Update on TSP Website Problems

As has been widely reported, there were numerous problems when the new website for TSP participants was introduced in June.

August was the third-month participants have been using the new Thrift Savings Plan (TSP) system. The Federal Retirement Thrift Investment Board (FRTIB) provided an update on how the system is working in its monthly meeting held on September 27, 2022.

Here is a brief summary of how the new system has progressed recently.

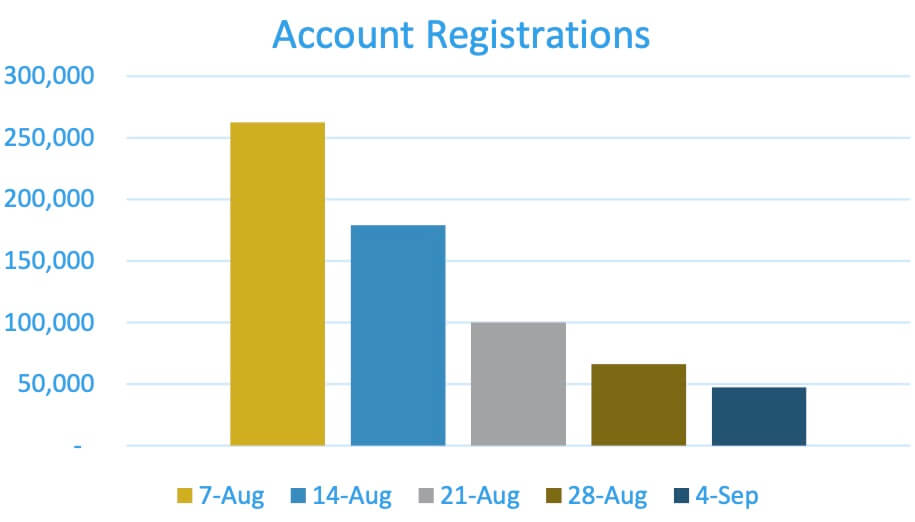

- Over 700,000 participants set up their new accounts online in August with over 2.3 million participants now signed in online.

- The number of participants logging in through the website and mobile app continues to climb, with most participants logging in through the web.

- Over 115,000 people have downloaded the TSP mobile app in August. The number of mutual-fund-window funded accounts increased 36%, rising from 1,398 to 1,901.

- There is an increase in loan withdrawal activity.

TSP Fact Checking

As part of the update on the TSP system, Tee Ramos, Office of Participants Services for the TSP, conducted a briefing he called “TSP Fact Checking”. He noted that over the past several months, a number of problems had been reported. Here is a summary of his presentation listing the comment or complaints and the current status of the issues.

You can’t get through when calling the TSP!

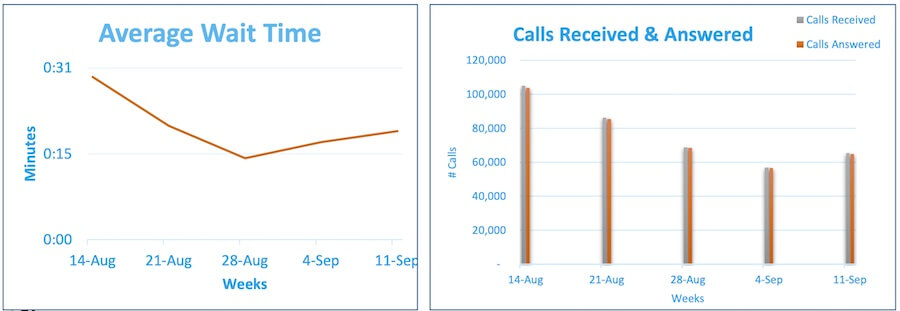

- Calls are now being answered within 30 seconds on average.

My account was not right after the blackout!

- The TSP received over a dozen inquiries from participants over accuracy and fund allocation.

- Every reported case of an inaccurately converted balance ended up being unfounded.

My beneficiaries were lost after the blackout!

- 4.8 million accounts leverage “order of preference” (no beneficiaries on file)

- 1.4 million accounts had beneficiary information on file and none were lost

- 1.24 million were converted electronically into the new system

- 157,000 Beneficiary Accounts were not converted electronically (TSP-3 Forms remain on file)

You Can’t Set up your account!

- 2.5 million participants have successfully set up their new My Account log in

- 92% of all attempts have been completed online

- TSP encourages everyone with an account to set up their new login

The Mutual fund window is a failure as no one is using it!

- FRTIB expected a usage rate of 1-2% of TSP participants over the next several years; the MFW provides options. It is not useful for all participants.

All TSP Funds Have Negative Year-to-Date Returns (Except for G Fund)

Any doubts investors may have had about whether there is now a bear market in stocks now know the answer.

Through September 26, 2022, all TSP Funds have a negative return for the year with the exception of the G Fund which has a return of 1.91% so far in 2022. All of the TSP core funds are down so far in September and for the entirety of 2022.

The TSP fund with the largest loss is the S Fund, down 30.24%. The C Fund is down 22.42% and the I Fund is down 27.39%. Here is how all TSP Funds are performing in September and for the Year-to-Date:

| Fund | Month-to-Date | Year-to-Date |

|---|---|---|

| G Fund | 0.24% | 1.91% |

| F Fund | -4.58% | -14.54% |

| C Fund | -7.48% | -22.42% |

| S Fund | -10.41% | -30.24% |

| I Fund | -9.57% | -27.39% |

| L Income | -2.18% | -5.85% |

| L 2025 | -3.69% | -10.93% |

| L 2030 | -5.41% | -15.85% |

| L 2035 | -5.97% | -17.50% |

| L 2040 | -6.49% | -19.06% |

| L 2045 | -6.96% | -20.44% |

| L 2050 | -7.39% | -21.69% |

| L 2055 | -8.57% | -25.03% |

| L 2060 | -8.57% | -25.04% |

| L 2065 | -8.57% | -25.05% |

Average TSP Balance Drops for TSP Investors

With the large drop in stock prices this year, it is not a surprise that the average balance in the TSP accounts has dropped. For those in the FERS system, their average TSP balance has gone down 12.44% since the end of December. For those under CSRS, their average TSP balance is down over 9.9%.

This chart shows the average TSP balance and the average Roth balance at the end of December 2021 compared to August 31, 2022.

| Category | Participants December 2021 | Participants August 2022 | December TSP Balance | August TSP Balance | December Roth Balance | August Roth Balance |

| FERS Investors | 3,766,146 | 3,840,668 | $181,279 | $158,726 | $22,942 | $21,191 |

| CSRS Investors | 274,520 | 268,791 | $195,424 | $175,990 | $31,667 | $29,120 |

Additional TSP performance statistics as of the end of August 2022 are provided in this short slideshow.

FedSmith will provide readers with a monthly and yearly update on the TSP performance for all TSP Funds on October 1, 2022.