There is no such thing as a free lunch even in the government. The Thrift Savings Plan (TSP) costs money to operate, and you, as the TSP participant pay to keep it going.

But for most federal employees, the fee is completely invisible unless you know where to look.

The Fees

The reason a lot of people don’t know about TSP fees is because they are paid automatically out of your TSP accounts.

The fees are a percentage of how much money you have in different funds. Consequently, the more you have in the TSP, the more you pay.

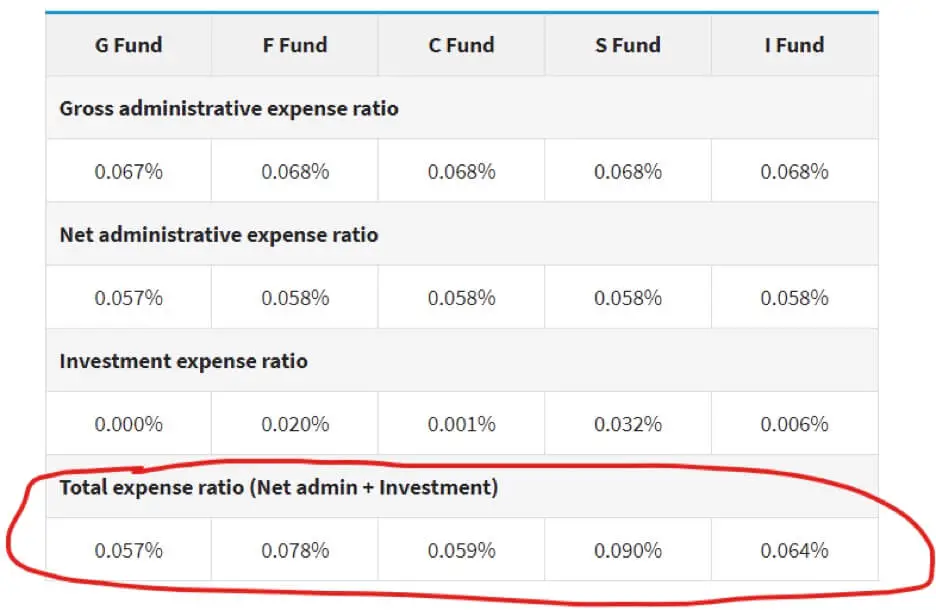

Here is a chart of the fees for the different funds (as of February 2023) and the total fee is at the bottom of the chart circled in red.

Fee Example in Dollars

So if you had $500,000 in the S fund (with a fee of .09%/year), you would be paying:

$500,000 x .09% = $450/year

You can do the rough math based on your allocation to determine what you are paying.

What About the L Funds?

The L funds are just a combination of the 5 core TSP funds, so the L Funds don’t have their own fees, they just have the fees of whatever underlying funds that are in.

You can find more information about what funds the L funds are using here.

Is It a Good Deal?

99.9% of funds in the world (including those in the private sector) have fees just like you have fees in the TSP. However, the amount of the fee can vary wildly.

The good news is that the TSP funds have relatively low fees compared to all the options out there.

Are there funds in the private sector that have lower fees than in the TSP? Yes, there are, but TSP fees are still very competitive.