A lot of federal employees use Blue Cross Blue Shield for their health insurance, but very few understand what happens to their plan in retirement, and I have seen many feds pay way too much for health insurance because of this.

Note: If you have health insurance through a different company, you will definitely want to research how these same changes will affect your plan as well.

The Options

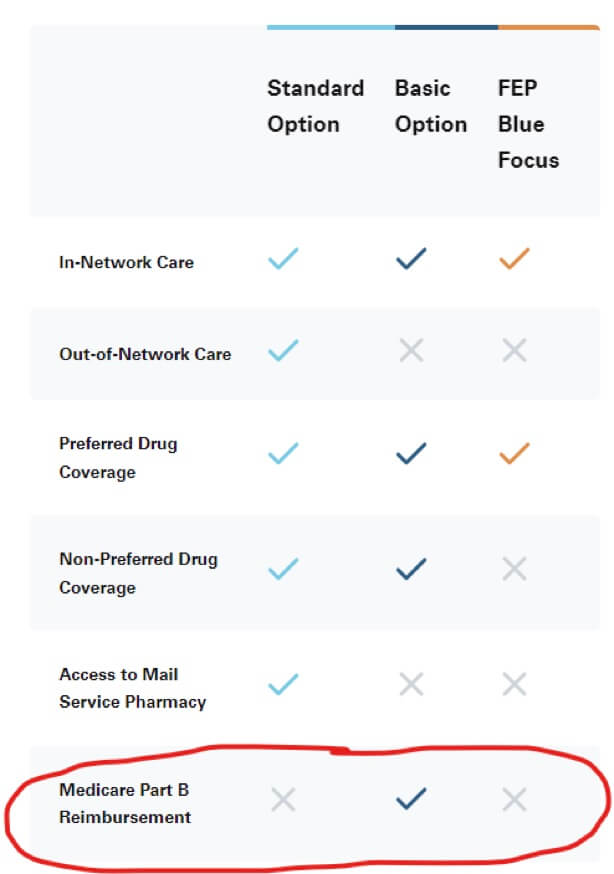

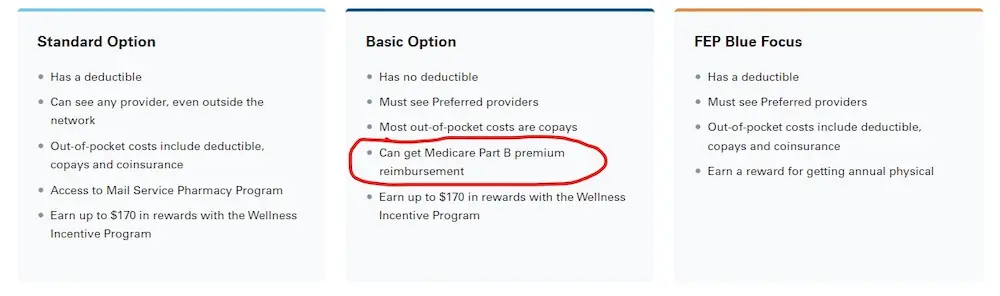

Here are the 3 different plan options for federal employees with Blue Cross for 2023:

And while there are many differences between these 3 plans, the one I want to dig into today is what I circled in red: Medicare Part B Reimbursement.

As you can see, Blue Cross Basic is the only Blue Cross plan to offer this benefit.

Blue Cross and Medicare

When picking a health insurance plan for retirement, a major factor to consider is how it is going to work with Medicare at age 65.

But long-story short, for most federal employees, it makes sense to get on Medicare parts A and B while keeping your federal insurance as well. And while part A is free, part B is not.

In 2023, the lowest premiums for Medicare part B are $164.90/month per person.

That is why it is crucial to find a health insurance plan that is meant to work really well with Medicare part B. This way you can minimize overlapping coverage and this will help keep your costs down in retirement.

Medicare Part B Premium Reimbursement

Your federal health insurance likes it when you get on Medicare part B because that means that Medicare becomes your primary coverage and your federal insurance becomes the secondary.

Because of this, some federal plans offer a Medicare part B premium reimbursement once you enroll in Medicare part B, but not all plans do.

And as I mentioned previously, Blue Cross Basic is the only Blue Cross plan that offers a medicare part B reimbursement out of the Blue Cross plans.

Blue Cross Standard does not offer a part B reimbursement even though it is the most expensive Blue Cross plan.

Comparing the Numbers

For 2023, Blue Cross Basic offers a $800/person/year Medicare part B reimbursement, so if you and your spouse are on Medicare part B and Blue Cross Basic, they’d reimburse you $1,600 every year (or $133/month).

Here is an example comparison of the monthly cost of having Blue Cross Standard and Medicare vs. Blue Cross Basic and Medicare for you and your spouse.

Blue Cross Standard and Medicare vs. Blue Cross Basic and Medicare

| Blue Cross Standard and Medicare | Blue Cross Basic and Medicare | |

| Blue Cross Premiums | $627.49 | $472.12 |

| Medicare Part B Premiums | $329.70 | $329.70 |

| Blue Cross Medicare Reimbursement | -$133.33 | |

| Total Monthly Cost | $957.19 | $668.49 |

| Total Annual Cost | $11,486.28 | $8,021.88 |

| Net Difference | $3,464.40 |

So as you can see, the annual cost difference between the two is over $3,000!

And having Blue Cross Basic and Medicare parts A and B together often makes for very comprehensive coverage.

Other Factors

But like always, cost is not the only factor that should be considered. Whatever plan you choose, you will want to make sure that it allows you to see your preferred providers and that it makes sense for your entire situation.

In this article, I focused solely on Blue Cross plans but there are lots of other plans that have pros and cons as well.

Because health insurance plans make changes every year, you will want to review your plan often to make sure it is still the best fit for you.