The question of “How much do I need to retire?” has been asked by millions and attempted to be answered by many. I met with a family recently to discuss their retirement plan, and they brought up an article from Fidelity that discussed how much you need to save to be able to retire.

It’s a popular article that helps people focus on saving, but the challenge is that this article utilizes rule of thumb advice that has a few major planning flaws, leaving readers vulnerable to some significant misunderstandings.

Fidelity is a respectable company in the investment space, but I take issue with utilizing off-the-shelf retirement advice. In helping countless families retire over the years, we have found that “one-size-fits-all” retirement planning just doesn’t work well, and we’ll show you exactly how things can go wrong.

Specifically, we will illustrate examples from our retirement planning process, and model out the exact scenario portrayed by Fidelity so that you can see the impact of life’s curveballs.

Multiples-of-Income Fallacy

Without having you read the whole Fidelity article, the main point they make is that you should have milestones for saving multiples of your income by certain ages.

I actually like this part of their article, because it encourages younger people to be saving more aggressively for their retirement. I also appreciate their mention that lifestyle impacts this.

But here’s where things start to get troubling – they indicate to save 10X your annual salary by age 67.

The first issue I have with this is that most federal employees tend to retire sooner. Depending on how long you’ve been a fed, you have your FERS pension available as early as 56-57 years old (sooner if under special provisions). If you haven’t been a fed your whole career, you likely have your unreduced pension at 60 or 62.

This is a substantial amount of time sooner than Fidelity’s 67, which means you’ve not had as much time to save, and inflation will have that much longer to impact your savings. But for an apples-to-apples comparison, we’ll play ball and assume retiring at 67.

The next major flaw with their analysis is seen when we read their assumptions at the bottom. In their analysis and modeling, they’re only replacing 45% of the income during the retirement years.

This essentially means they’re modeling your expenses to be 55% less in retirement. If you’ve seen any of our other content, we regularly discuss how most families don’t spend that much less in retirement.

You may have reduced your cash outflows by way of having paid off debt, but the reality is that you’re likely going to spend the same as you do now. In fact, in the early retirement years, some of our clients spend more when they first retire. We call those early retirement years the “Go-Go years”.

How much do I need to retire?

To help illustrate the problem with the multiples of income theory, let’s look at the numbers and how they all play out in a hypothetical example.

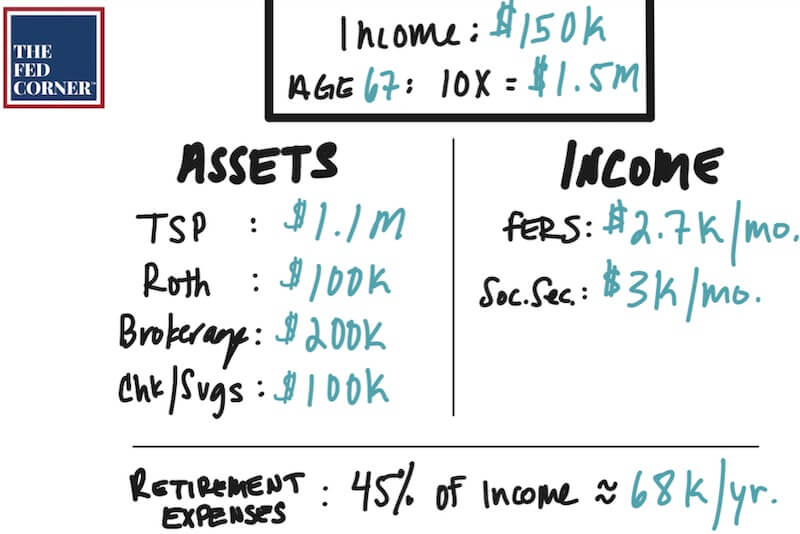

Let’s say we have the full 10X of an income of $150K by age 67. Saving 10X means they have around $1.5M saved, and we’ll break that down into different accounts to make a more realistic example. We also assume a $3K/mo Social Security and 20 years of service with $150K High-3.

Fidelity’s analysis utilizes 45% of salary replacement in retirement, which would be around $68K/yr.

