When you’re retired, the money you’ve saved until then begins to support you, but for it to do that successfully for the remainder of your life, there are four critical parts that need to be in place for your federal employee retirement income system.

In this article, we’ll cover the four different parts, how to set them up, and how to plan your income so that you keep your taxes as low as possible.

Cash Strategy

Before you can establish your income system, you must first understand what your cashflow needs will be in retirement. In the simplest form, your cash needs are formulaic, as follows: (Inflows – Outflows) – Planned Distributions = Net Cashflow.

In other words, your Federal Employees Retirement System (FERS) pension + Social Security – your expenditures = X, defined as what you still need in order to maintain your lifestyle.

For instance, let’s say that after FERS and Social Security payments, you still need around $5K/mo from your portfolio to maintain your lifestyle.

You’ll need $60K/year from your portfolio to maintain your lifestyle, in today’s dollars. As time goes on, inflation erodes purchasing power, and your cash needs will incrementally grow.

Continuing in our example, some families like to keep that amount ($60K) in cash. Other families prefer to keep 2-3 years of those portfolio withdrawal needs as cash, which puts them at $180K in cash in our example.

The first part of your income system is determining a strategy around your cash position. If you need $5K/mo from your portfolio, should you hold $60K or $180K in cash?

How much cash should you hold so that you have money that’s safe regardless of what happens in your portfolio? But just as important, how much cash is too much in that your wealth may not be growing fast enough to provide you with inflation-adjusted income in your future?

The same expenses that require $60K/year needed today is expected to cost nearly $100K/yr twenty years into the future. This is the effect of inflation, and cash loses this battle every day it remains in cash.

The cash position required is different for every family and can be determined through the process of retirement planning. In general, it is recommended that retirees maintain a higher cash position than when working.

When you’re earning an income, volatility in your portfolio is merely a concern. You don’t need to draw on investments that fell in value. But when you’ve stopped working, that same volatility can now be a problem as you look to your portfolio to supplement your life.

Last year was a great example of this. Many families were forced to liquidate investments at a loss to generate the income they needed in retirement.

Federal employees have a reduced need for cash than the general public given your guaranteed sources of income (FERS annuity and Social Security), but the need is still present.

Once determining how much cash is appropriate, you can move to the next part of your retirement income system.

