combined income:

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable.

Joint filers with combined income:

- between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $44,000, up to 85 percent of your benefits may be taxable.

As planners, we’ll be paying close attention to what’s happening downtown and the various economic indicators as we approach the significant months of October and November. With new information readily incoming to stack on the unrelenting inflation, it’s a great time to revisit your plan and ensure you’ve made appropriate considerations for next year.