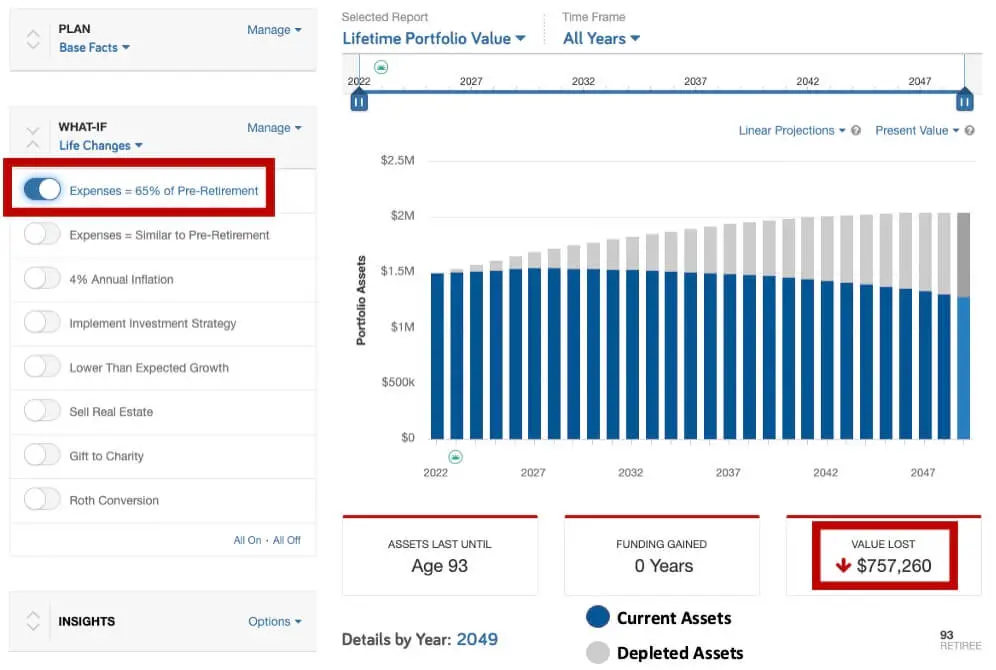

What does this actually look like in a retirement plan? Let’s look at the models. There’s a lot to fit in one image, so if necessary, please zoom in to see the details.

To give you a quick rundown of the technology, the blue bars are portfolio values, and each one represents a year. The numbers reviewed above are inputted into the system, as is an assumed average 2 percent inflation amount, annualized portfolio of around 6 percent, and end-of-plan at age 93 to identically match Fidelity’s model.

At first glance, this looks pretty good, so people think begin to think that the 10X rule of thumb may actually work. But when we look closer, a series of issues become apparent.

With retirement expenses being 45% of pre-retirement income, that’s only around $5.6K/mo in our example. Remember, you likely owe taxes on this money as well, since most retirees have the bulk of their assets in pre-tax retirement accounts.

By retirement, you may have paid off your mortgage by then, but you still owe taxes and insurance on your home as well as maintenance, landscaping, etc. And what if you decide—or need—to live somewhere else or buy a second home? You may need to have a mortgage.

Or what if you spend a little more because you’re traveling more often? What if you’re getting a new car or are helping fund your grandchildren’s education? What happens if your healthcare costs go up?

Our experience is that people don’t spend less in retirement, they spend just about the same as when they were working, just on different things. And in some cases, spending goes up for several years in early retirement, then again in late retirement on health care.

20% Increased Spending

On the left side of the bar graph, we created various what-if scenarios. By toggling a 20% increase of expenses from Fidelity’s 45%, we can see that it has quite a bit of impact on this retirement plan.

If this increase is the only change that happens in this retirement plan, then it’s likely going to be okay. But life is rarely this simple.

We’ve worked with many families over the years, and there are myriad variables in our lives, the economy, and the world writ large that have an impact on retirement plans. So simply applying a 10X multiplier to income and feeling confident that your retirement plan will be a success is a significant oversight.

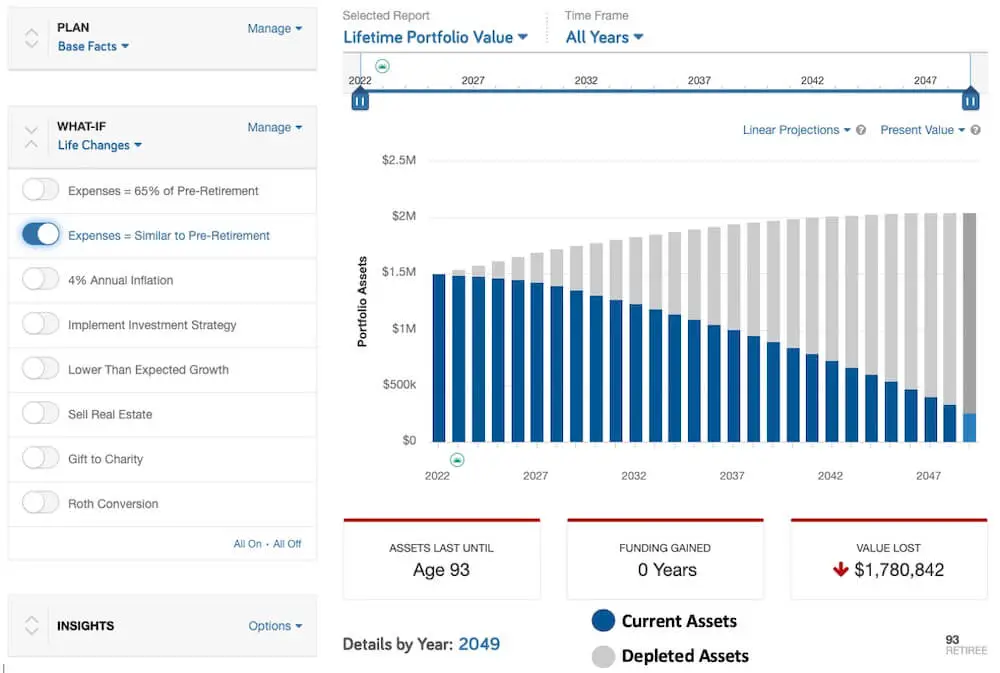

Expenses Similar to Pre-Retirement

As discussed, many families wish to continue their lifestyle through retirement. Most people don’t spend significantly less. Now let’s model spending a similar amount in retirement as when working:

