TSP Performance Up in 2023 After Dismal 2022 Returns

2022 was not a good year for stock returns in the Thrift Savings Plan (TSP). By the end of 2022, the total TSP fund returns were negative for all of the TSP stock funds. By the end of the year, the C Fund was down -18.13%, the S Fund was down -26.26%, and the I Fund ended down -13.94%.

As those who have been investing in the stock market for a long time already know, one bad year does not determine the future of your investment portfolio. In fact, when stocks have gone down significantly, as they did last year, it is not uncommon for a rebound in prices that benefits those who have increased their investments or at least stuck with their investment program.

2023 TSP Performance YTD as of January 23, 2023

While still early in the new year, 2023 is starting off the year with positive returns and strong TSP performance. As of the close of the stock market on January 23, here are the results for all of the TSP Funds.

| Fund | Year-to-Date |

|---|---|

| G Fund | 0.25% |

| F Fund | 2.84% |

| C Fund | 4.78% |

| S Fund | 8.25% |

| I Fund | 7.92% |

| L Income | 1.87% |

| L 2025 | 2.73% |

| L 2030 | 4.05% |

| L 2035 | 4.44% |

| L 2040 | 4.80% |

| L 2045 | 5.13% |

| L 2050 | 5.44% |

| L 2055 | 6.32% |

| L 2060 | 6.32% |

| L 2065 | 6.33% |

Bad News in 2022: Good News in 2023

2022 was filled with bad news impacting the stock market: roaring inflation, despite assurances from politicians that the inflation was “transitory,” the war in Ukraine, higher interest rates, and anticipation of more interest rate increases by the Federal Reserve. All of this impacted TSP performance last year.

Those negative factors are now leading to more positive news. Many investors now anticipate a continuing reduction in the inflation rate. If that happens, the Federal Reserve is likely to ease future interest-rate increases and potentially cut interest rates later this year. In fact, the central bank is preparing to slow rate increases for a second consecutive meeting.

The results are showing up in the TSP returns so far in January. The S Fund is up 8.25%, the I Fund is up 7.92% and the C Fund is up 4.78%. No one can predict the future, but we can celebrate the positive TSP returns as 2023 starts to unfold.

Falling Market in 2022 Results in G Fund Becoming Largest TSP Fund

In December 2022, TSP participants transferred $515 million out of the C Fund and another $440 million out of the S Fund. $606 million was transferred into the I Fund, and $464 million was transferred into the G Fund.

At the end of December 2021, the C Fund had 40.3% of the TSP assets totaling $326.8 billion. The G Fund had 33.3% of assets totaling $270.1 billion. At the end of December 2022, the G Fund had 40.3% of assets totaling $292.6 billion. The C Fund slipped into second place with $262.9 billion in assets for a 36.2% share of the total.

Here are how the core funds look at the end of January 2022:

| Fund | Core Funds Share of Total Assets December 2022 | Core Funds Share of Total Assets December 2021 |

| G | 40.3% | 33.3% |

| F | 4.2% | 4.6% |

| C | 36.2% | 40.3% |

| S | 10.8% | 13.2% |

| I | 8.5% | 8.7% |

Obviously, there was a significant shift during the year from stock funds into the safety of the G Fund.

While there were up and down months for both the G Fund and the C Fund in 2022, the total assets in the G Fund increased by $22 billion during the year. The C Fund total decreased by $63.9 billion during the year.

Obviously, these are large amounts of money. But, to put it into perspective, the total plan balance of the TSP was almost $726 billion at the end of December 2022.

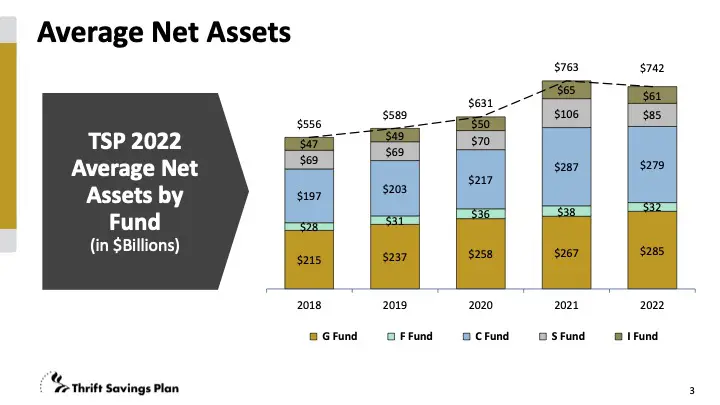

Here are the average net assets of each fund (in billions):

TSP Facts

At the end of December, there were 6.75 million TSP participants. This is an increase of 250,000 in the past year.

Both FERS and active-duty uniformed services participation rates ended the year with impressive numbers. FERS had a participation rate of 94.4% and uniformed services had a rate of 83.2%. At the end of 2021, FERS had a participation rate of 94.1% and uniformed services had a rate of 73.7%.

The TSP returns are off to a good start so far in 2023. Hopefully, TSP investors will be looking at a good return on their investment for the year after a disappointing 2022.