Bucket Strategy

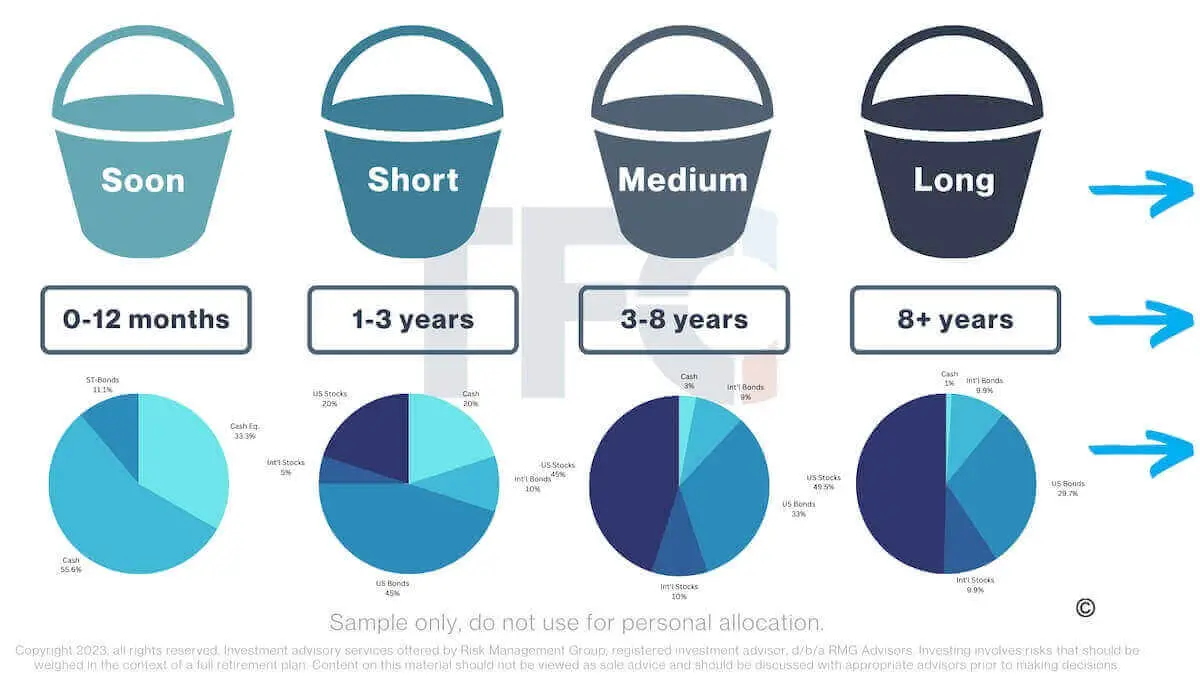

Your cash position makes up one of the buckets within your bucket strategy. Each bucket is broken down into different allocations for your wealth. Let’s utilize the following sample below.

Within one year, the overall markets are generally unpredictable. You’ll recall our mantra: volatility is risk in the short term, opportunity in the long run.

Your short-term cash needs should be represented by exactly that: cash, cash-equivalents, and possibly very short-term bonds.

But as you begin to push outward in time, say around 1-3 years into the future, that’s enough time that inflation will begin to harm your cash, but still not enough time to be heavily invested in stocks. Review our mantra.

If there is a significant market correction, 1-3 years just isn’t enough time to allow it to regrow again, so it needs to be in more stable positions.

A proper bond allocation can provide ongoing interest payments and can help you generate the income you need.

We often receive the question: why not just have a portfolio of various bonds over time?

The challenge is that you also need inflation-adjusted income 10, 15, 20+ years from now. Bonds simply don’t give you enough return to have this increased income over time.

Think about what a million dollars meant 20 years ago compared to what it means today. The same goes with your income, you’ll need your portfolio to grow and outpace inflation in order to maintain your lifestyle in the future.

Another consideration that falls into this bucket strategy is the type of stocks and bonds to choose. For instance, municipal bonds can help you save in taxes by exempting those bonds from federal income tax. That can be income that’s free from federal income tax, and often from state tax as well.

Markets are cyclical and some parts do better than others depending on our current economic cycle.

Distribution/Tax Efficiency Strategy

The next portion of your retirement income system is two-in-one because they work hand in hand.

Once determining how much cash you’ll need to generate from your portfolio and establishing the buckets properly to accomplish your goals, what’s the best way to receive this income?

As a fed, you pay taxes on most of your retirement income, and if you’re not careful, you can easily owe bigger parts of your retirement income to Uncle Sam as taxes.

Your FERS annuity is fully taxed, Social Security is partially taxed, your Traditional retirement assets (non-Roth) are fully taxed, and you quickly begin to put yourself in higher tax brackets. You need a strategy to plan how to best “realize” the income you need.

We refer to the period of time between when you retire and when you need to start taking RMDs as your Tax Planning Window. This is when your salary has gone away, and if you’ve planned well, you can be in low tax brackets for several years. These years present incredible opportunities to be paying taxes in very low brackets, prior to being forced into higher brackets when RMDs start.

At some point, your tax planning window runs out, and then you’re stuck paying higher taxes if you didn’t plan ahead. You can learn more how to maximize this strategy here.

Returning to our original example requiring $5K/mo: from which accounts should you make these withdrawals? Should you pull from your Traditional retirement accounts because your bracket is lower than expected in the future?

On the other hand, perhaps you pull from non-retirement accounts so that you can use strategies like max the bracket and Roth conversions to pay taxes before being forced into higher brackets in your 70s.

To summarize this section, you must determine what combination of investments will give you the income you need and in which kind of accounts to put them so that you can keep your taxes as low as possible when you take that income.

Social Security Strategy

The age-old question: when should you file for Social Security? Should you file and have your spouse wait? Vice Versa?

There are over 500 iterations of filing, and if you haven’t looked at modeling for various scenarios around your Social Security, I recommend that you do.

There are reasons to file early, a few of which we discuss here. But there are also reasons to file at your FRA or later, like if you’re earning some form of income prior to your Full Retirement Age (FRA).

The point is, filing earlier or later means you’ll have to tap into your portfolio earlier or later, which influences these other components we’ve discussed like your buckets and your taxes.

The most important factor is that all these parts are working together on a cohesive plan so that they give you the best chance of achieving your best retirement. After all it’s not just your money, it’s your future.