The FEHB, FEDVIP, and FSA Open Season closes at 11:59 ET Monday, December 12th. If you haven’t reviewed your options, there’s still time, but not much. Here are our last-minute tips on 2023 FEHB plans and how to save money on your 2023 FEHB premiums for the end of Open Season.

Know How Your 2023 FEHB Premiums Are Changing

Most federal employees will receive a lump of coal in their stocking with the largest Federal Employee Health Benefits (FEHB) program premium increase in the last 10 years, on average 8.7%. Not all plan premiums are going up that much, while some are increasing even more than the average.

How is your FEHB plan’s premium changing in 2023? While we don’t recommend choosing a plan based on premium alone, it’s a for-sure expense that can impact your budget.

Find a New Plan on Total Cost; You Might Save Thousands

Total cost is a better way to choose an FEHB plan. It’s the combination of for-sure expense (premium) and the likely out-of-pocket costs you’ll face next year based on age, family size, and expected healthcare usage.

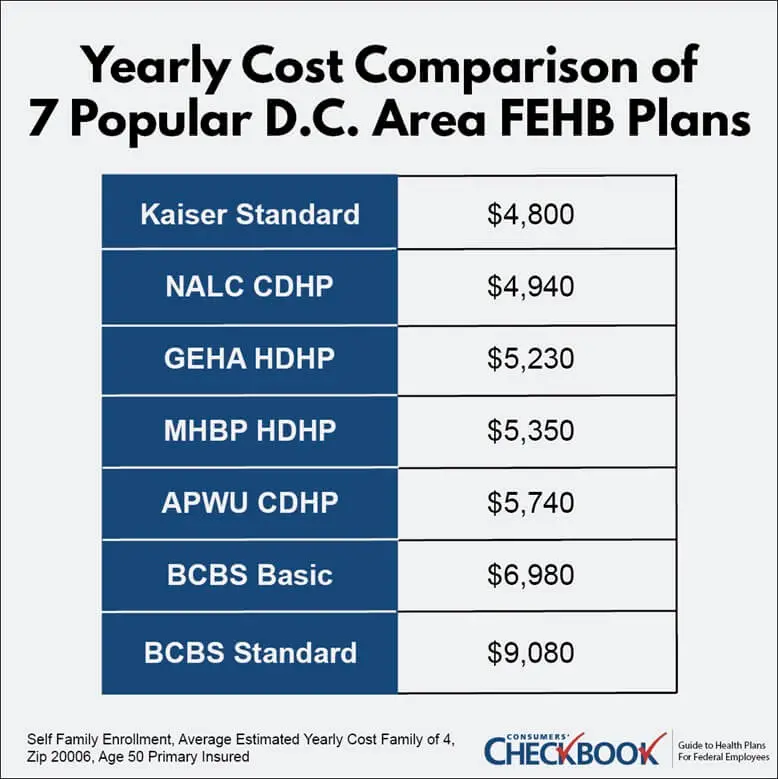

Checkbook’s Guide to Health Plans ranks plans by total cost, and there are big price differences in 2023.

For example, a family of four in the Washington, D.C. area could save $4,280 in estimated total costs by switching from Blue Cross Blue Shield (BCBS) Standard to Kaiser Standard.

Which Blue is Right for You?

About two-thirds of federal employees and annuitants are enrolled in a Blue Cross Blue Shield (BCBS) FEHB plan. Many could save thousands in estimated costs by switching plans, but most will stay enrolled in their current choice.

If you haven’t considered other BCBS plans in many years, it’s a good time to compare your options.

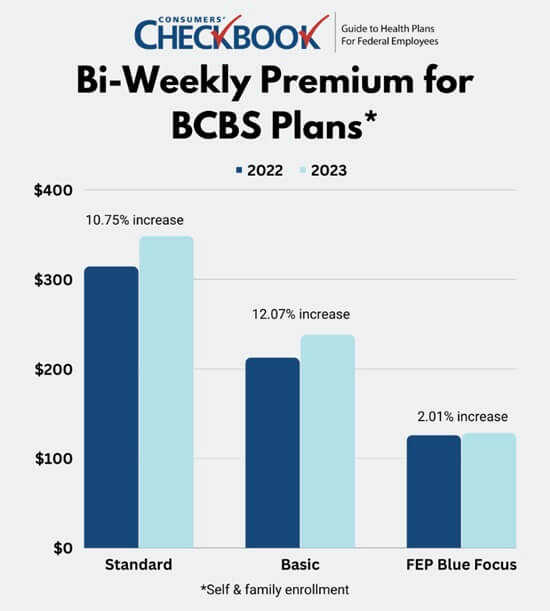

2023 premiums for the two most popular BCBS plans, Basic and Standard, are rising faster than the 8.7% FEHB average. However, the premium for FEP Blue Focus is much less and increasing at a slower rate than Basic and Standard. Keep in mind though that FEP Blue Focus has a higher deductible and out-of-pocket maximum compared to Basic and Standard, plus weaker prescription drug coverage.