You can immediately begin to see how suddenly this retirement plan is in jeopardy of failing if any other variables come into play, such as bad markets, periods of economic difficulty, higher medical expenses, slightly higher spending in some years, change of goals, etc. Markets alone are enough to derail a plan. Historically, bear markets have occurred around every 7 years on average.

The good news is that this is where planning comes in. You might be able to adjust your wealth and retirement plan in a way that helps you keep meeting your goals and living your ideal retirement.

Apples to Apples Comparison

For argument’s sake, let’s say that you did spend less in retirement. But you were worried about protecting the money you’ve saved, so maybe your portfolio was too conservative and earns less than it should have.

Or maybe you made a mistake by not rebalancing properly, withdrawing incorrectly from your assets and creating higher taxes, or by making it too aggressive and causing higher volatility, leading to an overall lower annualized average. Let’s see what that could do:

You can see that all these factors can significantly change the trajectory of your retirement. While it may appear okay, introducing additional variables like market volatility—or that perhaps you didn’t actually spend 55% less for your entire retirement—could mean that you’re in trouble. One long-term-care event in this retirement plan could mean that it runs out of money.

Your plan is going to look completely different and have its own unique variables, so using this rule of thumb of 10X your income isn’t really the most prudent way to plan. There is relief in knowing that as your life experiences changes, so can your retirement plan through prudent planning.

Successful Higher Spending

In this next scenario, we show a higher amount of spending than Fidelity, but with a proper income and investment system implemented, and you can see the significant difference:

This can be supported with proper strategy, and we could even keep expenses similar to pre-retirement and maintain sustainability, as modeled below:

Remember that these are models and that there are always risks with investing, but good planning can allow you to set up your wealth in a manner that helps you achieve your ideal retirement without compromise.

Most importantly, it can help you readjust along the way to help make sure that you’re still on track to keeping your financial independence.

When you are younger or first beginning to think about your future retirement, Fidelity’s article can be a good starting point. But as you get serious about retirement planning, there’s so much more that you can be doing to help give you the best chance of achieving your desired outcomes.

What We’ve Learned

The main takeaway is that you need to be careful before following blanket recommendations, even when from reputable organizations. Retirement planning is a very personally unique process, and most of the time your life won’t follow rule of thumb examples. Because of this, neither will your retirement plan.

You want to make sure that you have a plan that you can continue to update as your life and the world around you change.

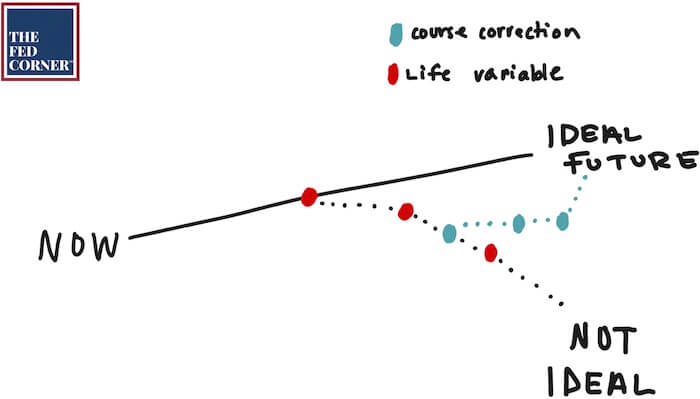

A retirement plan doesn’t generally fail in a short period of time. Typically, what we’ve seen is that small incremental variables are introduced over the years. These changes occur somewhere and start to cause your plan to deviate in the wrong direction. This is called “drift”, it can happen in retirement plans and in portfolios.

Often, these changes are so small that they go unnoticed or don’t seem threatening, and if you’re not making the appropriate course-corrections to get your plan back on track, then things can get worse, and you could be heading in a direction that’s far from your ideal retirement.

In the end, one-size-fits all hardly fits anyone at all. When life throws you a curveball, planning helps you remain in a good place without causing your life to veer off course. Make sure you consider all of the variables involved, or work with a team of planners that you can trust.

Knowing what decisions to make and when becomes critical to the success of your retirement. It can give you a sense of security that your plan can withstand all of life’s turns, so that you can focus more on living a more fulfilling retirement. After all it’s not just your money, it’s your future.