Longevity literacy is the understanding of how long people tend to live in retirement. If you don’t have a realistic understanding of your life expectancy, you are missing a foundational component of your retirement plan: a time horizon. Longevity literacy, like financial literacy, tends to be low among U.S. adults. Many of us apparently lack a basic understanding of how long we may tend to live in retirement.

Poor longevity literacy complicates financial planning and security, as people underestimate how much they’ll need to pay for the full length of their lives during retirement. Remember, there are no loans available for those who live longer than their planned financial assets.

Retirees, however, with strong longevity literacy more typically planned and saved for retirement while still working and now tend to experience better financial outcomes in retirement. Those with better longevity literacy typically plan and save better for retirement. These retirees with better longevity literacy tend to experience better financial outcomes according to a recent study.

The Teachers Insurance and Annuity Association of America (TIAA) and the Global Financial Literacy Excellence Center (GFLEC) at the George Washington University School of Business 2022 Personal Finance Index survey has revealed that longevity literacy may be as important as financial literacy for retirement readiness. This was because, for the first time, the annual survey was able to gauge longevity literacy by asking the participants how long people tend to live in retirement.

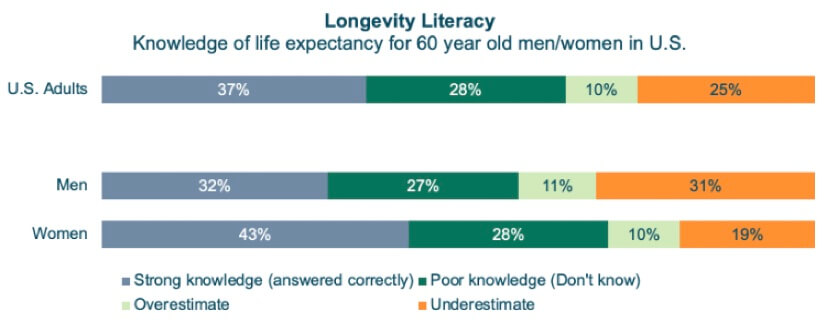

The survey asked 3,500 U.S. adults to select, from three different choices, the age that they thought was the life expectancy of a 60-year-old person of their gender. Only 37% of the Silent Generation, Boomers, Generations X, Y, and Z knew the correct answer. Just 10% of the respondents picked the answer choice that overestimates life expectancy. More than half (53%) either said they didn’t know or underestimated how long they’d live as illustrated in the chart below from the study.

The survey pool consisted of people still in the workforce as well as retirees. Women (43%) overall demonstrated stronger longevity literacy than men (32%). All retirees with strong longevity literacy differed significantly from their peers with lower longevity literacy in several ways such as:

- 81% saved for retirement while they were working, compared to 57% of those with poor longevity literacy.

- 54% have tried calculating the overall amount they need to save, compared to 30% of those with poor literacy.

- 40% find it very easy to make ends meet – almost twice as many as those with poor literacy (23%).

- 40% are very confident about having enough money to live comfortably throughout retirement, compared to 25% of those with poor literacy.

Longevity literacy is an overlooked factor in addressing retirement preparedness,” said Surya Kolluri, head of the TIAA Institute. “If you don’t have a realistic understanding of how long you are likely going to live, you are missing one of the most foundational components of any plan: a time horizon. If we can improve people’s longevity literacy, we can help create better retirement plans and increase their confidence.”

While you are working, how much should you save for your post-work years? The website, Money, has some rules of thumb to offer.

Fidelity’s guidance in their article How much do I need to retire? recommends saving 10 times your income by the time you’re 67. That means saving one times your salary by the time you’re 30, three times your salary by age 40, six times your salary by age 50, and eight times your salary by age 60.

If I’d known I was going to live this long, I’d have taken better care of myself.

Eubie Blake

Eubie Blake lived from 1897 to 1983. At the time of his birth, the average life expectancy for an American male was 42.5 years. To find what your life expectancy could be please use this table at Infoplease.