Standard enrollees should consider whether to switch to Basic. There are many differences between the two plans, but two of the most significant are out-of-network coverage and mail-order prescription drug benefits. Standard has both, while Basic only offers mail-order prescription drug coverage when you also have Medicare Part B. If you have Standard, are happy with BCBS network providers, and don’t use mail-order prescription drugs, switching to Basic will save you almost $2,900 in premiums next year with a self & family enrollment, plus there is no deductible with Basic.

Two-Person Family Enrollment Options

For two-person families, either a married couple or parent and child, self-plus-one is often the least expensive enrollment option.

However, there are 86 FEHB plans where self & family is less expensive than self-plus-one in 2023. The differences in some cases are substantial: For the Kaiser High (E3) plan in the D.C. area, the bi-weekly self & family premium is $50.90 less expensive than the self-plus-one premium. That difference totals $1,323 annually.

Keep in mind that the plan benefits you receive are the same under both enrollment options. The best way to check cost is to go to the last page of the official FEHB brochure, look for enrollee share of premium, and choose the cheaper option.

Provider and Prescription Drug Check-up

Though a plan’s providers and prescription drugs can change at any time during the year, it’s always important to check who is still in-network and what medications are covered by the plan formulary during Open Season. Most plan websites will have both a provider and prescription drug look-up.

Even if you don’t think you’ll switch plans, you should still check your existing plan’s coverage. You may find you’ll change your mind on which plan is best for you next year.

Benefit Changes

The plan you have this year will be different in 2023. That’s because almost every plan has some benefit changes and seeing how this impacts you is an important piece of homework during Open Season. The best place to find out how your plan is changing is section 2 “Changes for 2023” in the official FEHB plan brochure.

Flexible Savings Accounts

OPM reports less than 20% of active federal employees have a Flexible Savings Account (FSA). Remember: Annuitants are not allowed to have an FSA. That means most active federal employees are missing out on for-sure savings on some or all their out-of-pocket healthcare expenses.

You’ll fund your FSA with pre-tax payroll deductions. Contributed funds are not subject to payroll taxes, which saves you about 30% on out-of-pocket healthcare expenses paid through the FSA. In 2023, you can start an FSA with as little as $100, and the annual maximum contribution limit is $3,050, a $200 increase from last year.

You’ll want to budget somewhat carefully as FSAs have a use-it-or-lose-it provision. You can only roll over $610 of unused funds into the next plan year, a $40 increase from last year. Any additional funds above the rollover limit are forfeited if not used.

For budgeting, consider your known out-of-pocket healthcare expenses, some of which could be for dental or vision care, prescription drug or doctor co-pays, etc. Realize that you don’t have to be perfect with your budgeting. In fact, there would be no risk for any first-time FSA participant to start with contributing $500 dollars, knowing that in the unlikely event of having no out-of-pocket healthcare expenses next year, you could roll over the entire $500 into the next plan year as long as you stay enrolled in the FSA program.

While you’re budgeting, keep in mind that even more out-of-pocket healthcare expenses qualify for FSA reimbursement. Over-the-counter (OTC) items such as allergy medicine, pain relief medications, and hundreds of other items are once again FSA eligible as a result of the CARES Act passed during the COVID-19 pandemic.

If you’re part of the 80% of federal employees without an FSA, you’re guaranteed to save some money next year by taking advantage of this tax-preferred benefit.

The Final Word

With only a few days left until the end of Open Season, time is running out to make changes. Make sure you understand how your existing plan’s premium, benefits, provider network, and prescription drug coverage are changing for 2023. By doing so, you may find that your current plan is no longer the best for you.

Consider other plan options that can save you money in both premium and estimated yearly cost. There are significant savings available to many federal employees.

Finally, all federal employees should have an FSA to save on expected out-of-pocket healthcare expenses. This is a no-brainer, and in a period of high inflation it’s an easy way to save money next year.